Are we witnessing the calm before the storm in Dogecoin? The asset added over half a million holders in 2 weeks during February.

However, its number of profitable holders and weak support zone could lead to a potential downturn. Could this be a prelude to a bearish descent, or will the DOGE community manage to stave off the decline?

DOGE Reaches Record 6M Holders

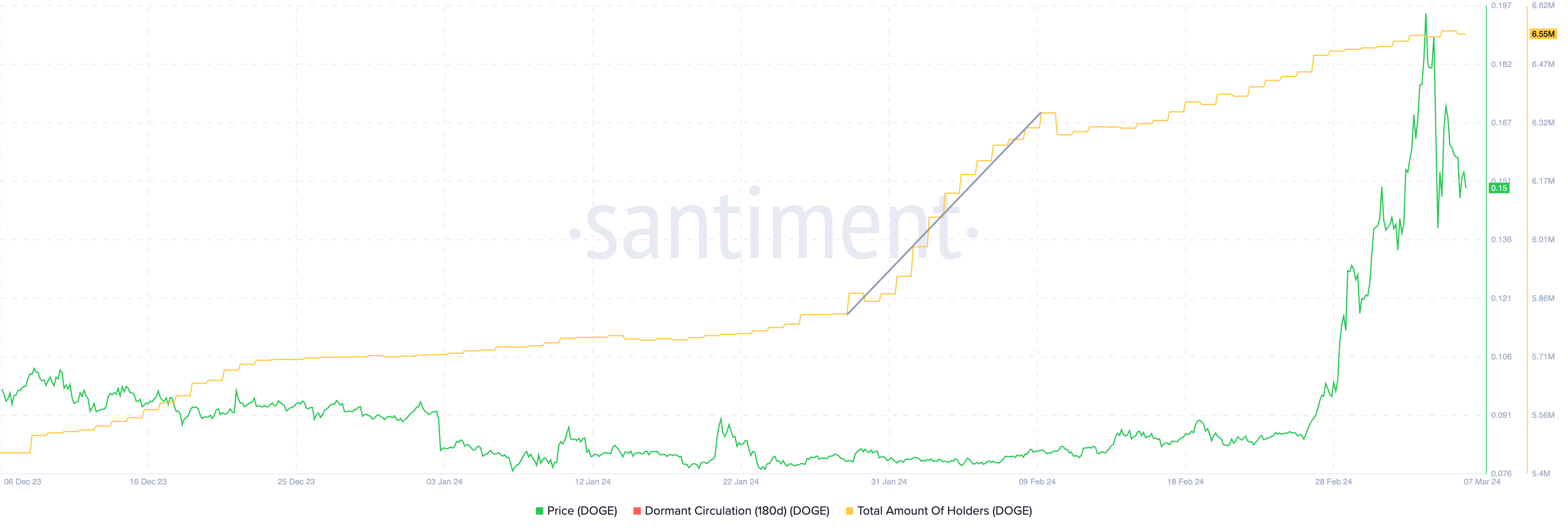

DOGE holders currently sit at 6.5M, one of the most impressive numbers in the crypto markets. This number was reached on February 2, which was part of an impressive surge in Dogecoin holders from 5.82M on January 28 to 6.35M on February 10. This is an almost 10% increase in holders, which is remarkable for a token of this size.

It is interesting to note that all that growth was followed by a price surge. However, between February 10 to March 4, DOGE prices grew from $0.081 to $0.1950, an increase of approximately 141%. There has been some pullback since then, leaving DOGE up 95% since the large move that began on February 26.

However, although the number of holders skyrocketed at the beginning of February, it became pretty stable since the beginning of March.

This may not mean anything on its own, but following a 140% price rally and a growing number of holders, the stable number could mean that new money is not flowing into DOGE. Investors may be unsure if the bullish sentiment will continue.

Profitable Holders Could Create Selling Pressure

Many holders entered two weeks before the price surge, contributing to the rising percentage of holders currently profitable in DOGE.

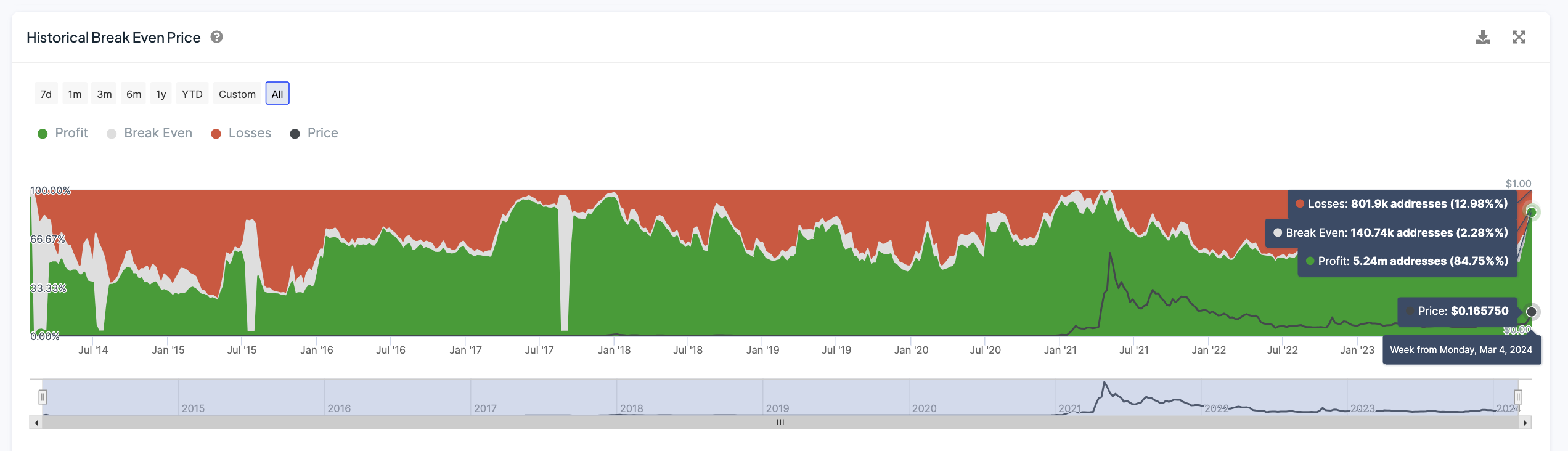

An impressive count of more than 5.24 million addresses, coincidentally equal to the total number of DOGE holders recorded on November 24, 2023, are in profit. They account for a substantial 84.75% of all holders. 12.28% face losses, while a small fraction of about 2.28% are positioned at the break-even point.

Given that nearly 85% of addresses are currently sitting on gains, it stands to reason that this could exert considerable selling pressure on DOGE. The rationale is that many of these holders might capitalize on their gains, choosing to sell off their holdings in the forthcoming days, thereby realizing their investment positions.

The last time the percentage of profitable DOGE holders was above 80% was in May 2021. During that period, the proportion of holders in profit soared to a staggering 93%.

The subsequent activity during that timeframe saw a significant market adjustment, with DOGE experiencing a correction of 67.86% over the following five weeks. This historical precedent suggests that the current market conditions could potentially mirror past outcomes, leading to a similar market response.

Dogecoin Price Forecast: $0.15 Support Level Takes Center Stage

The current market activity for DOGE is displaying a convergence in the trend lines, where the short-term 9-day Exponential Moving Average (EMA) has dipped below the 26-day long-term EMA. Market analysts and investors often regard this event as a bearish indicator.

The trend that has emerged subsequent to this EMA crossover is indicative of an increased momentum on the bearish side. This suggests that sellers are starting to dominate.

Should this downward trajectory maintain its course, it is plausible that the price of DOGE may approach and even test the established support level at $0.15.

Further bearish pressure, should the $0.15 support fail to hold, may result in DOGE’s price descending to the next level of support, which stands around $0.12.

Contrarily, a bullish DOGE scenario could emerge if it stays above $0.15, signaling active buyers and potentially reversing the downtrend. A more definitive bullish sign would be DOGE breaking the $0.1646 resistance. This could indicate a trend change and possibly start an uptrend, especially if trade volumes increase, making a case for a bullish reversal and aiming for a $0.1757 resistance challenge.

Remembering 2021, over 80% of DOGE addresses were profitable, yet its price continued to increase. Considering DOGE’s strong correlation to BTC and ETH movements, similar bull conditions could lead to a rally.