Hedera Hashgraph (HBAR) reached a new all-time high price on March. 11.

The Dogecoin (DOGE) price has broken out from a descending resistance line and is attempting to reach the February highs.

Basic Attention Token (BAT) has been increasing since breaking out from a two-year-long resistance area at $0.475.

Dogecoin (DOGE)

DOGE has been decreasing since Feb. 7, when it attained a high of $0.086. The drop continued until Feb. 23, when it reached a low of $0.041.

Afterward, DOGE began a bounce, which caused it to break out above a descending resistance line.

Currently, DOGE is facing resistance at $0.062. However, technical indicators are bullish, suggesting that DOGE is expected to break out. If so, it would likely move towards the high of $0.086 once more.

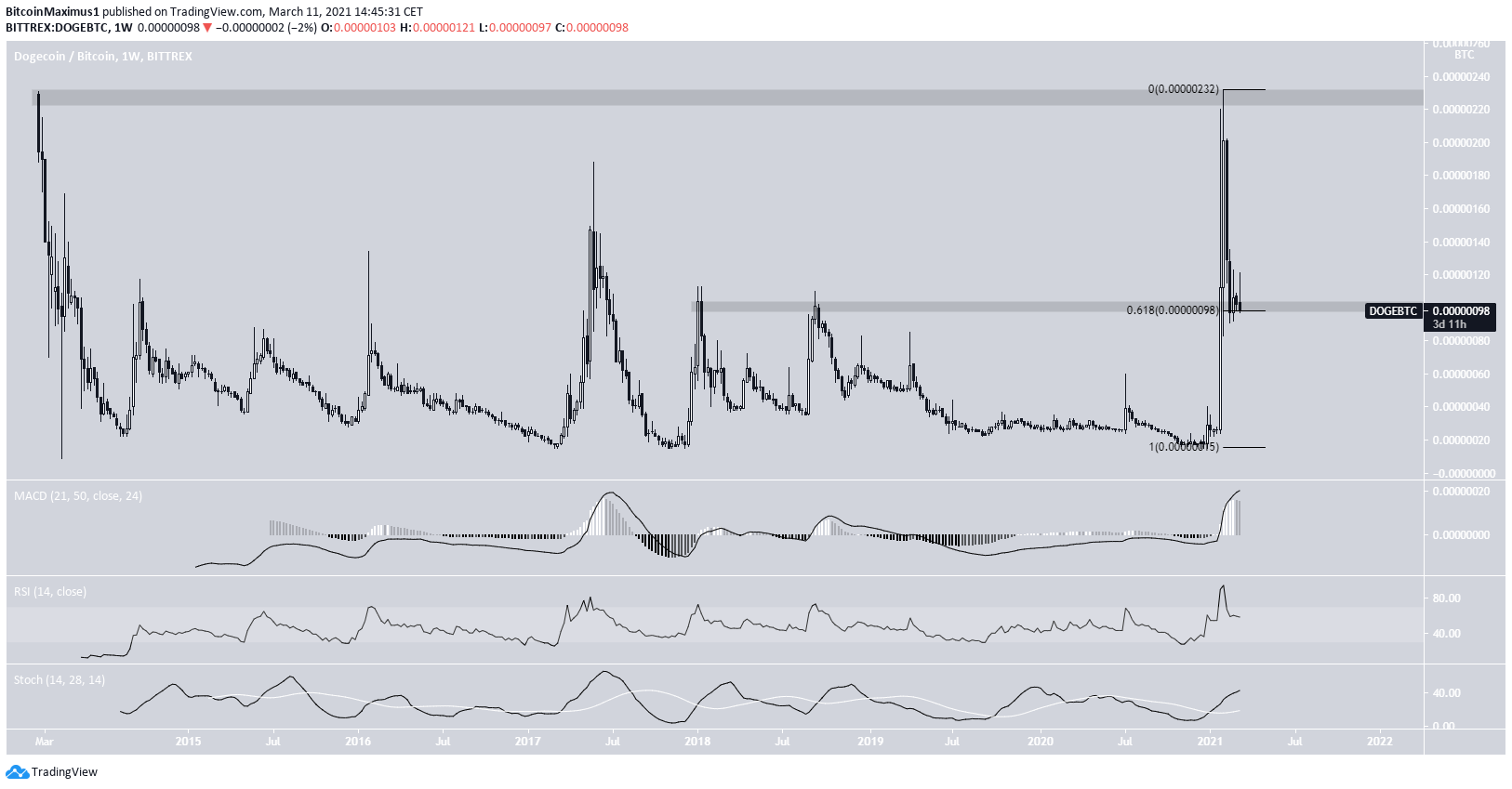

The DOGE/BTC pair has also been decreasing the past month, falling from a high of 232 satoshis.

Currently, it is trading just above the 100 satoshi support area, which is the 0.618 Fib retracement of the entire upward movement.

Technical indicators are bullish. Therefore, DOGE may create a range between the 100 – 230 satoshi levels.

Highlights

- DOGE has broken out from a descending resistance line.

- DOGE/BTC is trading above support at 100 satoshis.

Hedera Hashgraph (HBAR)

HBAR has doubled in price since March 5, reaching an all-time high of $0.278 on March 11.

Despite the parabolic rate of increase, technical indicators do not show weakness. On the contrary, The MACD & RSI have invalidated bearish divergences. Furthermore, the Stochastic oscillator has made a bullish cross.

Since HBAR is at an all-time high, we need to use an external Fib retracement to find potential targets for the upward move’s top.

Doing so on the 2020 drop gives us targets of $0.26 & $0.32 (white Fib). On the other hand, doing the same for the 2021 fall gives us targets of $0.27-$0.34.

Currently, HBAR is inside the first potential reversal area.

Therefore, despite the lack of weakness, the HBAR upward move is likely nearing its end.

Highlights

- HBAR reached a new all-time high on March 11.

- Potential targets for the top of the move are found at $0.27 and $0.34.

Basic Attention Token (BAT)

BAT has been increasing since breaking out from and re-testing the $0.475 area as support. While it is not confirmed whether this was a breakout from a horizontal or diagonal level, both provide the same outlook.

Despite being overbought, technical indicators are still bullish. Neither the RSI nor MACD have generated any lower highs, and the Stochastic oscillator is similarly increasing.

Therefore, it is likely that the long-term trend for BAT is still bullish.

A closer look at the movement shows that BAT is likely in the fifth and final wave (orange) of a bullish impulse.

A potential target for the top of the movement is found between $0.90-$0.92.

Technical indicators are mixed, though leaning on bullish.

The MACD & Stochastic oscillator are bullish, and the latter having just made a bullish cross (green arrow). However, there is a potential bearish divergence developing in the RSI.

Therefore, similar to HBAR, BAT seems to be approaching the top of the current upward movement.

Highlights

BAT has broken out above the $0.0475 long-term resistance area.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.