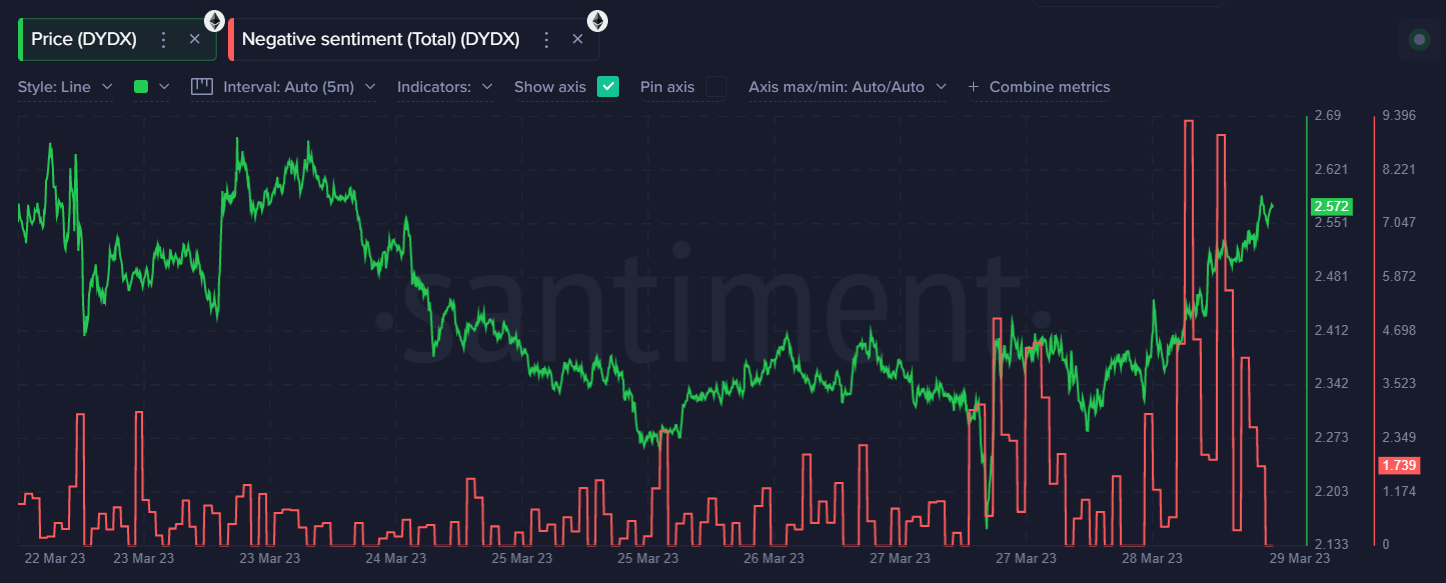

dYdX (DYDX) has seen a significant spike in negative sentiment, according to social data from the Blockchain forensics platform Santiment. Since the spike in negativity happened on March 28, DYDX has seen a price increase of close to 7%.

Traders Turn Pessimistic

DYDX is trading higher by nearly 15% from the week’s trading lows so far. When large one-way sentiment bias toward cryptocurrencies occurs, it can often be taken as a contrarian signal.

Historically, some of the large price increases for DYDX have occurred when large negative sentiment spikes have been recorded.

Another critical metric that has recently come to life, which could cause more price gains for DYDX, is the 90-day Dormant Coin Circulation metric.

On March 23, a 90-day Dormant Coin Circulation of 6.9 million, worth $17.25 million, moved on the dYdX network. This was the largest spike in this metric for dYdX since February 22. Also the second-largest spike of this year so far, according to data from Santiment.

Dormant Circulation shows the number of unique coins/tokens transacted on a given day that has not been moved for a large amount of time. Spikes in this metric can be either bullish or bearish.

Also, large spikes in this metric can signal the potential for large price movements. For example, the DYDX price grew by over 100% in just under 4 weeks after two massive spikes in Dormant Circulation during mid-December 2022.

Notably, no large movement was seen in either 180-day or 360-day Dormant Circulation for dYdX. This could add credence to the possibility of further upside as holders sit tight.

DYDX Price Prediction: Is $3.25 a Viable Target?

The market-value-to-realized-value (MVRV) best indicates dYdX’s potential price movements in the coming days. According to Santiment, this metric compares the ratio of an asset’s market capitalization to its realized capitalization.

The chart below shows that most holders who bought DYDX in the last 30 days are sitting with a minor profit of just 2.49%. As such, they are unlikely to take profit at current levels yet as DYDX is nowhere near overbought on a 30-day basis.

From the MVRV (30d) chart, the DYDX price prediction projects that if the token can break above the $2.89 price point, it can proceed on a major rally toward $3.25.

This would take the 30-day MVRV ratio close to 20% and could become the next euphoric market high where holders may begin to profit.

Still, if the bears take charge and the price slips below the lows of the week so far, at $2.27, expect a larger drop toward $2.15 before they choose to cut their losses.