Elrond (EGLD) has broken out from a descending resistance line and reclaimed a horizontal resistance level after.

Kava.io (KAVA) has reclaimed the $5.40 area and is moving upwards. It reached a new all-time high price of $8.01 on April 6.

The Graph (GRT) has broken out from a descending resistance line but has yet to reclaim the $2.28 resistance area.

Elrond (EGLD)

On Feb. 9, EGLD reached a high of $216.99 and began to move downwards. The decrease followed a descending resistance line. EGLD broke out above this line on March 26.

Following this, EGLD reclaimed the $160 resistance level, which is the 0.618 Fib retracement of the most recent drop. Currently, it’s in the process of retesting this level as support.

Technical indicators are bullish and support the continuation of the upward movement. The MACD has given a bullish reversal sign and has nearly crossed into positive territory.

The RSI and Stochastic oscillator are both increasing. The latter has made a bullish cross.

Therefore, EGLD is expected to increase towards the $217 resistance area. If it creates a new all-time high price, the next resistance would likely be found at $309.

Highlights

- EGLD has broken out from a descending resistance line.

- It has reclaimed the $160 area.

Kava (KAVA)

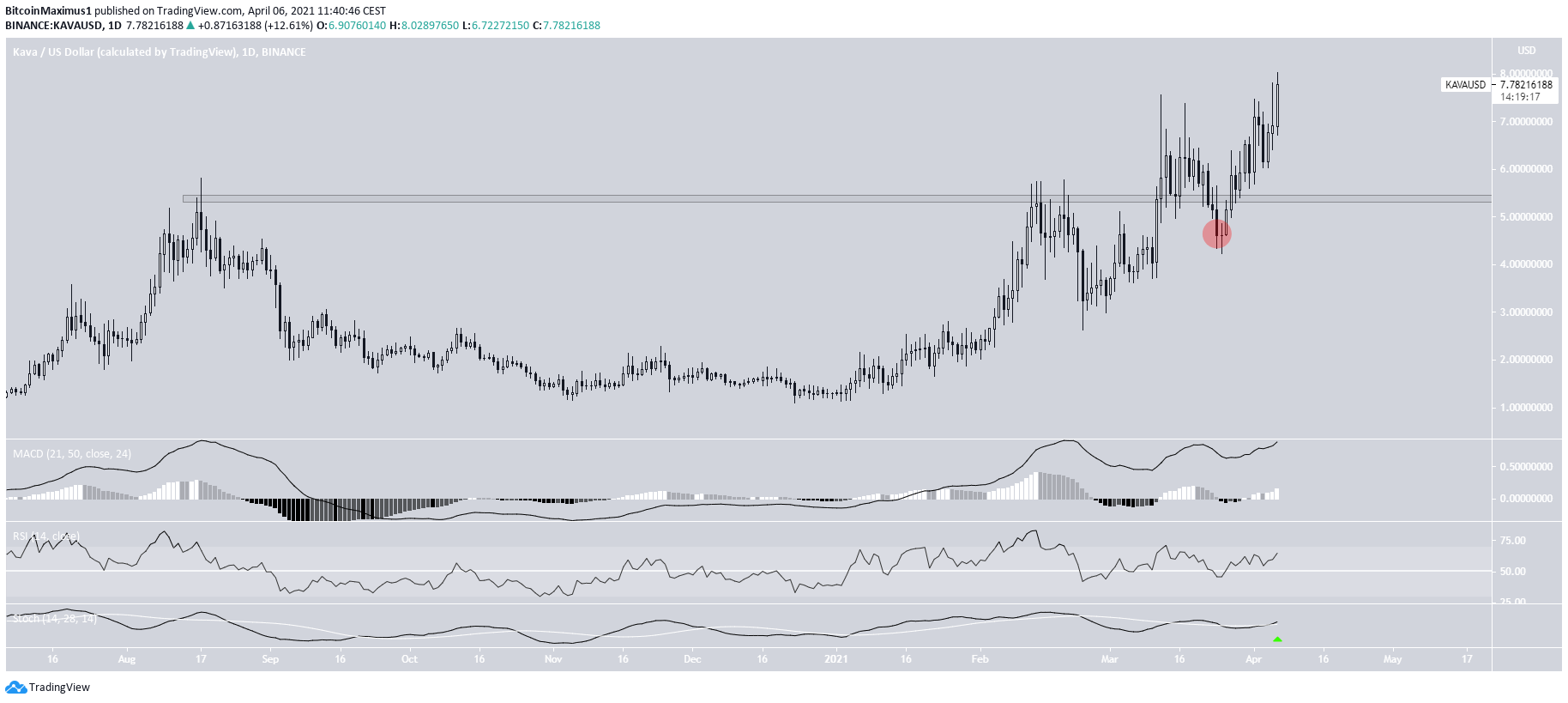

On March 25, KAVA fell below the $5.40 area. The movement was important since the $5.40 area was expected to act as support.

Nevertheless, KAVA reclaimed the area shortly after. This is a bullish development that often leads to a significant movement in the other direction.

Technical indicators are bullish, supporting the continuation of the upward movement. The MACD is positive, the RSI is increasing, and the Stochastic oscillator has just made a bullish cross.

Therefore, KAVA is expected to continue moving upwards.

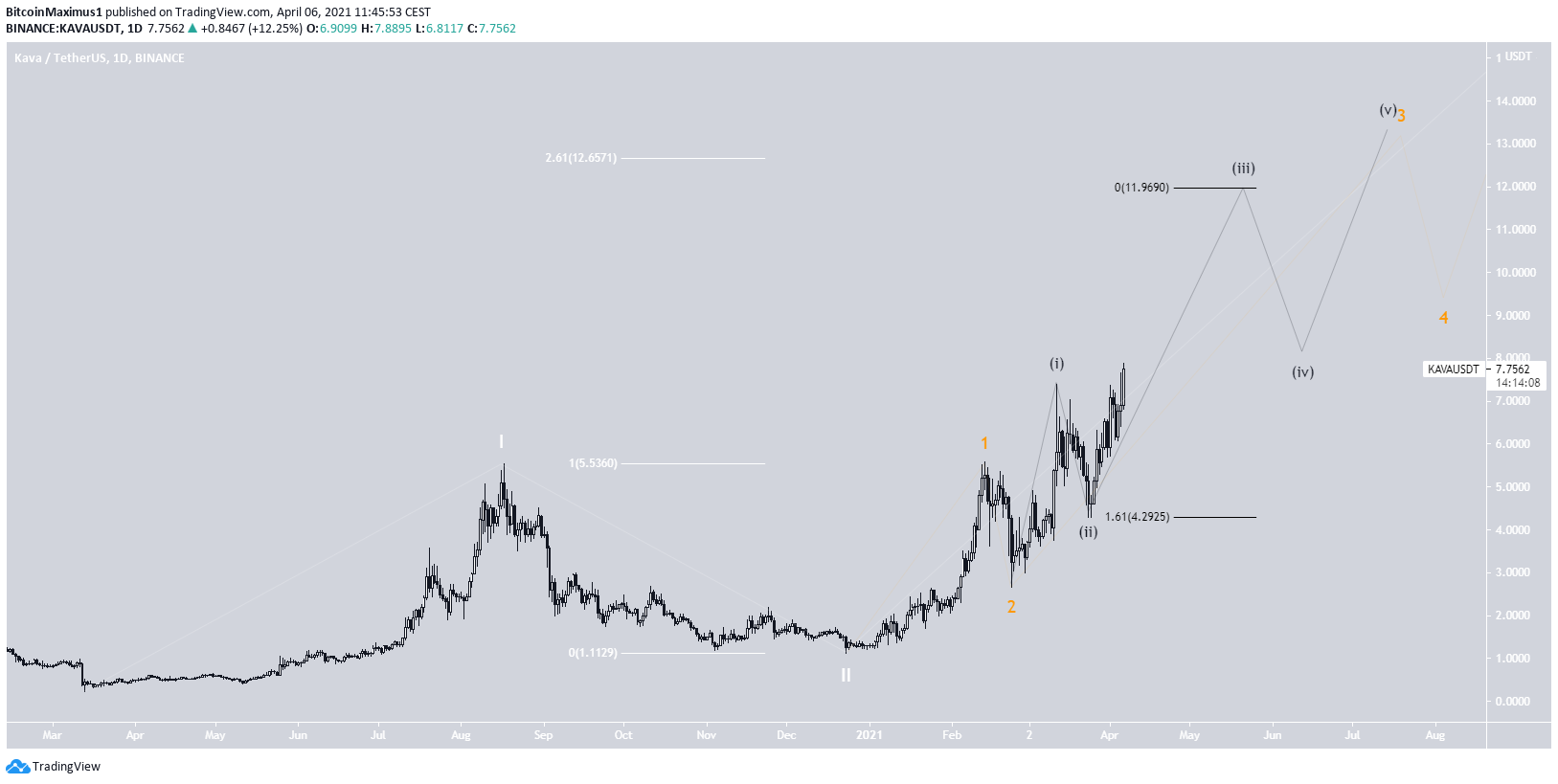

The wave count suggests that KAVA is in an extended long-term wave three (white).

In addition, the sub-wave (orange) and minor sub-wave (black) counts show a possible 1-2/1-2 wave formation. This means that the following upward movement is likely to transpire at a parabolic rate.

A potential target for the next resistance area is found between $11.95-$12.65.

Highlights

- KAVA has reclaimed the $5.40 level.

- It appears to be creating a 1-2/1-2 wave formation.

The Graph (GRT)

GRT has been decreasing since reaching a high of $3.88 on Feb. 12. The decrease followed a descending resistance line. GRT broke out above this line on March 28.

GRT validated the line as support and has been moving upwards since. However, the main resistance area is found at $2.28. GRT has yet to reclaim it.

Therefore, while the movement looks very similar to that of EGLD, GRT has yet to move above the 0.618 Fib retracement resistance.

Despite this, the daily chart still looks bullish.

GRT has confirmed a fourth wave pullback with a breakout from the descending resistance line. Daily indicators are bullish.

The most likely target for the top of the upward movement is found between $3.85-$4.15.

Highlights

- GRT has broken out from a descending resistance line.

- There is resistance at $2.28.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.