According to an on-chain analyst, the movement of dormant Bitcoins (BTC) increased by 121% in Q1 2025 compared to Q1 2024.

This shift may signal that long-term investors are reacting to broader economic trends or anticipating market changes.

Dormant Bitcoin on the Move: What’s Driving the Trend?

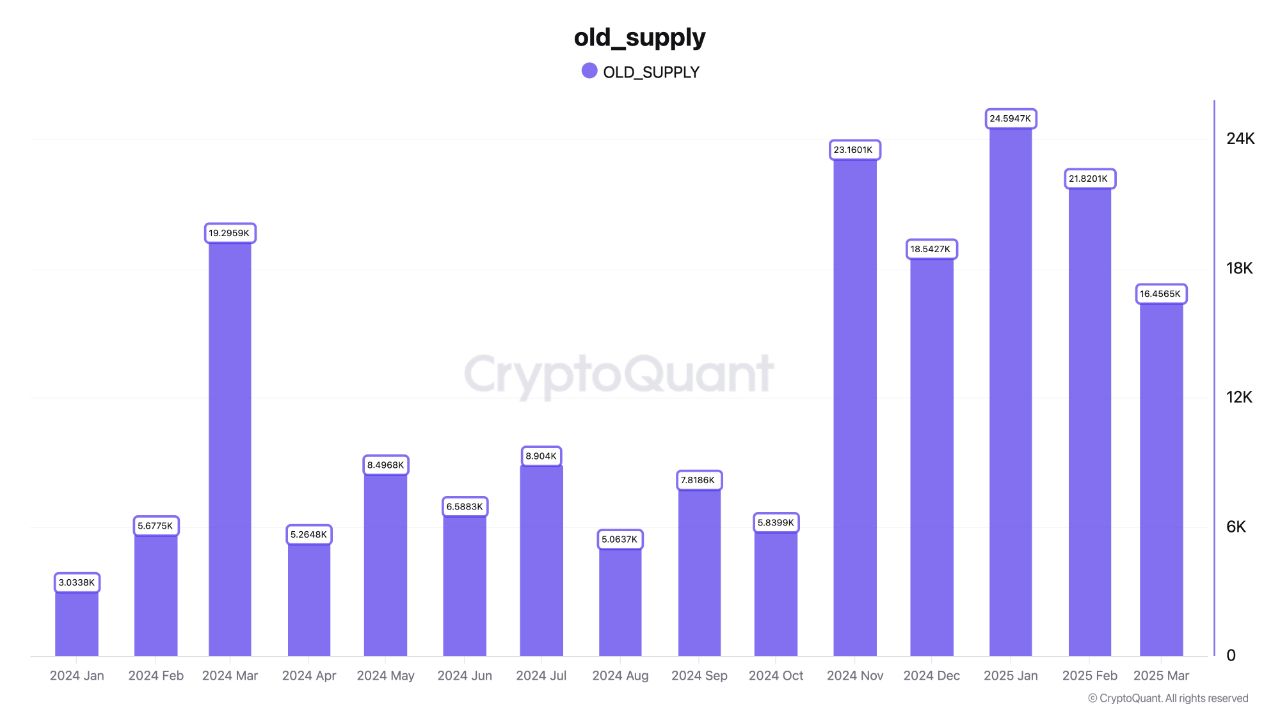

In a recent post on CryptoQuant, the analyst revealed that investors moved around 28,000 dormant Bitcoins in Q1 2024. March was particularly noteworthy, with approximately 19,296 BTC moved. This was in contrast to the lower figures in January (approximately 3,034 BTC) and February (approximately 5,678 BTC).

“In the first three months of 2025, more than twice the amount of long-dormant Bitcoin has been moved compared to the same period in 2024,” the post read.

Comparing this to the first quarter of 2025, the total amount of Bitcoin moved was notably higher. Over 62,00 BTC, dormant for over seven years, was transferred. Specifically, investors moved 24,595 BTC in January, 21,820 BTC in February, and 16,456 BTC in March.

The analyst suggested that this surge in activity reflects a shift in sentiment among long-term Bitcoin holders. This shift could be driven by macroeconomic factors, evolving price expectations, or institutional liquidity demands.

Notably, 2025 has proven to be a turbulent year for Bitcoin. Geopolitical shifts, rising trade tensions, and growing economic concerns have significantly impacted the market.

Recently, Glassnode pointed out that Bitcoin has experienced its deepest drawdown of the cycle. In its weekly newsletter, the firm emphasized that investors are facing intense pressure. Furthermore, many are currently experiencing their largest unrealized losses ever.

“Current unrealized losses are largely concentrated among newer investors, while long-term holders remain in a position of unilateral profitability. However, an important nuance is emerging, as recent top buyers age into long-term holder status, as noted, the level of unrealized loss within this cohort is likely to increase,” the newsletter read.

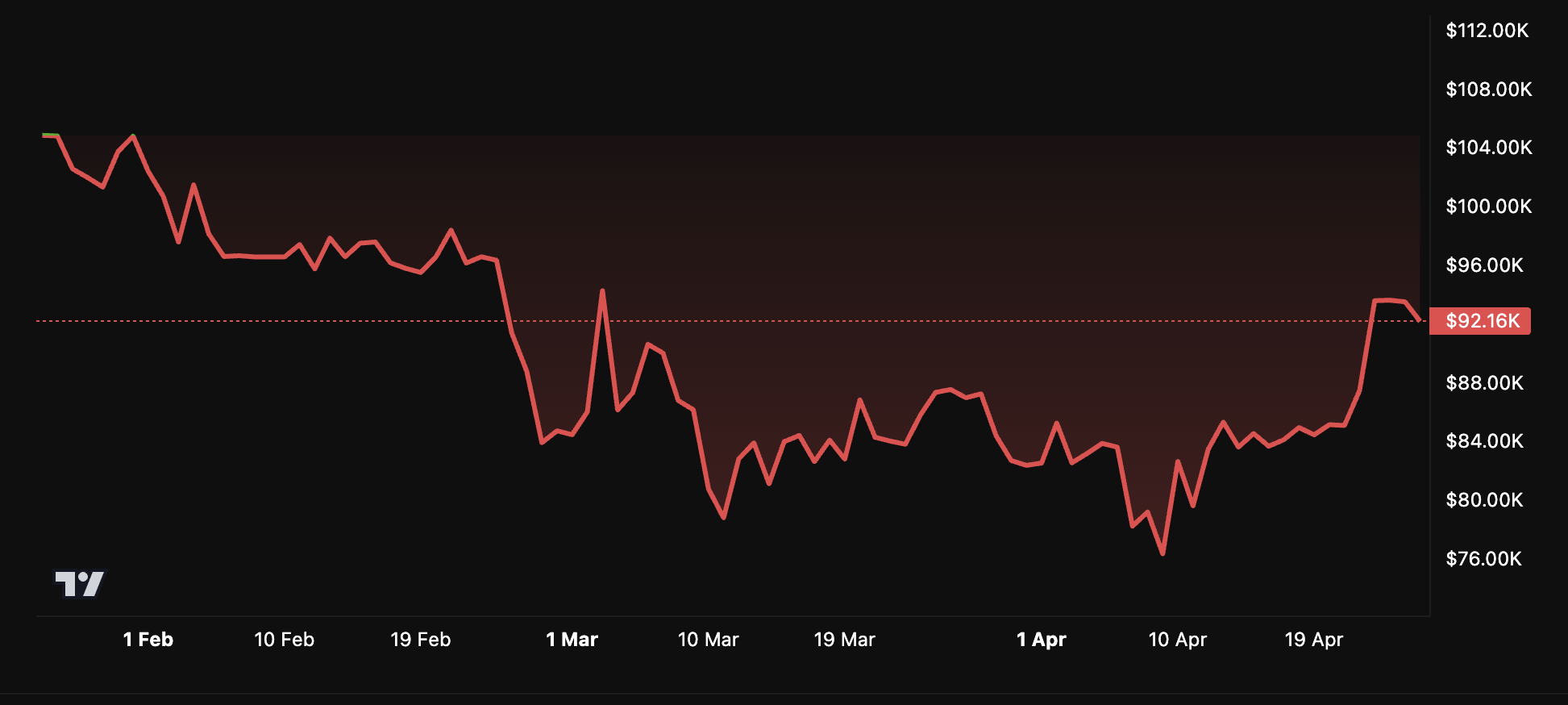

However, Glassnode noted that BTC’s dip remains within the typical range of previous corrections seen in bull markets. Importantly, Bitcoin has also been on a recovery rally lately.

Over the past week, its value has appreciated by 8.9%. Yet, daily losses stood at 2.2%. At the time of writing, BTC was trading at $92,164. The decline wasn’t isolated, as the broader crypto market also experienced a correction.

Meanwhile, the increased movement of dormant assets is not limited to Bitcoin. A parallel trend has emerged in the Ethereum (ETH) market. Data from Lookonchain showed that in early February, a whale deposited its entire holdings of 77,736 ETH into Bitfinex after being inactive for six years.

In early April, Onchain Lens posted about an eight-year dormant whale moving 11,104 ETH worth 19.97 million.

“Of this, 247.93 ETH was sent to Coinbase and 10,856 ETH to a new wallet. The whale initially withdrew ETH for $2.51 million from Kraken and Gemini, 8 years ago,” Onchain Lens added.

This asset movement reflects investors’ strategic repositioning amid economic uncertainty.