Digibyte (DGB) has been decreasing since Feb. 20 but has validated a long-term level at $0.05 as support.

DigiByte is expected to increase toward higher resistance levels after stabilizing.

DigiByte Long-Term Retest

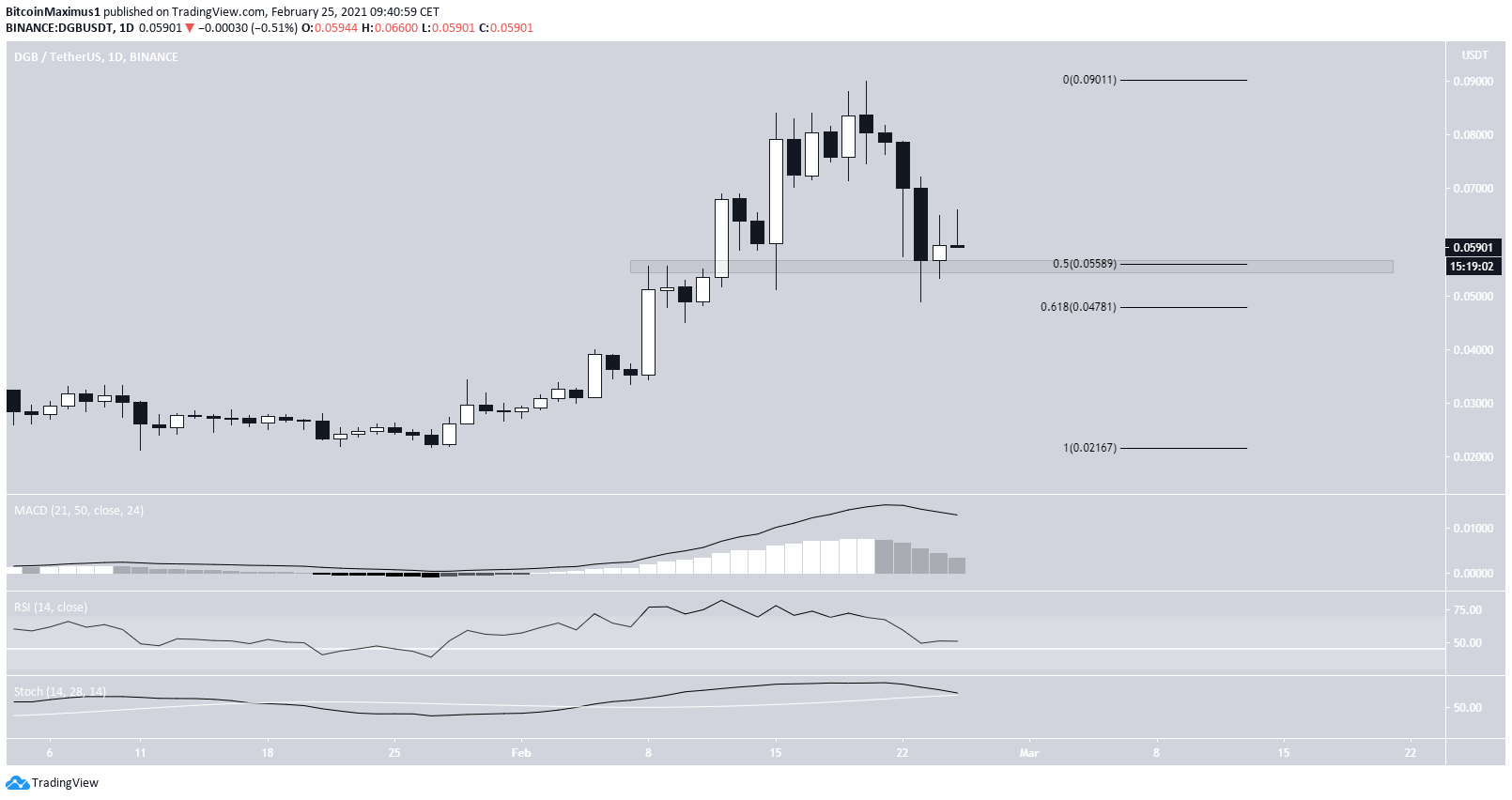

DGB has been decreasing since reaching a high of $0.091 on Feb. 20.

The drop has taken DGB back to the $0.05 area. This level previously acted as resistance but has now been potentially validated as support.

Technical indicators are bullish, as evidenced by the bullish cross in the Stochastic oscillator and the increasing MACD and RSI.

Current Movement

The daily chart shows that DGB has also bounced at the 0.5 Fib retracement of the most recent upward move. The wick lows in this candle even reached the 0.618 Fib level.

Technical indicators in the daily time-frame are at a crucial level in determining whether the trend is bullish or bearish. The RSI is at the 50-line and the Stochastic oscillator is close to making a bearish cross.

A bounce at the current support area would likely cause both the RSI and Stoch to reject bearish trends to move upwards instead.

The two-hour chart shows that despite breaking out from a descending resistance line, DGB has yet to move above the $0.064 resistance area. However, technical indicators are bullish.

Reclaiming the minor $0.064 resistance area would likely confirm that the trend is bullish, at least in the short-term.

Wave Count

The wave count suggests that DGB is in sub-wave five (orange) of a long-term wave three (white) that began in December 2020.

The most likely target for the top of this movement is located between $0.109-$0.117. This range is found by using the 2.61 length of wave one (white), the projection of the lengths of sub-waves 1-3 (orange), and an external retracement on sub-wave four (black).

A decrease below the sub-wave one high at $0.03 would invalidate this particular wave count.

DGB/BTC

Cryptocurrency trader @Incomesharks outlined a DGB/BTC chart, stating that the trend looks bullish and expects DBG to move higher.

Since the tweet, DGB has been hovering around the 1,100 satoshi area, which previously acted as resistance. While the bounce has been weak, DGB has moved slightly upwards.

Technical indicators are neutral/bearish, so it is possible that DGB will consolidate between the 1,100 and 1,900 satoshi levels.

At the time of press, we cannot determine the direction of the longer-term trend.

Conclusion

As long as DGB/USD is trading above $0.05, it is expected to continue increasing towards $0.11. DGB/BTC is consolidating in a range between 1,100 and 1,900 satoshis.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.