The hottest thing in the world of crypto at the moment is DeFi tokens. Some of them have gone from nothing to three-figure prices in a matter of days, which makes valuing them challenging to say the least.

June has been the month for DeFi, which has surged 70% in terms of total value locked across all protocols. Comparatively, cryptocurrency market capitalization has slumped almost 4% (over $10 billion) over the same period.

The big gains for DeFi have been catalyzed by a liquidity mining craze which enables investors and speculators to lock up their crypto as collateral on platforms for impressive interest rates and a share of these new tokens.

Further gains are made possible when arbitrage opportunities arise between various protocols and tokens. However, as Balancer found out over the weekend, they can be exploited by malicious actors seeking vulnerabilities in these nascent digital assets.

Valuing DeFi Tokens

The Compound Finance token, COMP, has been the darling of DeFi so far with an epic rise from around $16 at the seed phase to an all-time high of $327 according to Uniswap. It has corrected, as expected, but is still going very strong at $238 at the time of writing. This has defied the detractors who predicted and virtually willed it to dump back to zero within a couple of days.

Other DeFi tokens have also performed well as speculators seek the next big thing. The Synthetix Network Token, SNX, has gained 127% so far this month, Aave’s LEND token is up just over 100% since the beginning of June, Bancor has made almost 80% with BNT, and Kyber Network’s KNC has made 70% over the same period. The trend is clear, DeFi tokens are trouncing their traditional crypto brethren.

Messari researcher, Ryan Watkins [@RyanWatkins_] has taken a deep dive into what gives DeFi tokens their value. In a lengthy thread, the industry expert stated that DeFi tokens produce income through some value extraction mechanism at the protocol level.

Watkins mentioned that traditional valuation methods can be used to frame discussions about these tokens’ worth. The three most common methods are Discounted Cash Flow (DCF), Comparable Company Analysis (Comps), and Precedent Transactions (Precedents).

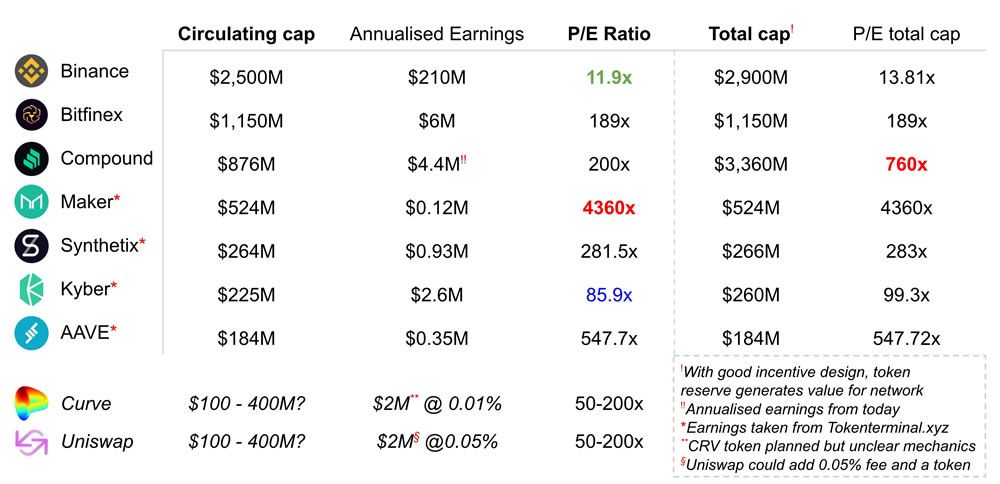

Watkins added that the primary method of framing DeFi tokens’ value is Comps, which is usually found by dividing the market cap of a token by its earnings, arriving at an earnings multiple which can be compared across projects.

Watkins suggested that this relative valuation is preferable since fundamental valuation is unreliable for DeFi tokens at this stage because they are like early-stage startups which have too much uncertainty over their future cash flows:

That we can use relative valuation at this stage is uniquely possible in DeFi given that tokens begin trading publicly virtually from inception. However, this unique opportunity to attempt valuing DeFi tokens at this stage poses challenges.

Citing a table from VC investor Julien Thevenard [@JulienThevenard], Watkins highlighted some of the issues that arise when comparing earnings multiples. These include earnings extrapolating the present, different value accrual mechanisms, different target markets, and evolving token economics.

The overwhelming majority of the value these projects will create is far into the future, which is inherently uncertain. But it goes to show how useless relative valuations may be at this stage.

As was the case with the ICO boom in 2017, the recent surge in DeFi token prices and subsequent valuation is primarily speculation driven. Those that earn big are those that spend big, and once again the whales are dominating the scene.

Over time, a handful of DeFi protocols will likely float to the top as liquidity increases and transaction fees become sustainable again, while the rest will sink to the bottom like the thousands of altcoins before them.

DeFi Not For The Masses (Yet)

There are a few factors holding DeFi back at the moment. First is the highly technical nature of operations on decentralized platforms for the non-techies, and secondly, Ethereum’s high network fees make smaller transactions unfeasible for the non-whales.

Regardless of token or project valuations, DeFi needs to address these two issues, along with the ever-present threat of security breaches and vulnerability exploits, to become a new unbanked financial landscape for the masses.

As BeInCrypto found out after conducting an experiment, transferring a small amount of accrued COMP off the platform into an Ethereum wallet generated a gas fee of almost the same amount. Once that COMP is then converted into fiat and withdrawn, we would have been out of pocket.

These issues are likely to be ironed out in the future as the ecosystem and technology evolve. As Bankless author, Ryan Sean Adams pointed out in his latest newsletter, every day a new crypto asset moons and a new yield farming opportunity surfaces. We cannot make it big from each one so we should not fret when some are missed.

If you own crypto money assets, if you’re leveling up a bit each week, if you’re here with us on the journey—be content. Because you already won. You own shares in the world’s future money system.

DeFi has a long way to go; it is barely a few years old. The explosive growth this year, however, is a testament to the desires for such a decentralized financial landscape. The current global economic climate and central bank currency manipulation will only strengthen that narrative and demand as time goes on.