The European Union is taking some steps forwards for its digital euro, having discussed some proposals and begun market research. However, some actions might need political support.

The European Union has offered an update on the digital euro, its much-discussed central bank digital currency (CBDC).

Finance Ministers from the EU talked about recent proposals on the digital euro on Jan. 16, with the members adopting a statement on the CBDC. They stated certain features and design choices require political affirmation.

The report on the meeting offers some more information on the group’s opinion on the digital euro. It notes that digital payments are becoming increasingly popular but that cash payments remain important for many countries in the region.

In terms of the motivation for why a CBDC might be necessary, the report states that it would be “a monetary anchor that would preserve public access to central bank money in the digitalized world by being widely accessible to prospective users.” It would also benefit strategic autonomy, as the EU sees it as a means of increasing independence from non-European payment solutions.

Privacy is an often discussed issue concerning CBDC, but the report confirms that the European Central Bank (ECB) will not have information on holdings, transaction history, or payment patterns. It also emphasizes that the digital euro is “not about programmable money.”

ECB Takes European Union’s Route

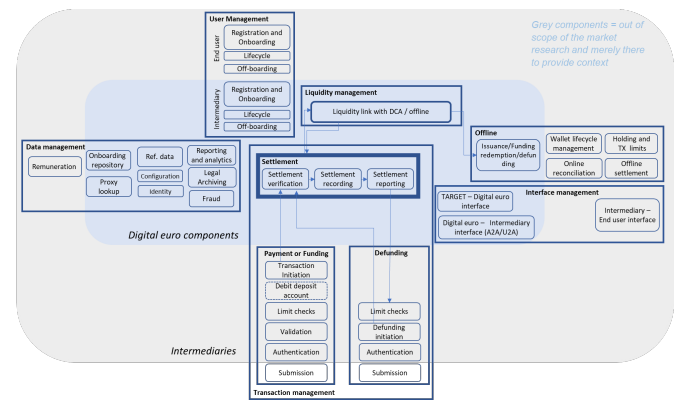

The ECB also published a market research post on technical solutions for the digital euro. Here they invited market participants to participate in market research to better understand a technical design for the CBDC.

Ir provided an outline for a potential design for the digital euro for the sole purpose of market research. The stakeholders in this system are consumers, intermediaries like financial institutions, and the ECB and central banks in the region.

The end-to-end flow of the design sees various aspects expected from a CBDC. The consumer makes an onboarding request to the intermediaries, which capture data and perform KYC checks. Once done, they issue wallets to the consumer. At the other end, the digital euro components (overseeing the overall process) check if the user has a wallet already and makes settlement confirmations.

Bank of England Governor Not Swayed by CBDC

CBDCs have been taking off in various parts of the world, including India, China, Japan, and Sweden, among other countries. However, not all central banks seem convinced that they are necessary.

The Bank of England Governor Andrew Bailey had doubts about a digital pound, saying he wasn’t sure if it was necessary. He said, “We have to be very clear what problem we are trying to solve here before we get carried away by the technology and the idea,” a position England has generally taken with digital assets.