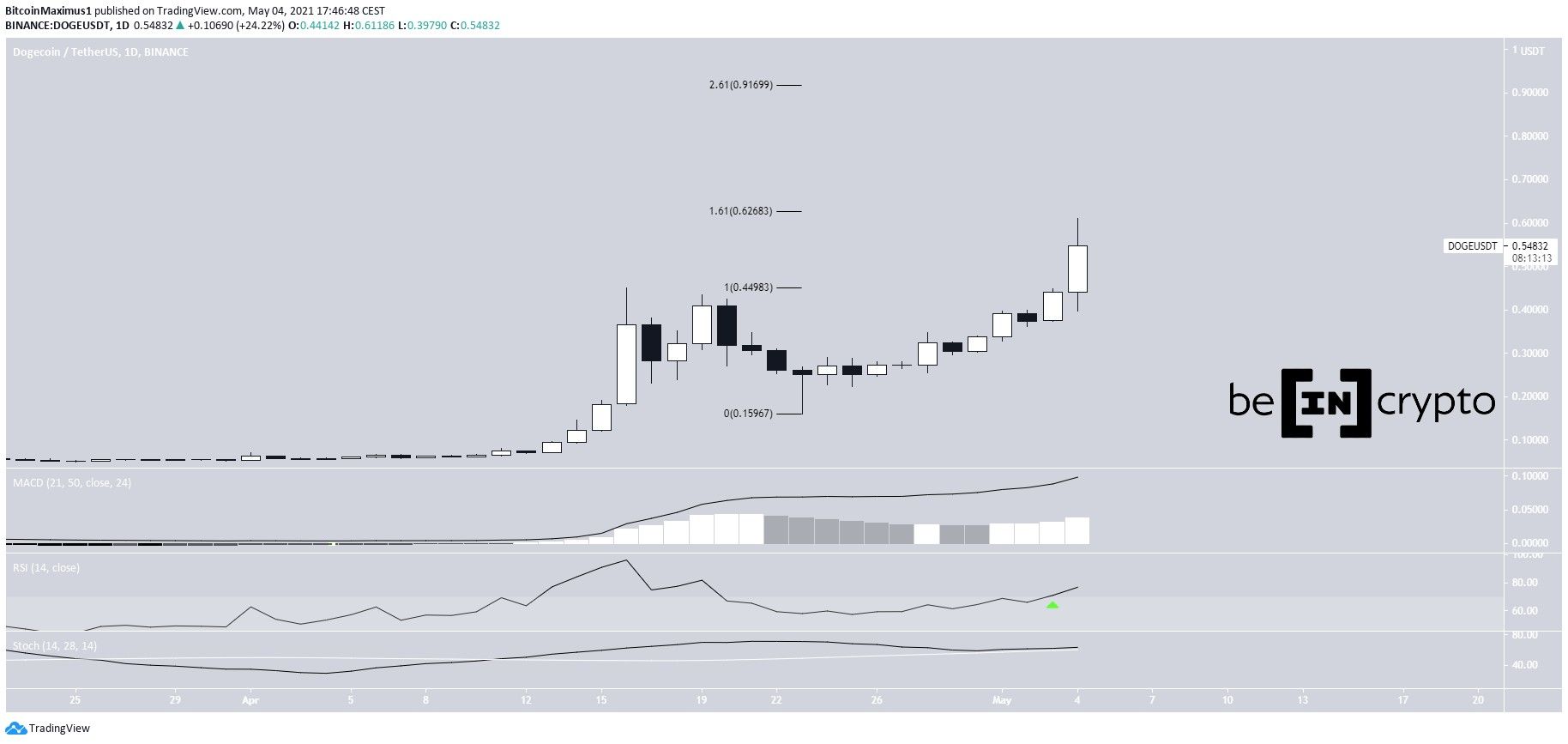

Dogecoin (DOGE) reached a new all-time high price on May 4. Its valuation is now higher than established companies like Twitter and Ford.

DOGE has reached a confluence of resistance levels near $0.62 and has been rejected by it. Despite the rejection, technical indicators do not yet show significant signs of weakness.

New all-time high for DOGE

DOGE has been increasing since April 23, when it was trading at a low of only $0.169. The increase is still ongoing. Today, the token managed to reach a new all-time high price of $0.60.

Technical indicators are still bullish, supporting the upward move. This is especially evident by the RSI cross above 70 and the increasing MACD.

However, DOGE can be said to have reached the 1.61 external Fib resistance at $0.626. If the upward movement eventually continues, the next significant resistance area is found at $0.916.

DOGE wave count

The wave count suggests that DOGE is in wave five of a bullish impulse. In addition, it further supports the importance of $0.62 resistance area.

A target for the top of this move is found by projecting the length of waves 1-3 to the bottom of wave four. This gives a target of $0.616, very close to the previously outlined $0.626 resistance area.

If the current wave extends, there is another Fib resistance found at $0.76. This would likely serve as a minor resistance level prior to $0.916.

At the current time, we cannot determine if wave five will extend.

To conclude, DOGE is likely in the fifth and final wave of a bullish impulse. While there are no signs of weakness present, the token has reached a confluence of resistance levels, which could signify the top of the upward movement.

If the movement extends, the next resistance levels are found at $0.76 and $0.91, respectively.

As reported, crypto trading app Robinhood “experienced intermittent issues” with crypto trading earlier today, as DOGE had gained 120%, over the last week, and sent users flocking to the app. However, the trading app has not clarified whether the issues were actually caused by the increased interest and trading volume.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.