Dogecoin’s (DOGE) price is dropping despite the rest of the meme coins experiencing growth these past few days.

The meme coin is facing selling from its whales and very low investor participation, which might be a bane for DOGE.

Dogecoin Investors Pass

Dogecoin’s price has already failed a potential bullish outcome and could now continue slipping down that path. This is because the whale addresses are opting to sell their holdings to secure whatever profit they have and minimize their losses.

The addresses holding between 10 million and 100 million DOGE have sold off over 300 million in the past week. This supply worth nearly $50 million has brought their total holdings down to 17.36 billion DOGE.

But in addition to the whales selling, the retail investors also see little incentive in the asset. This is visible in their participation, or more accurately, in the lack thereof.

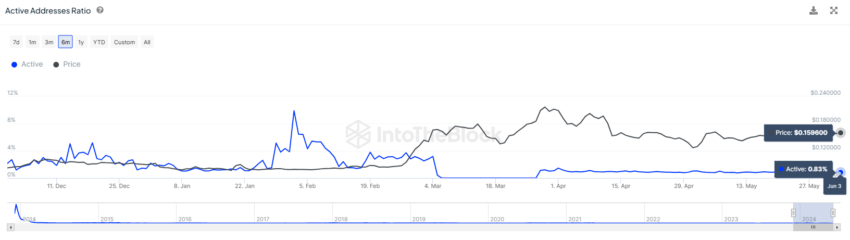

The active addresses ratio is calculated as the active addresses divided by the addresses holding any balance. This shows that of the total investors with DOGE, what percentage is actively conducting a transaction on the network?

Currently, this ratio sits at less than 1% at 0.89%. This shows that not only are investors unsure of their profits, they are certain of the losses, keeping their participation at bay.

Read More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

DOGE Price Prediction: After the Fail

Dogecoin’s price recently failed the ascending triangle pattern. This bullish continuation pattern suggested a potential 22% rally as the target, but DOGE fell even before crossing $0.190.

The meme coin is currently changing hands at $0.159, holding above the critical support of $0.151. While this is a good sign for DOGE, the broader market bearishness might affect its ability to persist.

Read More: Dogecoin (DOGE) Price Prediction 2024/2025/2030

This could send the meme coin trickling down to $0.142 or lower.

But if the bounce-off is successful and Dogecoin’s price reclaims $0.168 as support, it could rise to $0.182. Breaching this resistance would invalidate the bearish thesis, sending DOGE towards $0.190 and higher.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.