There is a busy week ahead on the economic calendar following the holiday weekend in the United States. With US GDP figures and inflation data slated, it could set the tone for the market mood and investor confidence for the rest of the year.

Macroeconomics outlet The Kobeissi Letter has listed the key economic events for the United States for the week beginning Nov. 27. They include inflation data and a Fed governor speech on Friday.

The Week’s Economic Calendar

Monday sees the release of new home sales data which is expected to decline slightly from the previous month.

Tuesday will include the release of monthly consumer confidence data which is an induction of overall economic activity.

Moreover, three Federal Reserve governors – Christopher Waller, Michelle Bowman, and Michael Barr will speak on Tuesday, Nov. 28. The addresses cover topics on monetary policy and the economy. Still, they are not expected to include any market-moving bombshells.

Wednesday sees the release of the third quarter’s gross domestic product data. However, this is expected to remain unchanged from the previous quarter.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

PCE (personal consumption expenditures) inflation data will be released on Thursday. Nov. 30. This is forecast to decline slightly from the previous month, another induction of economic recovery.

ISM manufacturing data will be released on Friday and Fed Chair Jerome Powell will also speak on Friday, Dec. 1 to round off the busy week.

The Kobeissi Letter said there would be a full trading week ahead and “volatility is here to stay.”

Overall, the forecasts are bullish for markets and economic sentiment which has been suppressed for the past couple of years.

Crypto Market Outlook

It is unlikely that any of this week’s economic calendar events will trigger large moves in crypto markets. However, investor sentiment is strengthening which may result in more eyes on high-risk assets such as crypto.

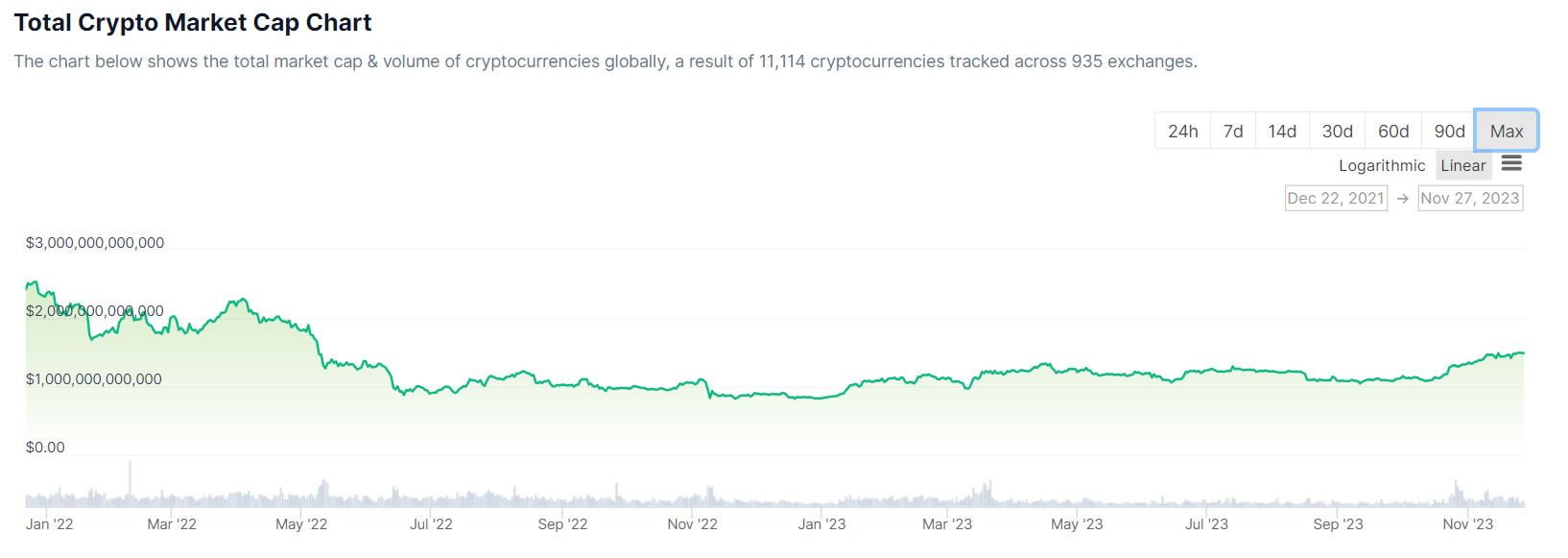

Total market capitalization reached its highest level since early May 2022 over the weekend. The figure came just shy of $1.5 trillion but has decreased marginally during the Monday morning Asian trading session.

Bitcoin is currently trading at $37,290 after dropping 1.3% over the past 24 hours. The asset reached a weekend high of $37,840 after a big options expiry event on Friday, according to BeInCrypto.

Ethereum prices were down 1.5% on the day at $2,045 at the time of writing as crypto markets cooled. Altcoins were also all in the red this Monday morning, retreating from weekend highs.