Dogecoin’s (DOGE) price was on track to note significant gains following its breakout from the descending wedge.

However, this could be failing due to the lack of bullishness among investors.

Dogecoin Investors Are Unsure

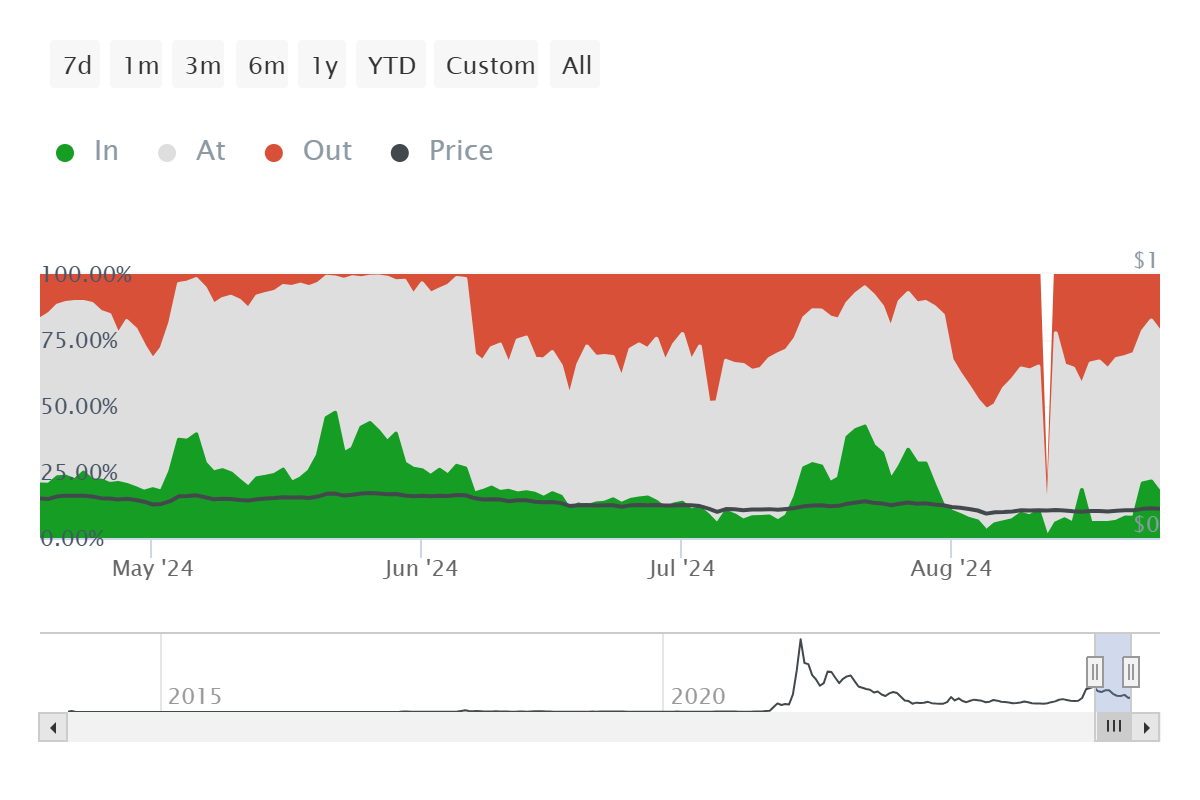

Dogecoin’s price is affected by investor bearishness. The Chaikin Money Flow (CMF) indicator reveals that inflows into Dogecoin have been notably weak over the past few days.

This lack of strong inflows has contributed to the cryptocurrency’s failure to sustain its recent rise. In fact, it has taken Dogecoin 12 days to accumulate less than the amount of inflows that were recorded in just six days at the beginning of July, highlighting a significant slowdown in momentum.

Read More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

Despite the weak inflows, selling pressure on Dogecoin has remained relatively low. This limited selling activity has helped prevent a sharp decline in the coin’s price, offering some stability amid the overall market weakness. The absence of heavy sell-offs suggests that investors are holding onto their positions rather than exiting the market.

Overall, weak inflows have hindered Dogecoin’s ability to continue its rally. However, the low selling pressure and the current profitability of a portion of the investor base may provide some support to the meme coin.

DOGE Price Prediction: Up, up, and Sideways

Dogecoin’s price began slightly recovering towards early August and proceeded to break out over the past week from the descending wedge. This bullish pattern suggests a potential rally of 90% upon breakout, placing the target at $0.20.

While the meme coin is not expected to skyrocket anytime soon, it looks like even a considerable rise could fail. This is because, upon the breakout, DOGE noted a 7% rise on August 23 and has since been declining. As a result, trading at $0.10, the altcoin could end up consolidating under $0.11.

Read More: Dogecoin (DOGE) Price Prediction 2024/2025/2030

Any rise above this resistance will be fruitful for Dogecoin’s price. However, the bearish-neutral thesis can be considered invalidated only when DOGE flips $0.12 into a support level.