Dogecoin price has always responded to news of Tesla founder Elon Musk engaging with the meme coin. The same was expected this week.

However, the broader market conditions weighed much more heavily on the price action, resulting in DOGE seeing red on the chart.

Dogecoin Feigns No More

Dogecoin’s price first reacted to Elon Musk in 2021 and has since formed a bond with Tesla’s founder. This bond weakened over the last year as Musk’s interest shifted from DOGE to Artificial Intelligence.

However, the DOGE community rejoiced this week as Musk went on to speak in favor of the meme coin. During a session at Tesla’s Berlin Gigafactory, Musk stated that Dogecoin would be enabled as a means of payment for Tesla purchases. He went on to call the dog token the “people’s crypto.”

Surprisingly, this did not impact the Dogecoin price in any capacity and even failed to prevent a drawdown. DOGE is set to initiate a downtrend owing to the broader market cues.

Over the past 24 hours, Bitcoin prices have declined considerably, and Dogecoin prices have followed the same trend. Since the meme coin shares a high correlation of 0.89 with BTC, it was directly influenced.

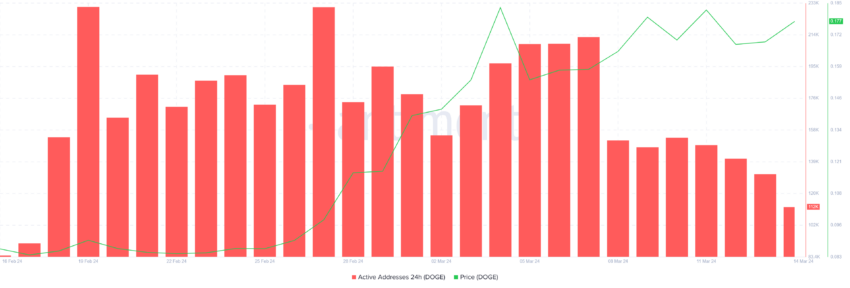

Furthermore, the cryptocurrency notes no support from its investors, who have begun falling back as the bullish momentum wanes. The addresses that have been conducting transactions on the network have declined considerably.

The bullish community did not contribute to actual activity on-chain, bringing the active addresses down to a four-week low.

DOGE Price Prediction: A 20% Correction Cannot Be Ruled Out

Looking at the daily chart, it can be seen that the Dogecoin price is not too far from beginning a downtrend. The first signal comes from the Moving Average Convergence Divergence (MACD).

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of a MACD line (the difference between a short-term and a long-term exponential moving average) and a signal line (a moving average of the MACD line).

At the time of writing, these averages are forming a bearish crossover for the first time in a month. Usually, these crossovers are followed by considerable corrections since the market is still cooling down. In the case of DOGE, a fall to $0.147 or $0.134 is possible, marking a 12% or 20% correction, respectively.

Nevertheless, the 50-day Exponential Moving Average (EMA) is still positive, sitting underneath the candlestick. If this level continues acting as a support, Dogecoin price could have a shot at recovery, bouncing off $0.164.

If DOGE successfully manages to breach through $0.182, the bearish thesis would be invalidated, opening the meme coin up to a rally to $0.20.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.