Dogecoin (DOGE) has suffered a double-digit price decline over the past week. This comes as investors race to offload holdings and lock in gains from its recent rally.

After climbing to a multi-month high this month, the meme coin now faces significant sell-side pressure that has intensified across major exchanges.

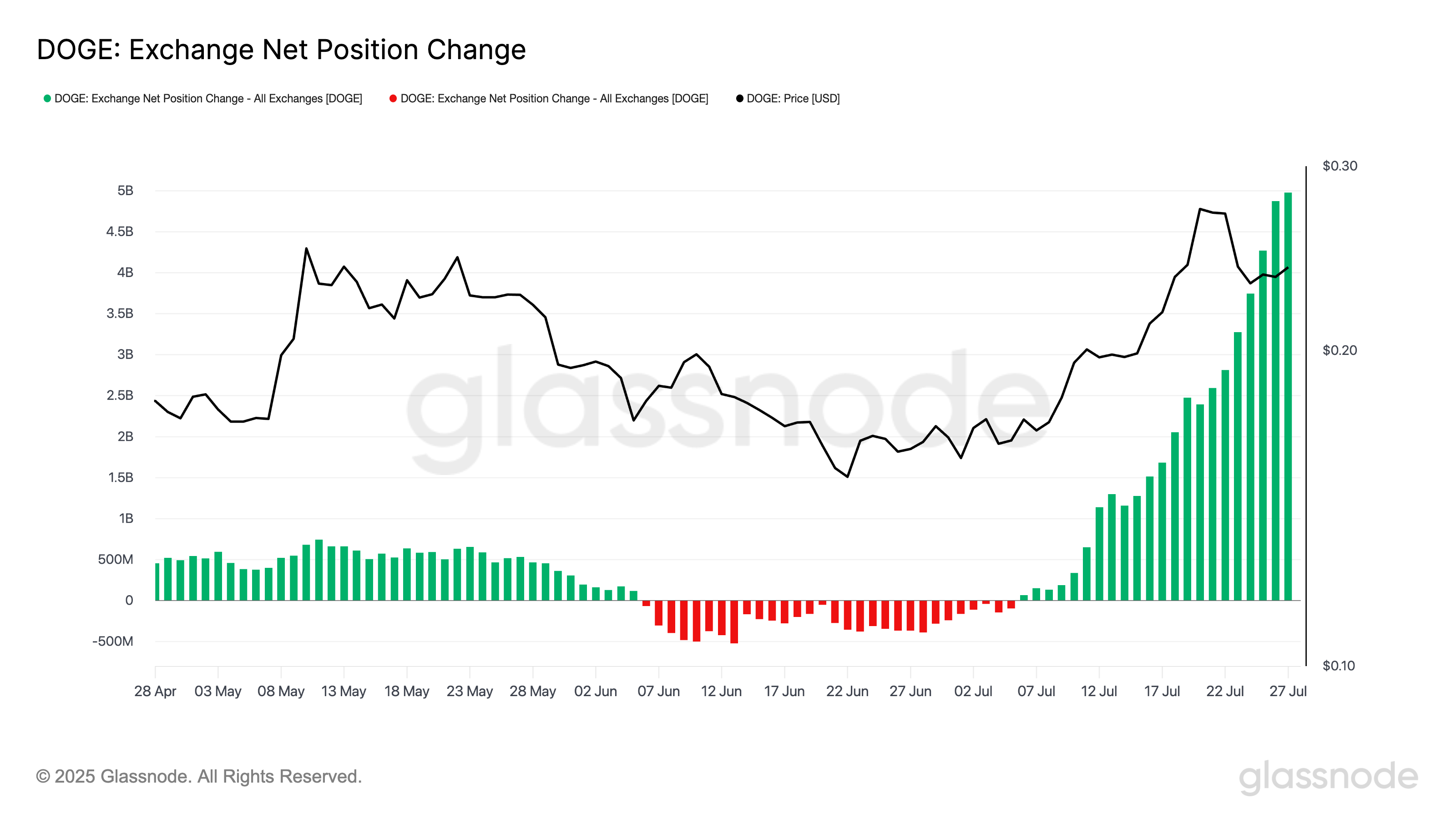

DOGE’s Rally in Jeopardy as Traders Dump 5 Billion Coins into Exchanges

According to data from on-chain analytics platform Glassnode, DOGE’s Exchange Net Position has steadily increased over the past week, closing at a 3-year high of 5 billion coins on Sunday.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This metric tracks the net amount of DOGE moving into exchanges. As more holders transfer their tokens to centralized platforms, it clearly shows an intent to exit positions, especially after the meme coin’s recent price rally.

When it climbs like this, more tokens are deposited into exchanges than withdrawn. It is a bearish signal that suggests more DOGE is being prepared for sale rather than being held in cold wallets or withdrawn.

This trend aligns with DOGE’s rising Realized Profit/Loss (P/L) Ratio, which shows that sellers are offloading at a profit. Per Glassnode, this currently sits at 15.78.

The metric measures the difference between the value of coins at the time they were acquired and the value at which they are sold. When the ratio is above 1, it indicates that coins are being sold at a profit on average.

DOGE’s current reading of 15.78 suggests sellers are realizing profits at a staggering scale. This means for every $1 loss, there is $15.78 in profit realized. This may continue to fuel sell-side momentum as more investors are tempted to take gains before any potential correction deepens.

DOGE Rally May Fade as Sell Pressure Builds

DOGE’s price has recorded a modest 2% increase in the past 24 hours, driven by the broader market rally. However, rising exchange inflows accompanying this upswing suggest the momentum may be short-lived.

If profit-taking intensifies, DOGE risks a pullback below the $0.23 support floor, opening the door for a deeper drop toward $0.17.

Converesly, if buying pressure grows and demand strengthens, the meme coin could stage a rebound, eyeing a climb toward the $0.28 resistance zone in the near term.