Dogecoin’s (DOGE) price has experienced a significant 14% correction in the past two days, erasing the gains it accumulated toward the end of September. This sharp decline has led some investors to question the meme coin’s trajectory.

However, despite the drop, crypto whales are showing signs of preparing for a potential price reversal, indicating that this could be a buying opportunity for savvy investors.

Dogecoin Whales to the Rescue

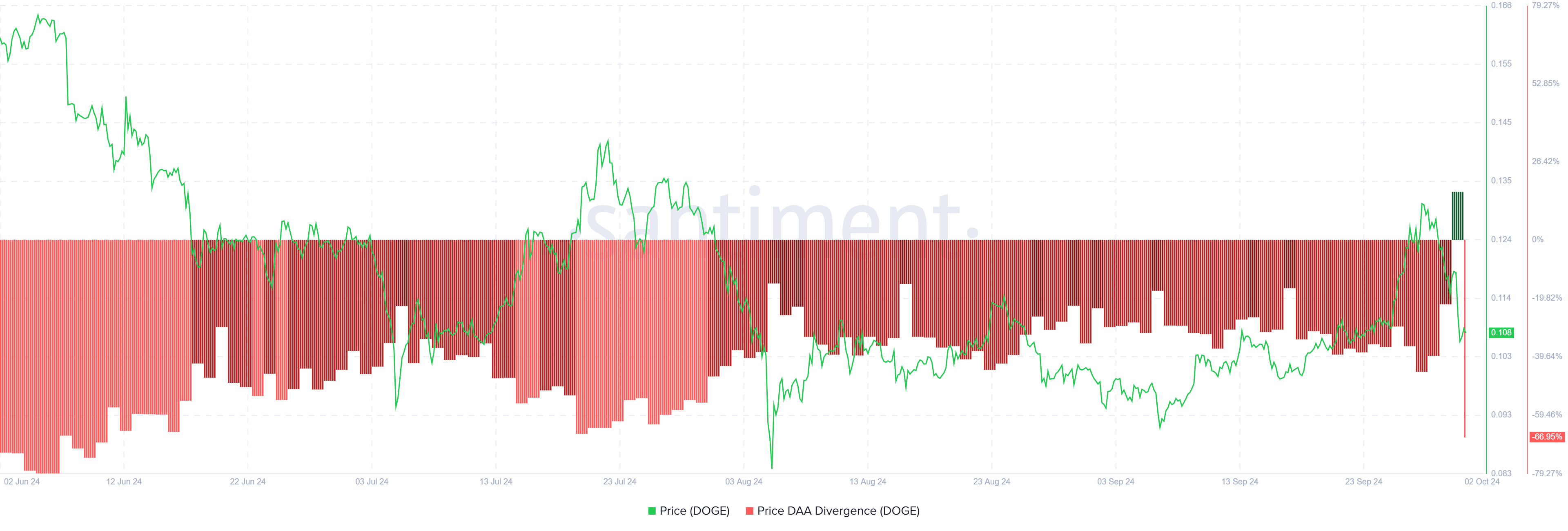

The price-DAA (Daily Active Addresses) divergence indicator is flashing a buy signal for Dogecoin. Even as the price has dropped, the number of investors actively transacting on the Dogecoin network has risen, signaling a potential accumulation phase.

Typically, when a cryptocurrency’s price falls while its network activity increases, it suggests that investors may be positioning themselves for a future rally.

This increase in activity aligns with the broader sentiment that Dogecoin may be primed for accumulation. Investors are capitalizing on the lower prices, and the heightened activity could indicate that the meme coin is in the early stages of a recovery despite the recent correction.

Read more: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

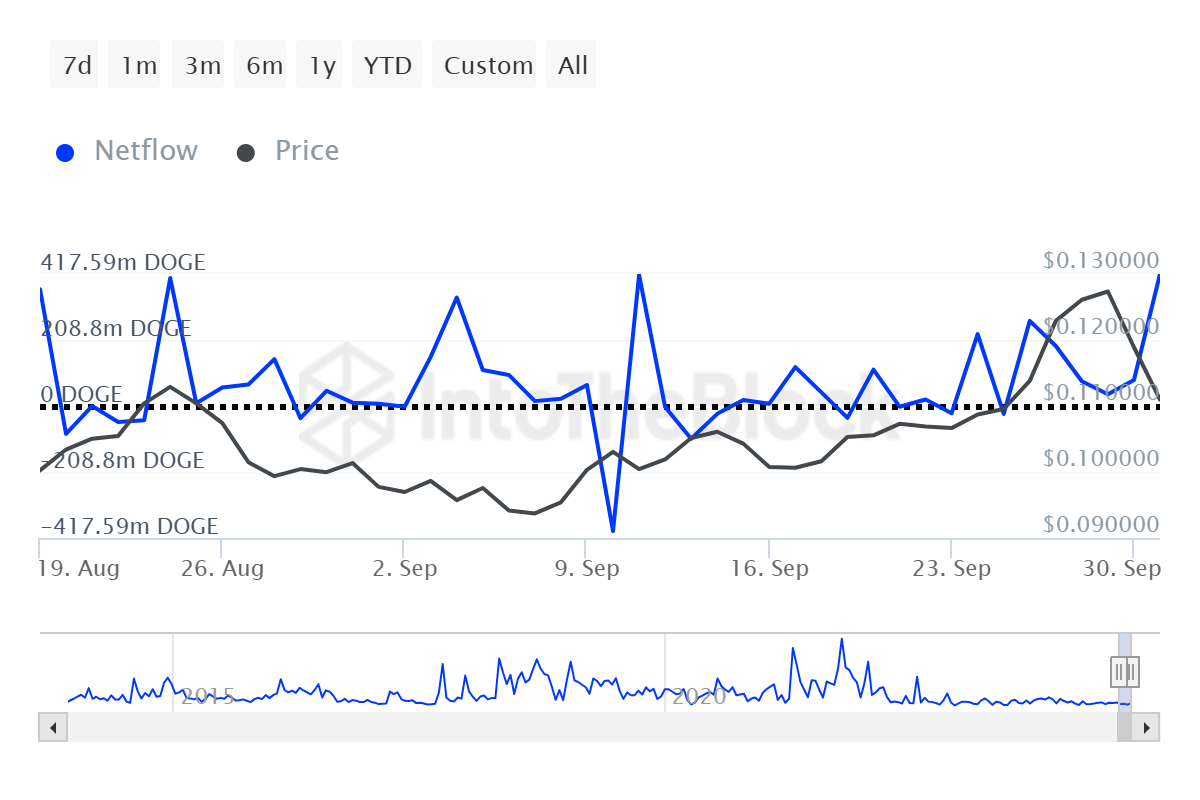

Dogecoin’s macro momentum further supports this bullish outlook. Whale addresses, which hold at least 0.1% of the circulating supply of DOGE, have been capitalizing on the low prices.

In the last 24 hours alone, these whales registered net inflows totaling 417 million DOGE worth around $45 million—the largest in nearly a month. This shows that large holders are confident in a potential price bounce.

Whales often play a significant role in influencing the price of cryptocurrencies, and their recent activity suggests growing confidence in Dogecoin’s recovery. The large inflows highlight the possibility of a rebound in the near future as these influential market players position themselves for a potential rally.

DOGE Price Prediction: Staying in Its Lane

Dogecoin is currently trading at $0.107 after failing to breach the resistance level at $0.130 over the weekend. The meme coin is now testing a crucial resistance at the $0.108 price point. Flipping this level into support is essential for initiating a recovery.

If Dogecoin manages to turn $0.107 into support, the next hurdle would be breaching the $0.118 resistance. Successfully crossing this threshold could pave the way for a rally toward $0.130, which could signal a stronger recovery for DOGE.

Read More: Dogecoin (DOGE) Price Prediction 2024/2025/2030

However, Dogecoin has faced consolidation multiple times between $0.107 and $0.094. If DOGE does not hold the support of $0.107, it would likely result in further consolidation and repeating historical patterns. This would invalidate the current bullish thesis and delay the anticipated recovery, leaving investors waiting for a more substantial turnaround.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.