The much-hyped House of Doge announcement — a planned merger that could list Dogecoin’s corporate arm on NASDAQ in early 2026 — briefly reignited optimism across the DOGE community. The hype around it helped the Dogecoin price rebound almost 45% by October 13, recovering sharply from its “Black Friday” crash lows.

However, this recovery also became an exit window. Key holder groups offloaded portions of their holdings, signaling that optimism may have come more from hype than conviction. Over the past 24 hours, the price has mostly traded flat, prompting traders to zoom in on the 4-hour chart for early signs of Dogecoin’s next move.

SponsoredWhales and Long-Term Holders Exit Through and After the Rebound

Following the House of Doge buzz, on-chain data shows that major wallets and long-term investors both reduced their positions substantially.

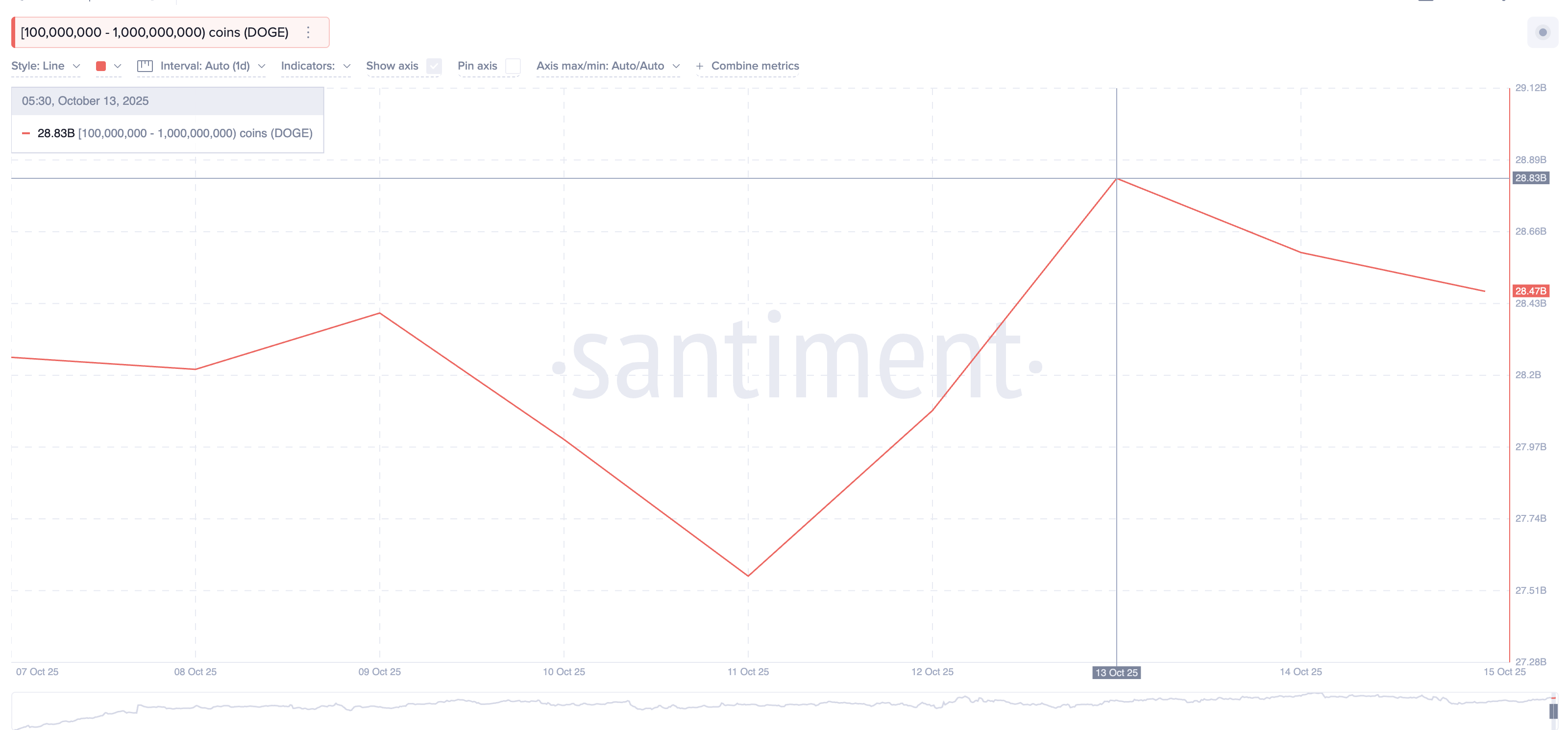

Whale wallets — those holding between 100 million and 1 billion DOGE — lowered their balances from 28.83 billion DOGE on October 13 (day of merger announcement) to 28.47 billion DOGE two days later. That’s roughly 360 million DOGE sold, worth about $74 million at the current Dogecoin price.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

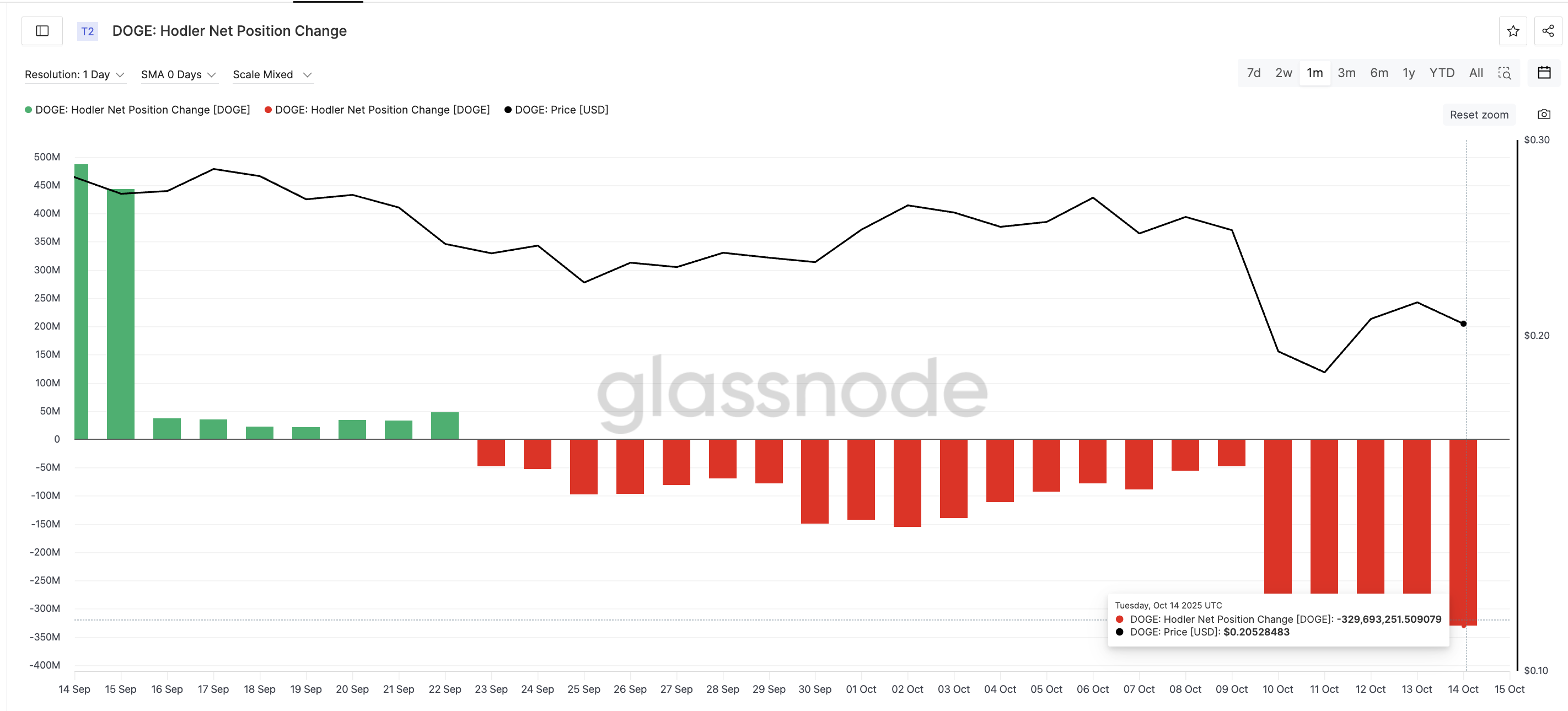

Meanwhile, the Holder Net Position Change, an indicator that tracks whether long-term investors are buying or selling, remained negative and worsened. Between October 9 and October 14, net selling grew from –48 million DOGE to –329 million DOGE, a clear sign that even committed holders moved out. While the crash sentiment had a role to play, things didn’t get much better even when the Black Friday jitters eased out.

Sponsored

Note: There’s one small positive: compared to October 12, when the figure sat near –366 million DOGE, the current value of –329 million DOGE suggests that some slow buying may be returning post the merger news.

In total, nearly 640 million DOGE, valued at around $130 million, exited whale and holder wallets during and after the 45% bounce. The pattern suggests that many took advantage of the temporary strength to cut exposure or lock in smaller losses.

Dogecoin Price Faces Key Test Near $0.20

On the 4-hour chart (used to locate early trend shifts). The Dogecoin price continues to trade inside a descending triangle — a pattern that usually signals potential weakness if buyers fail to defend key levels. The upper resistance zone lies near $0.206, and a daily close above it would indicate short-term strength.

However, all’s not bullish with the chart. The Relative Strength Index (RSI) — which measures momentum and identifies overbought or oversold conditions — shows a hidden bearish divergence. Prices have made lower highs while RSI has made higher highs, suggesting fading buying power. This kind of divergence hints at a correction in the shorter time frame.

However, $0.194 remains a critical support line and a key base for the bearish triangle. A decisive break below this level could open the way to deeper corrections. That would open levels of $0.181 and even $0.149 for the Dogecoin price (acting as other lower bases for the descending triangle).