Dogwifhat (WIF) has consolidated within a tight range since its price touched a year-to-date peak of $0.49 on March 31.

This has led to the formation of a symmetrical triangle with accompanying uncertainty regarding the meme coin’s breakout direction.

Dogwifhat Bulls and Bears Tussle

When a symmetrical triangle is formed, an asset’s price hits various lower highs and higher lows. This means that neither the buyers nor the sellers present in the market can push the asset’s price far enough in their direction to make a clear trend.

When this happens, the asset in question is deemed to be consolidating within a range, with flashes of bullish and bearish signals.

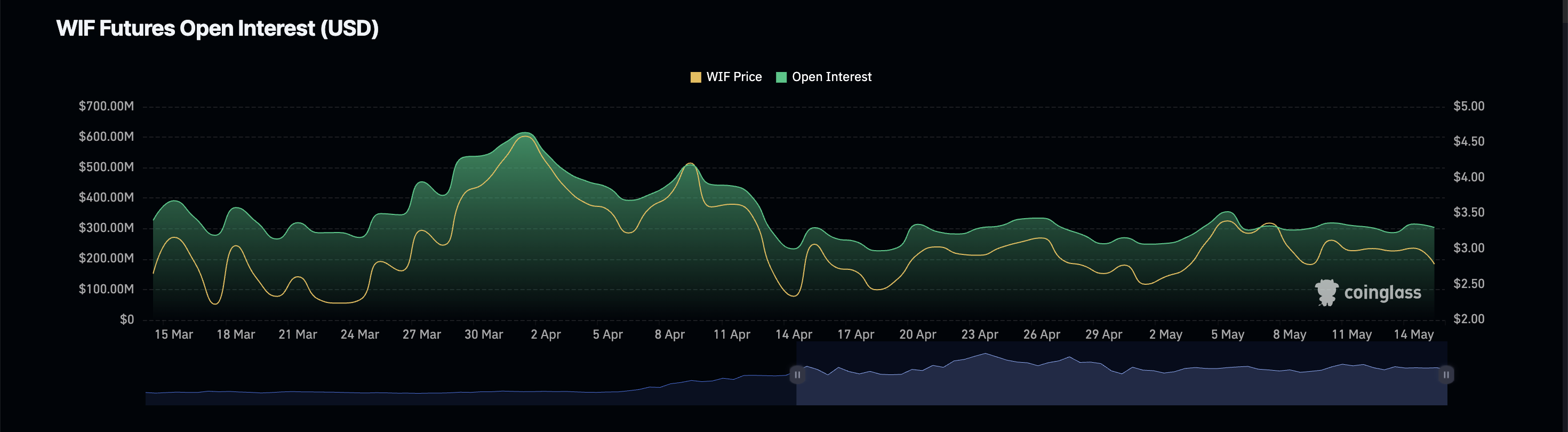

One such bullish signal in WIF’s case is its rising futures open interest. At $304 million at press time, it has grown by 23% since the beginning of May.

The meme coin’s futures open interest refers to the total number of futures contracts yet to be settled or closed. When it rises like this, it indicates an increase in market participants entering new positions.

Mixed Signals for the Memecoin

Also, despite its narrow price movement in the past few weeks, WIF’s funding rate across cryptocurrency exchanges has remained positive.

Funding rates are a mechanism used in perpetual futures contracts to ensure the contract price stays close to the spot price.

When an asset’s funding rate is positive, it means that its contract price is higher than its spot price, and more traders are holding long positions. At press time, WIF’s funding rate stands at $0.004%.

Despite these bullish markers, readings from WIF’s price chart show significant bearish sentiments. For example, the token’s Moving Average Convergence Divergence (MACD) suggested that selling activity exceeded accumulation among spot traders.

At press time, WIF’s MACD (blue) rests under its signal line. When these lines are positioned in this manner, it means that the asset’s short-term moving average is below the long-term moving average. It is a bearish signal, and traders interpret it as a sign to sell.

Further, the dots of WIF’s Parabolic SAR indicator rest above their price at the time of press, confirming the bearish trend.

Read More: How To Buy Dogwifhat (WIF) and Everything Else To Know

This indicator identifies an asset’s potential trend direction and reversals. When its dots lie on top of an asset’s price, the market is declining. This suggests that the asset’s price has been falling and may continue.

WIF Price Prediction: Who Takes the Crown?

At press time, WIF exchanges at $2.97, trading close to the lower trend line of the triangle. If the bears emerge victorious, they may pull the meme coin’s value below this trend line, and WIF may trade at the $2.5 level.

Read More: Dogwifhat (WIF) Price Prediction 2024/2025/2030

However, if buying pressure increases and the bulls can initiate an uptrend, WIF may rally above $3 and race toward $3.4.