Here we take a look at three DeFi coins, Serum (SRM), Polkadot (DOT), and Kava.io (KAVA).

Serum (SRM) has broken out from a descending resistance line and validated it as support afterward.

Polkadot (DOT) has broken out from a descending resistance line but is facing resistance at $39.50.

Kava.io (KAVA) is attempting to reclaim the $5.30 area.

Polkadot (DOT)

DOT had been following a descending resistance line since Feb. 20. On March 21, it managed to break out from the line and reach an all-time high price of $48.36 on April 17. It has been decreasing since.

The $39.50 area was supposed to act as support but did not. Rather, the price fell right through it.

Despite this, it is possible that the decrease validated the descending resistance line as support. However, technical indicators are firmly bearish. This is especially evident by the bearish cross in the Stochastic oscillator and the RSI cross below 50.

The short-term chart is bullish. After generating bullish divergence, the MACD has crossed into positive territory. The RSI has also generated bullish divergence and is in the process of moving above 50.

Therefore, DOT is expected to increase towards $3.95. Whether it manages to reclaim it will be vital in determining the direction of the future trend.

Highlights

- DOT has broken out from a descending resistance line.

- It is facing resistance at $39.50.

Serum (SRM)

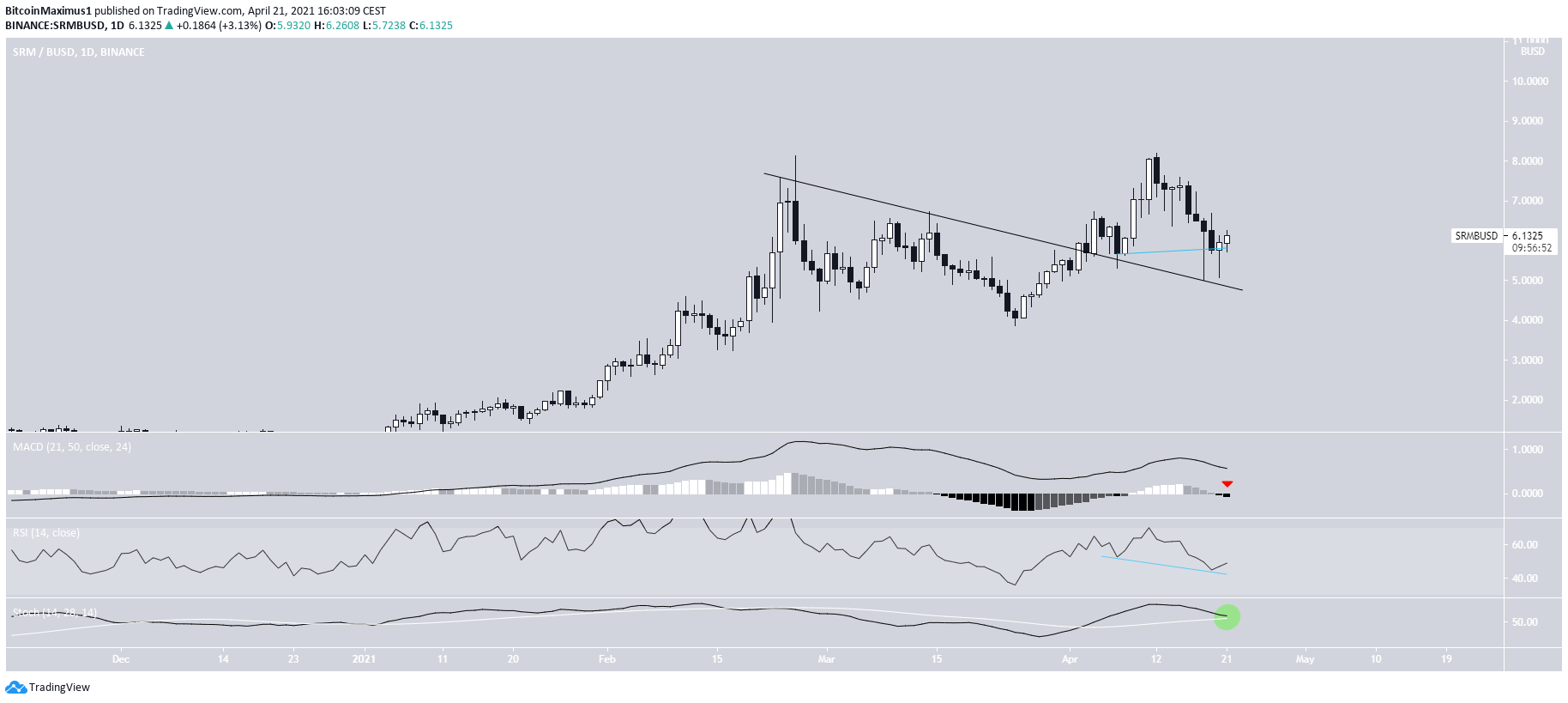

Similar to DOT, SRM had also been following a descending resistance line since Feb. 23. It managed to break out from it on April 4, and after validating it as support, proceeded to reach a new all-time high price of $8.20 on April 12.

Technical indicators are mixed. The RSI has generated hidden bullish divergence, but the MACD has crossed into negative territory. Whether the Stochastic oscillator makes a bearish cross or gets rejected will go a long way in determining the direction of the trend.

Since SRM has broken out from a descending resistance line, it is more likely that the trend is still bullish.

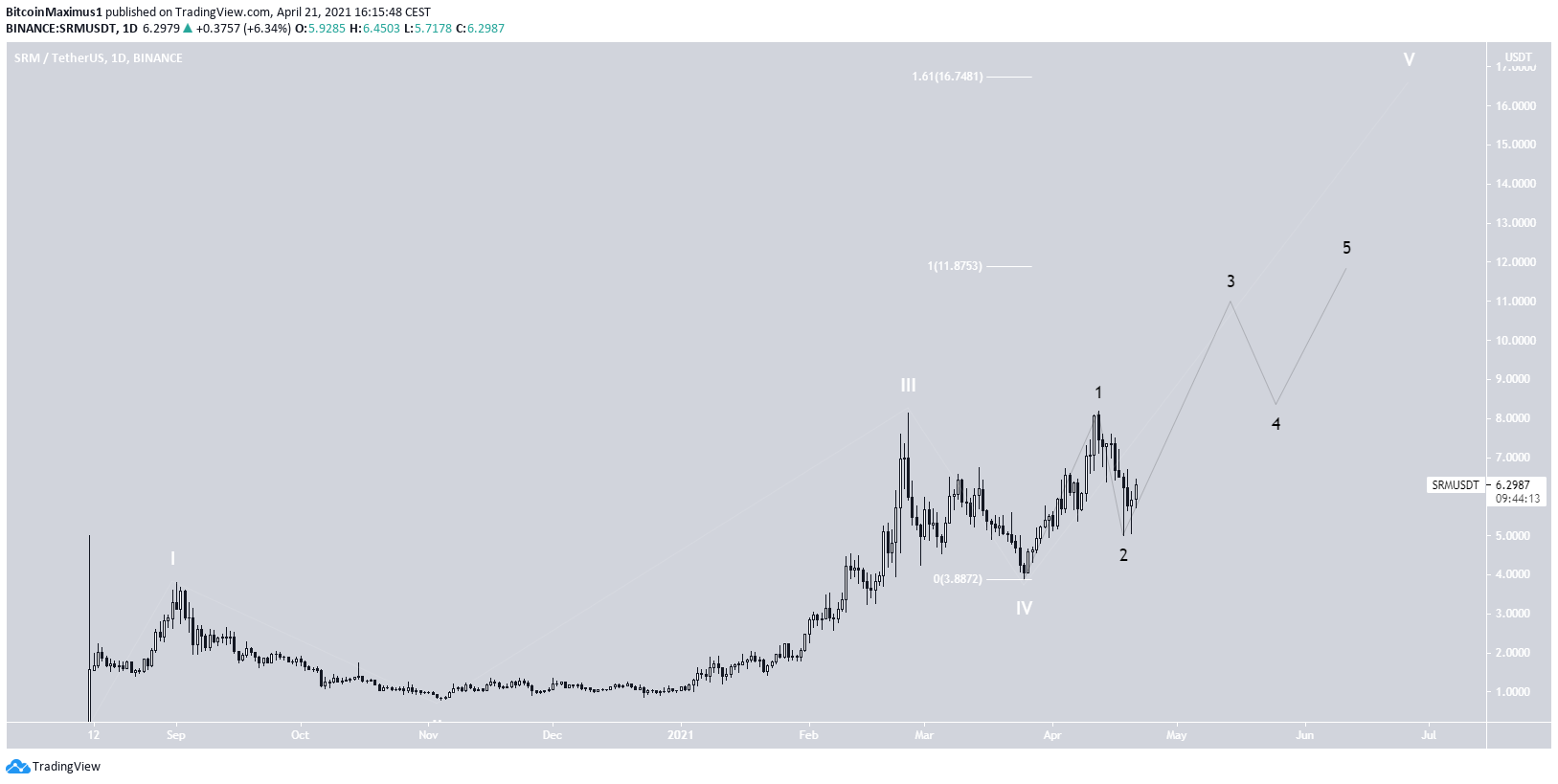

The wave count is also bullish. The most likely movement suggests that SRM has just begun wave five of a long-term bullish impulse (white). The sub-wave count is given in black.

The two most likely targets for the top of the current movement are found at $11.87 and $16.75, respectively, depending on whether the current wave extends.

Highlights

- SRM has broken out from a descending resistance line.

- It is potentially in wave five of a bullish impulse.

Kava.io (KAVA)

KAVA has been moving downwards since April 6, when it reached an all-time high price of $8.28.

The decrease took it to a low of $4.10. However, the token has bounced since and is in the process of reclaiming the $5.30 area.

The RSI has generated hidden bullish divergence. However, similarly to DOT, both the MACD & Stochastic oscillator are bearish.

The wave count is bullish. It suggests that KAVA is in an extended third wave (white). The sub-wave count is given in orange. It indicates that the token has just completed sub-waves one and two of this extended wave.

The first resistance area is likely to be found between $12.30-$12.65. It is created by a confluence of external fib retracements. Afterward, the target for the top of the move is found at $17.

Highlights

- KAVA is attempting to reclaim the $5.25 area.

- It is potentially in an extended third wave.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.