All the hype around decentralized finance’s latest liquidity farming craze is attracting new players eager to get their tokens out to investors and enjoy the subsequent moon shots. The latest to join the digital bandwagon is lending platform bZx.

DeFi markets are starting to cool off after what has been a pretty wild week or two for the nascent financial landscape. With Ethereum prices retreating, total value locked across DeFi protocols should also fall as the two are directly related.

TVL has fallen from an all-time high yesterday of nearly $1.7 billion to around $1.6 billion today according to DeFi Pulse. However, as previously mentioned, this is to do with the decline of ETH prices and not necessarily investors pulling out their crypto collateral.

The huge successes of Compound Finance and Balancer last week has spurred a frenzy of activity in the space as other platforms rush to launch their own liquidity farming incentives.

bZx Proposes Yield Farming DeFi Tokens

Decentralized Ethereum-based lending and margin trading protocol bZx has announced two new proposals to update the tokenomics of its governance token, BZRX. A fee-sharing mechanism that leverages Balancer pools is the first, while the second involves a distribution program where protocol users will be awarded tokens.

The platform is likely to follow in the successes of Compound and Balancer if the proposals get the green light. Tweeting the official blog post, bZx stated;

We have been working to continuously improve and refine the protocol and its governance. Over the years, the $BZRX token model has evolved along with the industry, presenting fresh new ideas in the process.

The blog post breaks down the timeline of developments for the protocol which began in 2018 with a token that was initially designed for governance and a medium of exchange. In her latest Defiant newsletter, industry analyst Camila Russo added that BZRX tokens were designed to be locked and non-transferable, except when used inside the protocol to pay for relay fees.

In 2019 there was another proposal that BZRX tokens could be redeemed for a proportional percentage of the insurance fund. Increased protocol activity would increase this fund which would move token value higher, in theory.

This year, the bZxDAO proposed participation incentivized through staking rewards. This allowed token rewards for users who staked BZRX holdings to a representative of the DAO. Rewards were determined through inflation and a share of protocol fees, though the inflation part was later rescinded.

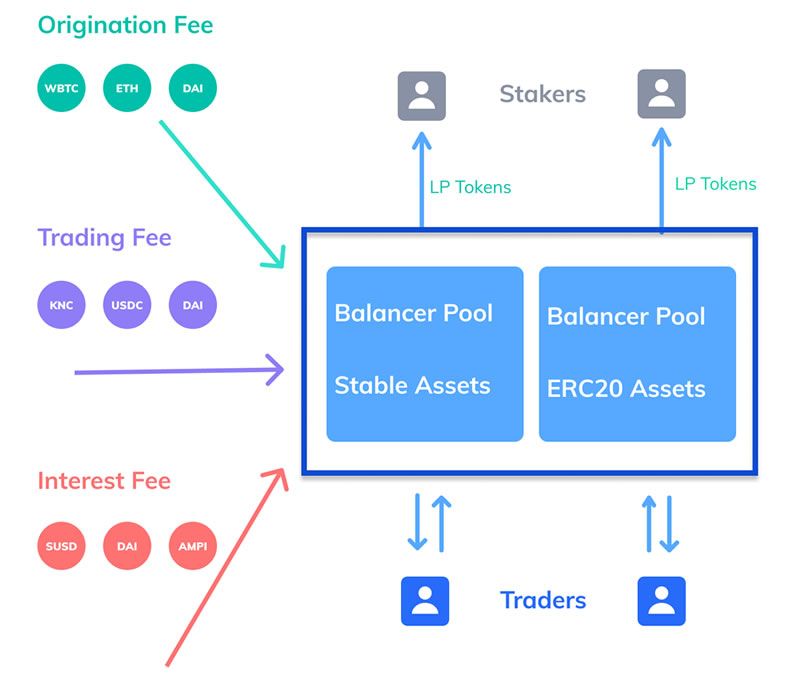

The new proposals this week include a fee-sharing incentive which breaks down the three fees collected by the protocol and disperses them into Balancer pools, creating incentives for users to stake their BZRX tokens. The current fee structure is as follows; origination fee (0.09%), a trading fee (0.15%), and interest fee at 10% of interest paid.

When fees enter the pool, it is rebalanced producing a liquidity provider token representing pool ownership. This token is then distributed to users who can later redeem them for any of the assets in the pool. Pools will be broken down as follows; two Balancer fee token pools, a stablecoin pool with no impermanent loss, and a variable fee pool containing more volatile assets such as ETH and other ERC-20 tokens.

Additionally, while the assets remain in the Balancer pool they earn fees from providing liquidity to users of Balancer. Liquidity provision may be extended to the team’s UX-focused lending and trading dApp, Fulcrum, in the future. The platform tweeted how easy staking would become on the new system;

The user experience of claiming fees and staking $BZRX is as simple as can be with the introduction of our bZx Staking Portal. You can stake or unstake with a single click, and you can claim your rewards with a single click as well.

A protocol disbursement program is the second part of this week’s proposal announcement. From the total token supply, 20% has been allocated to rewarding the users of the protocol. This allocation is further split into two categories, 17% to users that pay protocol fees by reimbursing half of their spending with BZRX tokens, and 3% disbursed on a weekly basis to users based on the number of fees generated that week.

bZx co-founder, Kyle J. Kistner, who penned the post added:

This means that anyone who executes a trade, opens a loan, or keeps a loan open, will begin to accrue ownership of the protocol.

A Rocky Year For bZx

The bZx DeFi platform has not had a smooth ride this year after suffering a large loss due to flash loan exploits back in February. A crypto pirate managed to exploit a low-liquidity Uniswap market in order to make one single transaction to net a profit of around $350,000. A second attack within a week resulted in the loss of around $600,000 in ETH from bZx, which suspended operations following the exploit.

This caused a wave of criticism from the DeFi detractors at the time who said that the fact bZx has been able to freeze the platform during both attacks shows that even though it is touted as DeFi, it is ultimately a centralized platform with someone in control.

Before the digital incursion, bZx was on a roll hitting an all-time high in terms of total value locked in mid-February which topped out at almost $20 million. Since then, crypto collateral has left the platform with TVL slumping 96% to current levels which are around $720k.

bZx is currently 24th in the DeFi charts with under a million dollars in TVL according to DeFi Pulse. The platform hopes to revive itself with this latest liquidity farming incentive which it hopes will draw collateral back into the protocol.

The move reinforces the notion that yield farming is gaining in popularity, which is good for DeFi and ultimately good for Ethereum as its foundation. Russo rounded off her newsletter summing up;

As yield farming keeps getting traction, and we get ready for a new cycle in the evolution of the Ethereum network, more protocols will seek to increase liquidity and activity on their systems by leveraging money legos and creating incentive mechanisms.

At the moment, however, ETH prices have been in decline all week, sliding back below $225, its lowest level in a month. Despite major gains in DeFi investment and liquidity, Ethereum has yet to benefit from this new investment model.