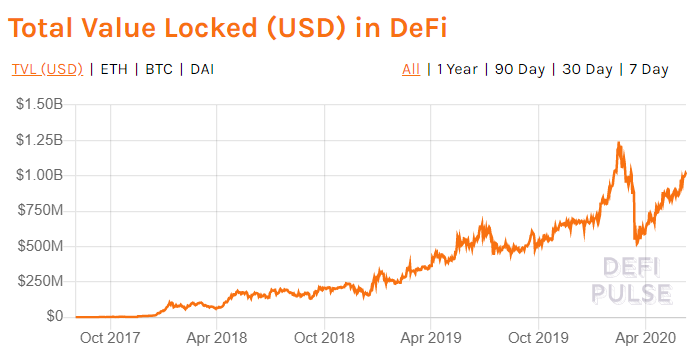

Decentralized financial markets (DeFi) have made a remarkable recovery since the mid-March COVID-19 crash. So much so, that the total locked value has again surpassed $1 billion.

The DeFi ecosystem took a big hit three months ago when the Ethereum price crashed by 50%, wiping out a considerable amount of locked-up crypto collateral. The all-time high for locked-up value in DeFi markets stood at $1.25 billion in mid-February 2020.

However, the amount of collateral in dollar terms plunged by some 58% from over a billion dollars to just above $500 million the following month.

Since then, the emerging market has made a solid recovery, and total value lockup (TVL) has topped the $1 billion milestone again, according to DeFi Pulse.

eToro’s Mati Greenspan was quick to acknowledge the achievement with the following tweet:

“Value in #DeFi smart contracts has returned to $1 billion.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored