Antonio Juliano, the founder of decentralized derivatives exchange dYdX, has announced a 35% reduction in the company’s core workforce. Interestingly, this news has not affected the price of dYdX.

dYdX is not the only crypto company announcing layoffs in October.

dYdX Restructures Workforce for New Development Plans

In an official announcement, Juliano did not specify the exact reasons or the number of employees being let go. However, he mentioned that the company now has the team needed for future plans.

“Today, I made the incredibly difficult decision to lay off 35% of the dYdX core team. We now have the team we need going forwards, but first we say goodbye to those who have left,” Juliano stated.

He also noted that dYdX was built differently from the vision it now needs to pursue, leading to this tough decision.

“The decision to let go was a realization that the company we’ve built is different from the company dYdX must be. We will move forward with clarity and renewed passion. We will create amazing things,” Juliano added.

According to the official website, dYdX has around 50 employees and is currently hiring for several engineering and design positions. This announcement did not negatively impact the price of dYdX, which is still trading above $1, marking an 8% increase since the start of the week. However, the price remains 96% below its all-time high (ATH).

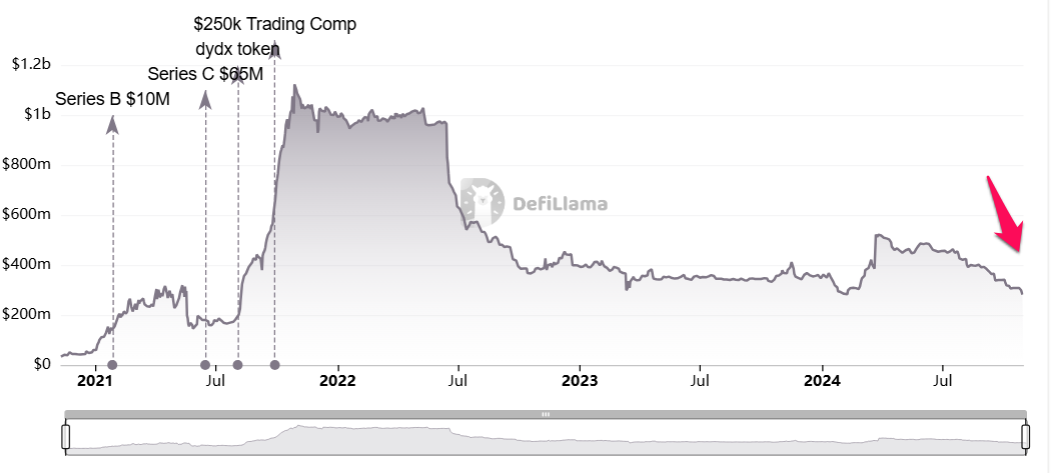

This decision comes amidst a sharp decline in dYdX’s Total Value Locked (TVL) in 2024. TVL dropped from over $500 million in March to just $287 million. Meanwhile, another decentralized derivatives exchange, Hyperliquid, saw its TVL grow tenfold in 2024, recently hitting an ATH of over $870 million.

Read more: Understanding dYdX: A Guide to the Decentralized Perpetual Exchange

dYdX is not alone in this trend. Recently, Consensys, the developer behind the MetaMask wallet, also announced a 20% reduction in its workforce. Consensys cited macroeconomic pressures and regulatory challenges as reasons for this decision.