As the US presidential campaign gains momentum, the upcoming televised debate between Republican nominee Donald Trump and Democratic nominee Kamala Harris has caught the attention of political and financial observers.

Scheduled for Tuesday, the debate is expected to have significant ripple effects across multiple sectors, including the cryptocurrency markets.

Trump vs Harris Debate: How It May Shake Crypto Markets

The economic policies championed by both candidates will be at the forefront. Trump has reiterated his plans to reduce taxes and government spending, while Harris advocates for raising taxes on the wealthy with measures aimed at supporting small businesses.

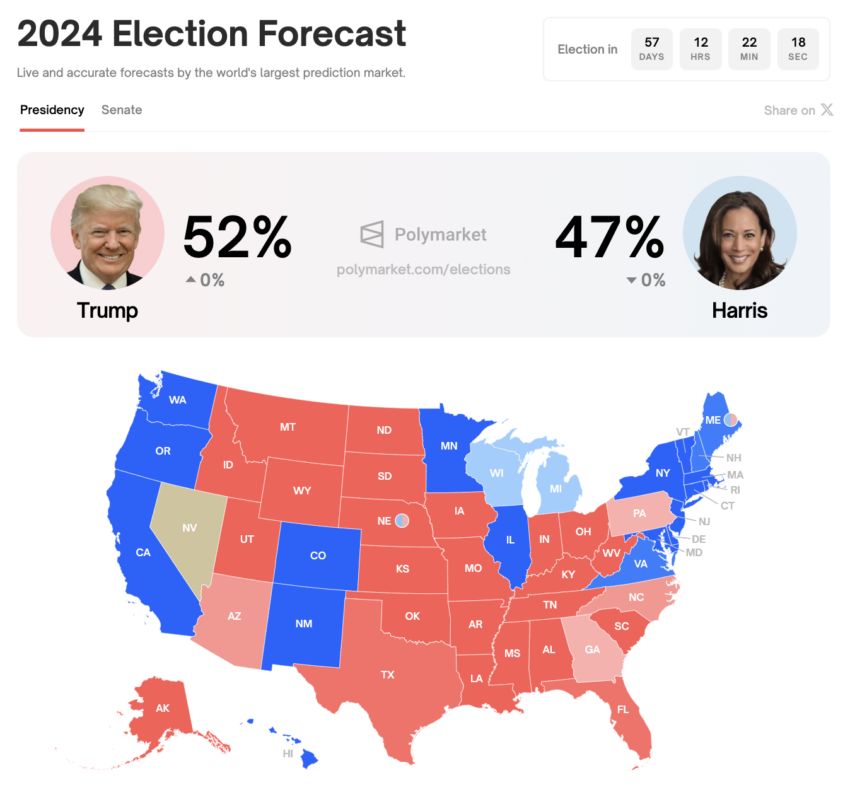

With voters deeply concerned about the economy and Trump leading the polls, the debate could be pivotal in shaping opinions—and, in turn, market reactions.

Crypto traders are particularly sensitive to the potential volatility this debate could unleash. The crypto market has already been cautious following a dip last week that raised concerns among investors.

“Crypto has stabilized after last week’s move but implied volumes are still elevated. It seems the market is still anticipating some volatility heading into this week’s events, specifically the Trump vs Harris debate,” QCP Capital highlighted.

The timing is critical. Markets will also be watching key economic data, particularly the US Consumer Price Index (CPI) report due the day after the debate. With the Federal Reserve weighing potential rate cuts at their upcoming meeting, any economic signals from the CPI could influence market trends, further compounding volatility in traditional and crypto assets.

Read more: How to Protect Yourself From Inflation Using Crypto

According to QCP Capital, crypto traders are closely monitoring Bitcoin and Ethereum. Risk reversals are skewed toward puts, indicating caution about further downside risks. Despite near-term uncertainties, long-term traders remain optimistic, signaling potential buying opportunities as volatility persists.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.