EOS is leading the crypto market today. Its price is up 19% over the past 24 hours and currently trades at its highest price in 30 days.

The surge follows two major catalysts: a dovish signal from the US Federal Reserve and the announcement of EOS’s rebrand to A, marking a new chapter for the project.

EOS Soars on Vaulta’s Rebrand Announcement

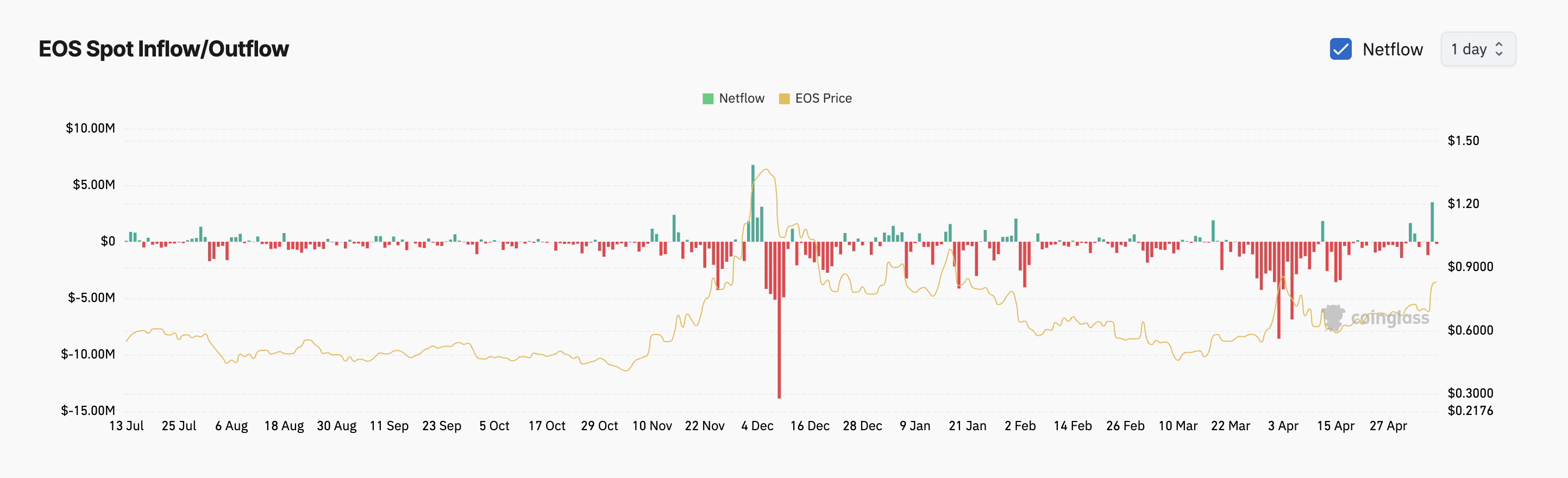

On Wednesday, Vaulta announced that EOS will officially rebrand to A, introducing a 1:1 token swap as part of the project’s transformation. The news sparked renewed investor interest, evident in the sharp spike in EOS spot inflows recorded on Wednesday.

According to Coinglass, this totaled $3.49 million and represented the coin’s single-day highest spot inflow since December 3.

A surge in spot inflows like this means more investors are buying the asset on regular (non-derivative) markets, signaling increased demand and bullish sentiment. Although the price hike has prompted a net outflow of $195,290 from the EOS spot markets today as traders lock in profits, the token’s rising daily trading volume indicates that significant buying activity is still underway.

As of this writing, EOS’s daily trading volume sits above $480 million, rocketing by 270% today.

When an asset’s price and trading volume increase simultaneously, it mirrors a strong bullish presence in the market. This trend reflects heightened investor interest in EOS and can lead to further price appreciation and increased market activity.

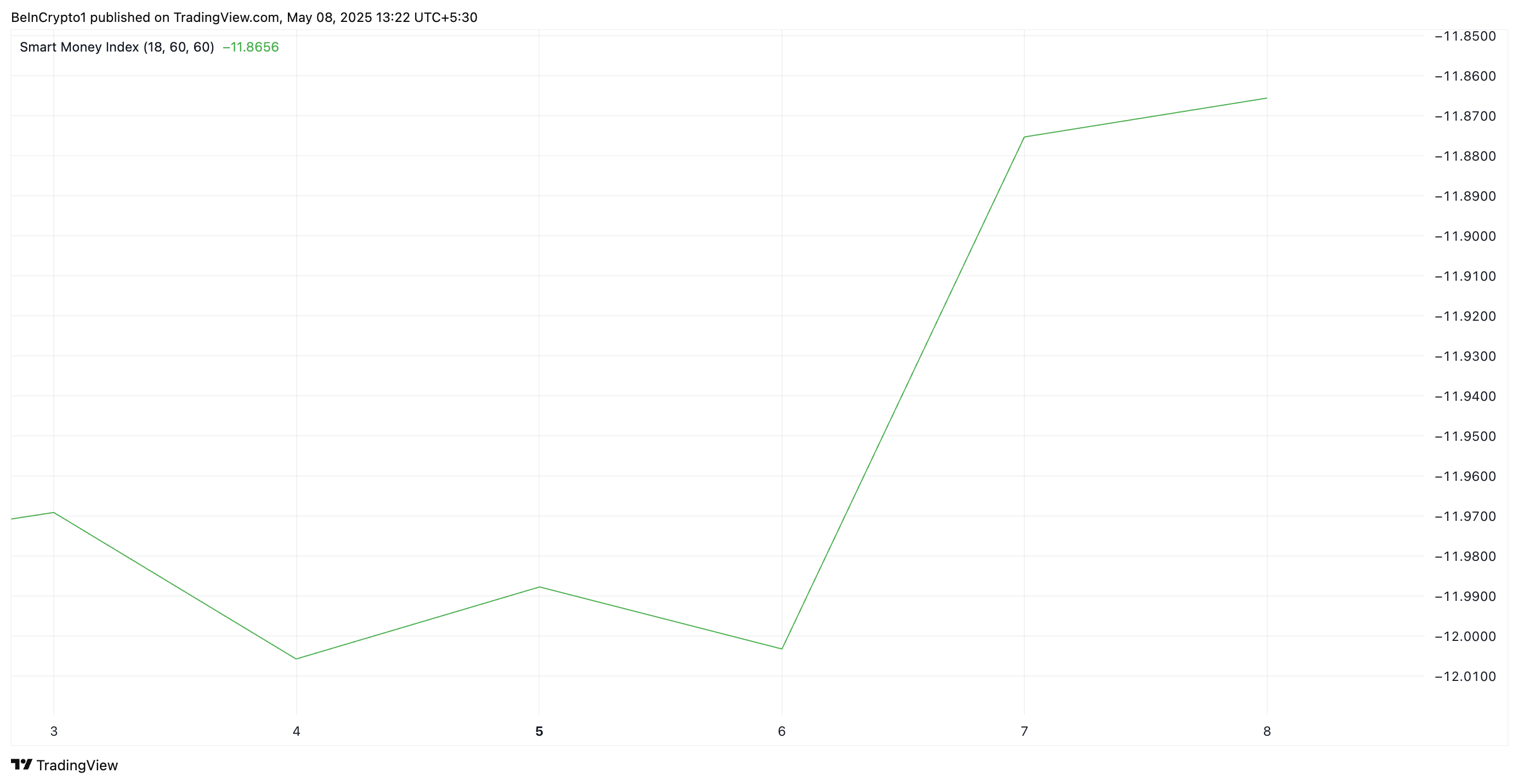

Moreover, smart money indicators reveal that institutional accumulation is on the rise. On the daily chart, EOS’ Smart Money Index (SMI) has surged to a five-month high of -11.86.

An asset’s SMI tracks the activity of institutional investors by analyzing market behavior during the first and last hours of trading. When it drops, it signals reduced confidence from these investors, pointing to expectations of price declines.

Conversely, as with EOS, when it rises, these investors increase their buying activity, signaling growing confidence in the asset. This points to the likelihood of an extended rally.

Can EOS Flip $0.85 Resistance to Fuel Surge to $0.98?

At press time, EOS trades at $0.83, resting below a key resistance level formed at $0.85. If bullish pressures persist and this zone flips into a support floor, it could propel the EOS token price to $0.98, a high it last reached on January 18.

However, an uptick in profit-taking could cause EOS to lose its recent gains and plunge to $0.67.