Binance Labs has made a strategic investment in Rango, a cross-chain decentralized exchange (DEX) and bridge aggregator. However, neither party has disclosed the terms of the investment, including its size.

Rango facilitates transactions across various blockchain ecosystems. This capability is essential for propelling DeFi’s growth.

Crypto Community Anticipates Rango Airdrop After Binance Investment

Rango supports major blockchains like Bitcoin (BTC), Solana (SOL), Tron (TRX), the Cosmos Ecosystem, Starknet (STRK), and more. Such comprehensive backing is critical for multi-chain wallets that need reliable cross-chain functionality.

Access to Rango is available through popular wallets and decentralized applications (dApps) such as Trust Wallet, Exodus, Binance Web3 Wallet, and Compound. Currently, Rango supports over 60 blockchains, more than 70 DEXes, and over 20 bridges. It boasts a transaction volume exceeding $3 billion.

Read more: Best Upcoming Airdrops in 2024

To date, the platform has processed over 2.5 million swaps for 590,000 unique wallets. Moreover, it manages more than 3,000 organic cross-chain swaps daily. Handling over 2 million daily swap quotes, Rango ensures rapid response times for its growing user base.

“Rango’s suite of services aligns with Binance Lab’s goal of supporting projects that bolster cross-chain development and innovation,” Yi He, Co-Founder of Binance, said.

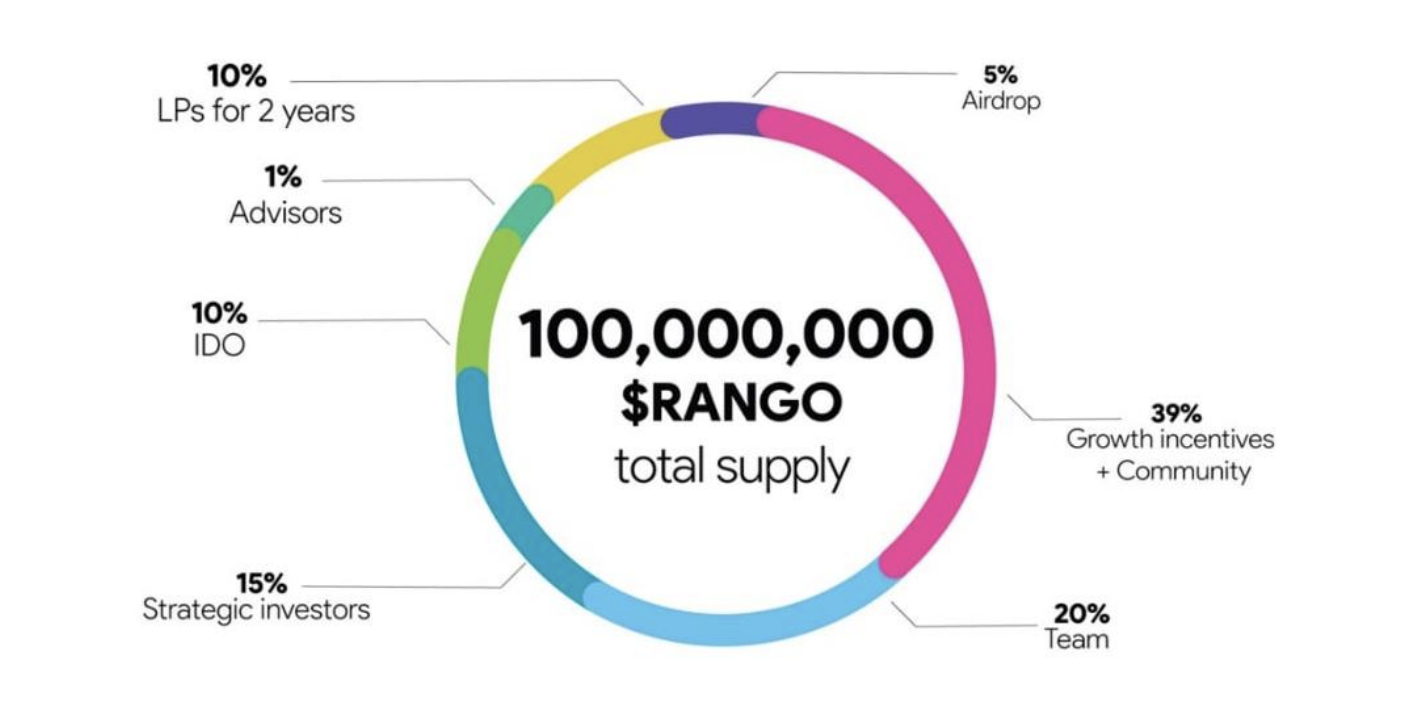

The recent investment by Binance has sparked speculation about a possible airdrop and a token generation event (TGE). Notably, Rango has allocated 5% of the RANGO token supply for the airdrop, heightening community anticipation.

This investment comes shortly after Binance Labs’ involvement with Zircuit, a layer-2 network. Zircuit combines zero-knowledge rollups with artificial intelligence (AI) to boost security. Its aim is to protect users against smart contract vulnerabilities and other security threats.

Read more: A Complete Guide to P2P Decentralized Exchanges (DEXs)

Recent attacks on the Ethereum blockchain, which led to significant financial losses, highlight the critical need for improved security measures. Ethereum accounted for 43% of the total damages across all networks in May 2024. Zircuit aims to address these issues as it approaches its mainnet launch this summer, with over $3.39 billion in staked assets.