Amid the broader market uncertainty, (DOGE) price has decreased to $0.0096 after trading at $0.12 just ten days ago. This decline may be tied to Ethereum’s (ETH) performance, as ETH has played a key role in Dogecoin’s past rallies.

However, unlike previous instances, Ethereum may now limit DOGE’s chances of rebounding on its own. This on-chain analysis explores the factors behind this shift.

Ethereum Takes Part in Dogecoin’s Slow Recovery

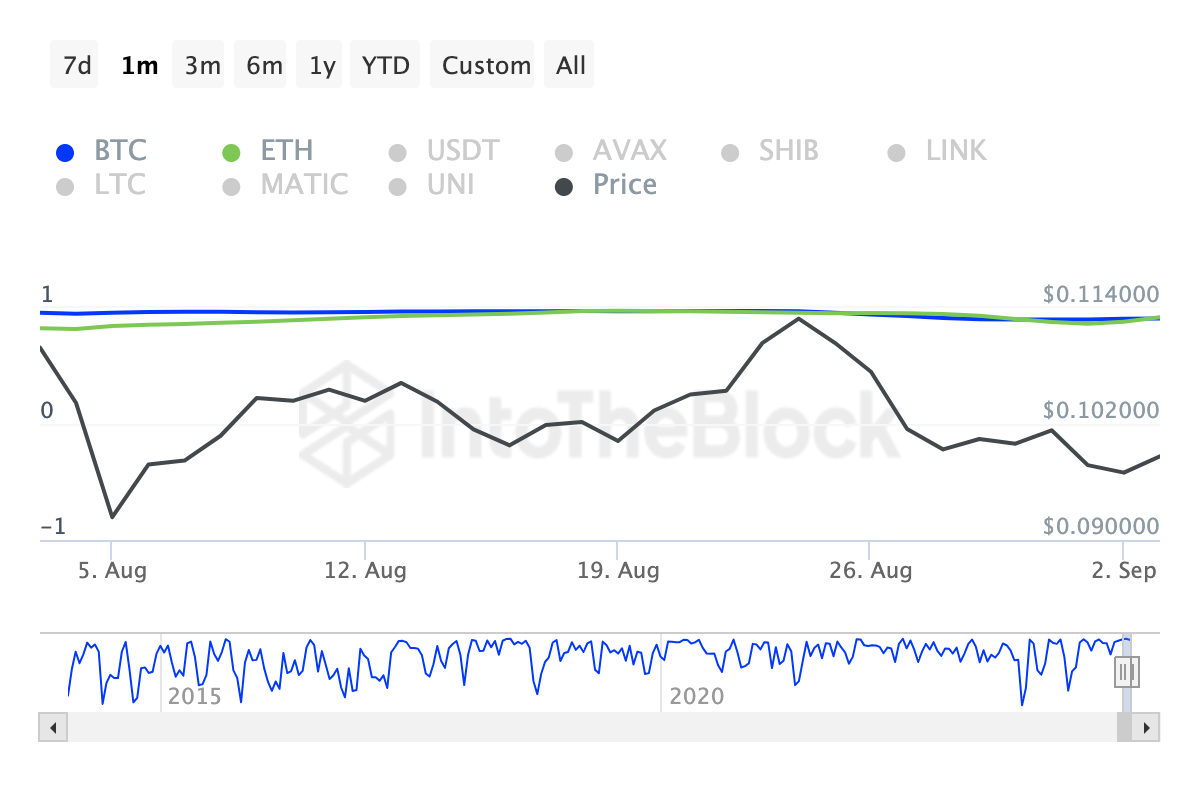

According to IntoTheBlock, Dogecoin and Ethereum have a high correlation of 0.92 over the past month, meaning DOGE’s price is closely tied to Ethereum’s movements. As Ethereum is the second-largest cryptocurrency, DOGE holders should monitor its performance, as it could heavily influence Dogecoin’s price trends.

For those unfamiliar, the correlation coefficient ranges from -1 to +1. A value near +1 indicates a strong relationship, where two crypto assets move in sync. Conversely, a coefficient near -1 suggests that the assets rarely move in the same direction.

Recently, BeInCrypto reported how DOGE’s rally largely depends on Bitcoin. However, its solid price movement with ETH might also be a condition for the next level the cryptocurrency’s value hits.

Read more: How To Buy Dogecoin (DOGE) and Everything You Need To Know

As of this writing, Ethereum (ETH) is priced at $2,402, marking a 37.46% decline over the past 90 days. If ETH continues to underperform, Dogecoin (DOGE) is likely to follow suit.

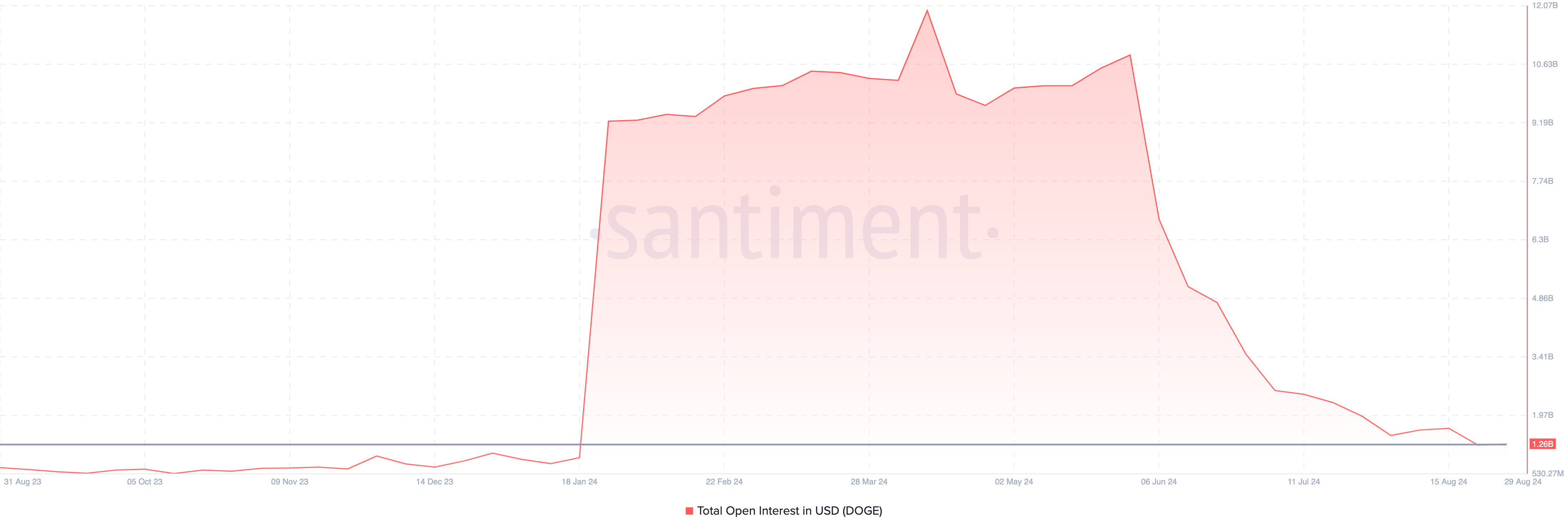

Another factor that could hinder DOGE’s recovery is its Open Interest (OI) in the derivatives market. OI represents the total number of active contracts. In volatile markets, crypto rallies are often driven by rising OI or spot buying pressure.

A decrease in OI signals traders closing positions and pulling money out, while an increase indicates aggressive buying. For Dogecoin, OI has dropped to $1.25 billion, its lowest since January 18.

DOGE Price Prediction: Bears Remain in Control

In August, Dogecoin formed an ascending triangle as the coin moved from $0.080 to $0.11. This bullish technical pattern was supposed to trigger a higher value for DOGE.

However, bears rejected the move, as shown below. According to this analysis, DOGE might find it challenging to rebound in the short term. One reason for this is the Commodity Channel Index (CCI), an indicator used to spot price reversal and trend strength.

Using the difference between the current price and the historical price average, a positive reading indicates that the strength to rebound is solid. But in Dogecoin’s case, the reading is negative, suggesting that the trend around the coin is bearish.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

As long as this remains the same, DOGE’s price could drop to its support level around $0.091. However, if Ethereum’s price rises, the strong correlation between the two could trigger a jump in DOGE’s value, potentially pushing it back to $0.11.