The dot-com bubble of the late 1990s and early 2000s serves as a cautionary tale for speculative markets. Now, with the meteoric rise of cryptocurrencies, many are drawing parallels between these two events.

This article aims to compare and contrast the dot-com bubble with the current state of the cryptocurrency market, delving into similarities, differences, and potential outcomes.

A Brief History of Speculative Bubbles: Learning from the Past

Speculative bubbles have been a recurring theme throughout financial history, with numerous examples offering insights into their causes, effects, and aftermaths. By examining these historical bubbles, we can better understand the context surrounding the dot-com and cryptocurrency phenomena.

Tulip Mania: The Flower That Bloomed and Withered

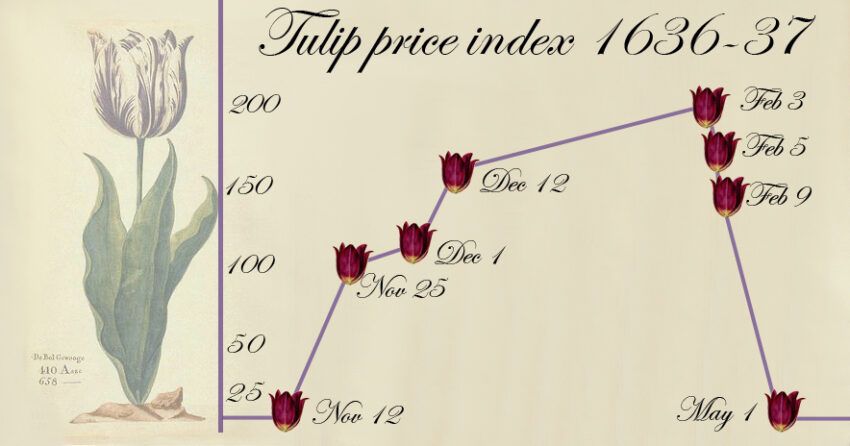

One of the earliest recorded speculative bubbles occurred in the Dutch Golden Age during the 1630s, known as Tulip mania. Tulip bulbs became a status symbol in Holland, and their prices skyrocketed as demand soared. At the height of the bubble, some tulip bulbs were worth more than an average worker’s annual salary.

However, the tulip market crashed in 1637 when the bubble burst, leaving many investors bankrupt. Tulip mania serves as a classic example of how speculation, herd mentality, and the fear of missing out can drive asset prices to unsustainable levels.

The South Sea Bubble: An Ocean of Greed

This bubble offers another example of speculative mania. The South Sea Company, a British joint-stock company, held a monopoly on trade with South America. Shares of the company surged as investors anticipated immense profits from this lucrative trade route.

To capitalize on the frenzy, the company’s management engaged in fraudulent practices, including insider trading and false accounting.

When the bubble eventually burst, many investors lost their fortunes, and public confidence in the financial system was severely shaken.

The U.S. Housing Bubble: The Domino Effect

The U.S. housing bubble, which culminated in the 2007-2008 financial crisis, illustrates how speculative bubbles can have far-reaching consequences. Low interest rates, lax lending standards, and the belief that housing prices would perpetually increase led to a surge in demand for real estate.

When the housing market began to crumble in 2007, the effects rippled through the global financial system. Banks that held large quantities of mortgage-backed securities faced significant losses, leading to a credit crunch and a severe economic recession.

The Dot-Com Bubble: When the Internet Boom Went Bust

The dot-com bubble, also known as the Internet bubble or the dot-com crash, was one of the most notable speculative bubbles in modern history. It occurred in the late 1990s and early 2000s, fueled by the rapid growth and excitement surrounding internet-based companies.

Origins and Growth of the Bubble

The dot-com bubble was primarily driven by a combination of technological advancements, investor enthusiasm, and unrealistic expectations about the potential of internet companies. The widespread adoption of the Internet and the emergence of e-commerce created a wave of optimism, leading to an influx of venture capital and initial public offerings (IPOs) for Internet startups.

Investors were eager to invest in any company with a “.com” in its name, regardless of its actual business model or profitability. The market witnessed astronomical valuations, with companies often trading at price-to-earnings ratios that were far beyond traditional measures of value.

The bubble inflated further as the traditional metrics for evaluating companies, such as earnings and revenue, took a back seat to user growth and market share. Investors believed that these companies, despite not generating profits, would eventually become dominant players and monetize their user base.

Excessive Speculation and Irrational Exuberance

Speculation and irrational exuberance fueled the dot-com bubble. Investors believed that the internet represented a new era and that traditional business models were becoming obsolete. This belief led to a disconnect between stock prices and underlying fundamentals, as investors poured money into companies with little regard for their financial viability.

The concept of “eyeballs” became a key metric for valuing dot-com companies. The more users a company attracted, the higher its perceived value, even if it didn’t have a clear path to profitability. This speculative mindset contributed to a self-reinforcing cycle of rising stock prices and increased investor enthusiasm.

Failures and Bursting of the Bubble

As the dot-com bubble reached its peak in early 2000, signs of trouble started to emerge. Many internet companies were burning through cash at an alarming rate, and doubts began to surface about their ability to generate sustainable profits. Investors started questioning the viability of the business models and the lofty valuations.

In March 2000, the bubble began to burst. The Nasdaq Composite Index, which was heavily weighted towards technology stocks, experienced a sharp decline, losing over 10% of its value in a single day. This event, known as the “dot-com crash,” triggered a widespread sell-off as investors rushed to exit their positions.

Over the following months, numerous dot-com companies collapsed or experienced substantial declines in their stock prices. Many of these companies had never turned a profit or generated significant revenues. Investors realized that the valuations had been driven by speculation rather than solid financial foundations.

Impact and Lessons Learned

The bursting of the dot-com bubble had significant repercussions. Thousands of internet companies went out of business, and investors suffered substantial losses. The NASDAQ index, which had reached a peak of 5,132.52 in March 2000, plummeted to around 1,100 by October 2002.

The aftermath of the dot-com bubble led to increased scrutiny and regulation in the financial markets. Companies and investors became more cautious, and a greater emphasis was placed on profitability and sustainable business models. The experience served as a reminder that speculative manias can lead to severe market downturns and highlighted the importance of conducting thorough due diligence before investing.

However, the dot-com era also had a lasting impact on the technology industry. While many companies failed, some emerged from the wreckage stronger and more focused. The bubble forced a reevaluation of business models and a shift towards profitability, leading to the growth and success of companies like Amazon and Google.

Speculative Mania: Unraveling Market Dynamics

Both the dot-com bubble and the cryptocurrency market witnessed a frenzy of speculative investment. In the case of the dot-com bubble, the public’s fascination with the internet-fueled the boom. Companies with little more than a website and a “.com” domain name saw their valuations soar, often without any proven business model or profitability.

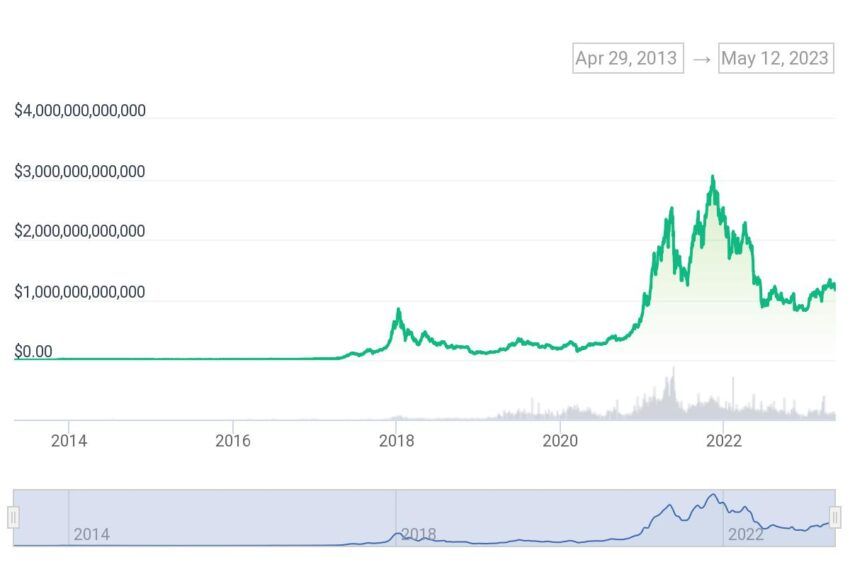

Similarly, the cryptocurrency market has experienced dramatic price increases driven by the potential of decentralized finance and blockchain technology. Investors in both markets often act on hype and FOMO (Fear of Missing Out), leading to inflated asset prices and market volatility.

However, there are crucial differences between the two markets.

The dot-com bubble was characterized by a plethora of internet companies, many of which lacked solid business foundations. In contrast, the underlying technology of cryptocurrencies, blockchain, has far-reaching implications and use cases that extend beyond digital currencies, such as smart contracts, supply chain management, and digital identity verification.

Market Maturity: A Race Towards Mainstream Adoption

The dot-com and cryptocurrency markets share similar trajectories, experiencing rapid growth from inception to mainstream adoption. However, the dot-com bubble ultimately burst, causing many companies to collapse and wiping out billions in market value.

One key difference between the two markets lies in their stages of development. The dot-com era saw a rush of businesses attempting to capitalize on the Internet, but many failed to achieve profitability or sustainable business models. In contrast, the cryptocurrency space has shown resilience and adaptation over the past decade.

Cryptocurrencies have faced numerous challenges, including regulatory scrutiny, security concerns, and scalability issues. Despite these hurdles, the market has continued to grow and mature, with an increasing number of institutional investors and businesses embracing digital currencies.

The Boom and Bust Cycle of the Cryptocurrency Market

The cryptocurrency market has witnessed a boom and bust cycle reminiscent of other speculative bubbles throughout history. While the dot-com bubble serves as a cautionary tale, it’s important to analyze and compare the cryptocurrency market’s unique dynamics.

Similarities with Other Speculative Bubbles

- Speculative Mania: Like the dot-com bubble, the cryptocurrency market experienced a frenzy of speculative investment driven by hype and FOMO (Fear of Missing Out). Both markets saw inflated asset prices and high market volatility due to exuberant investor behavior.

- Market Dynamics: The dot-com bubble and the cryptocurrency market were characterized by a wave of investments based on potential rather than solid financial foundations. In both cases, valuations often surpassed traditional measures of value, such as earnings or revenue, leading to a disconnect between stock prices and underlying fundamentals.

- Risk of Market Downturns: Just as the dot-com bubble eventually burst, the cryptocurrency market is not immune to severe market downturns. Both markets experienced significant declines in asset prices, resulting in financial losses for investors.

Contrasts with Other Speculative Bubbles

- Business Foundations: Unlike the dot-com era, where many internet companies lacked solid business models, cryptocurrencies are built on the underlying technology of blockchain. This technology offers diverse applications beyond digital currencies, such as smart contracts and supply chain management, providing a more robust foundation for the cryptocurrency market.

- Resilience and Adaptation: While the dot-com bubble resulted in the collapse of numerous companies, the cryptocurrency market has shown resilience and adaptation over time. Despite facing regulatory scrutiny, security concerns, and scalability issues, the market has continued to grow and attract institutional investors and businesses.

- Market Maturity: The dot-com era witnessed a rush of businesses attempting to capitalize on the Internet, often without achieving profitability or sustainable business models. In contrast, the cryptocurrency space has evolved over the past decade, addressing challenges and maturing as an industry. This development could indicate a more favorable trajectory compared to the dot-com bubble.

Lessons Learned: Gleaning Wisdom from the Dot-Com Bubble

The dot-com era offers valuable lessons for investors, regulators, and innovators in the cryptocurrency space. One key takeaway is the importance of diversification in a volatile market. Investors who put all their eggs in one basket during the dot-com era suffered significant losses when the bubble burst. In the cryptocurrency market, a diversified investment strategy can mitigate risk and protect against sharp declines in specific assets.

Another lesson from the dot-com frenzy is the need for balanced regulation. Regulators must strike a delicate balance between protecting consumers from potential fraud and fostering innovation in a rapidly evolving industry. By studying the regulatory missteps during the dot-com era, we can better understand how to approach the cryptocurrency market.

Lastly, the dot-com bubble highlights the importance of sustainable business models and practical applications of technology. Long-term success in the cryptocurrency sector will hinge on the development of scalable solutions and widespread adoption of blockchain technology across various industries.

Navigating the Path Ahead

As cryptocurrencies become more integrated into the global financial system, questions about their sustainability and future abound. Some experts argue that cryptocurrencies are experiencing a bubble akin to the dot-com era and warn of an impending crash.

The dot-com bubble and the current state of the cryptocurrency market share similarities in terms of speculative mania and market dynamics. However, it is crucial to recognize the differences between the two and consider the lessons learned from the dot-com bubble.

While both markets have witnessed exuberant investments driven by hype and FOMO, the underlying technology of cryptocurrencies, blockchain, holds significant potential for various applications beyond digital currencies. The dot-com bubble was characterized by a wave of internet companies with questionable business models, whereas the cryptocurrency market has demonstrated resilience and adaptation over time.

The dot-com era taught us the importance of diversification, balanced regulation, and the need for sustainable business models. Investors in the cryptocurrency space should adopt a diversified investment strategy, regulators should find the right balance between consumer protection and innovation, and businesses should focus on practical applications and scalability.

As cryptocurrencies continue to evolve, their future remains uncertain.

Some believe that a crash is imminent, drawing parallels to the dot-com bubble. However, it is essential to approach this emerging market with a cautious yet optimistic mindset. The sustainable growth of cryptocurrencies will depend on continued innovation and widespread adoption. And the ability to address regulatory and scalability challenges.

The dot-com era reminds us of the risks of speculative manias and market downturns. But it also shows the technology industry’s resilience and the potential for companies to emerge stronger. We can apply those lessons to the cryptocurrency market by learning from the past. And thus navigate the future with wisdom and foresight.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.