The digital asset treasury market is entering a fierce “PvP” phase, where the early movers’ advantage is no longer a guaranteed ticket to growth.

Institutional treasuries have accumulated over 1 million BTC and nearly 5% of the circulating ETH supply. This accumulation turns them into players directly influencing market supply and demand. Which organizations will actively leverage this advantage to lead the game? Which ones will fall behind in the next wave of intense competition?

PvP: The Selection of the Strong?

David Duong — Head of Research at Coinbase — recently emphasized that the digital asset treasury (DAT) market is entering a “player-versus-player” (PvP) stage. The scarcity premium enjoyed by early entrants is fading. The market now demands superior trade execution, governance, and strategic differentiation to maintain a competitive edge.

“We think technical demand from digital asset treasuries will provide ongoing support for crypto markets in the short term. But the DAT phenomenon has reached a critical inflection point,” Duong shared.

According to Duong, the market is no longer in the early-adoption phase that characterized the past 6–9 months. However, this does not mean the market is nearing its endgame.

DATs and public companies hold over 1 million BTC, about 5% of the supply. This represents a symbolic threshold reflecting their identifiable influence on spot market supply and demand dynamics. Leading ETH-specific DATs own roughly 4.9 million ETH, valued at about $21.3 billion. This represents over 4% of the total ETH circulating supply.

The shift into the “PvP” phase has two clear implications.

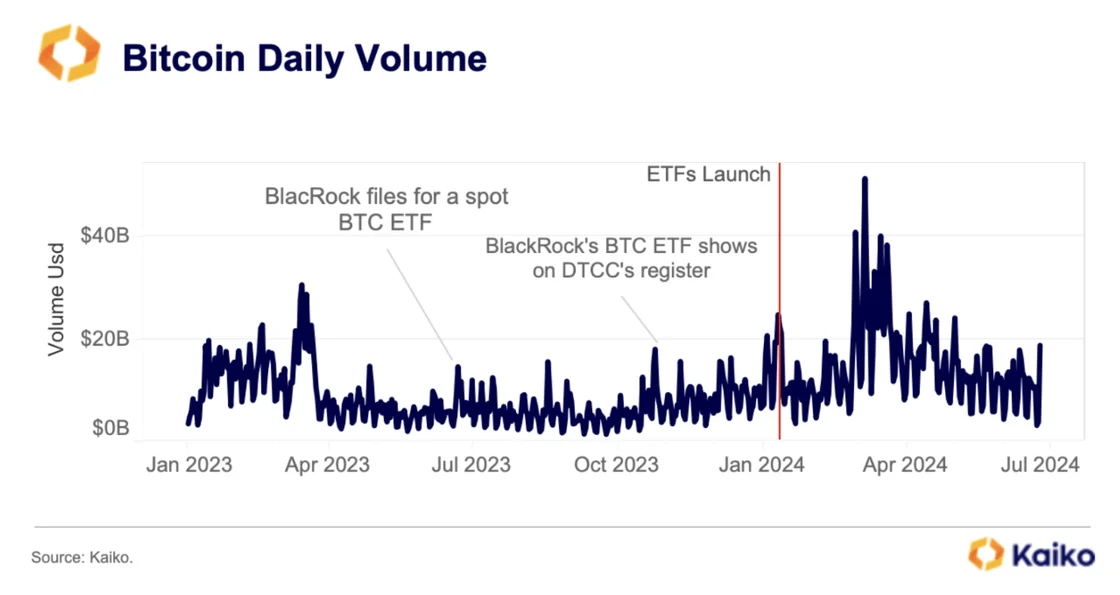

As more institutions accumulate large amounts of BTC and ETH, institutional demand will increase. This demand will periodically support prices in the short term, resembling the liquidity boost seen when ETFs drive activity in spot markets. Researchers found that institutional products like ETFs improve liquidity and unpredictably reshape market structure.

As competition rises, first movers actively squeeze the share price/trading fee premium over net asset value (NAV) they once enjoyed. Investors are starting to compare performance among entities directly. MicroStrategy is the classic case. Its trading premium over NAV was once very high but has come under pressure. Capital markets and their financing strategy are increasingly scrutinized.

“The scarcity premium that benefited early adopters has already dissipated, in our view. In this PvP stage, only the most disciplined and strategically positioned players will thrive,” Duong added.

In this “PvP” environment, success will belong to organizations that optimize execution and risk management. This is a shift from those who previously relied on passively holding large token positions.