The decentralized finance (DeFi) sector is starting to awaken again following a seemingly month-long hiatus. A slew of new liquidity farming incentives are starting to hit the scene, and the latest goes by the name BOND.

The latest craze in DeFi is a yield farming and liquidity pool incentivization network called BOND. It is the product of BarnBridge which has just opened the floodgates for the flocks of DeFi farmers.

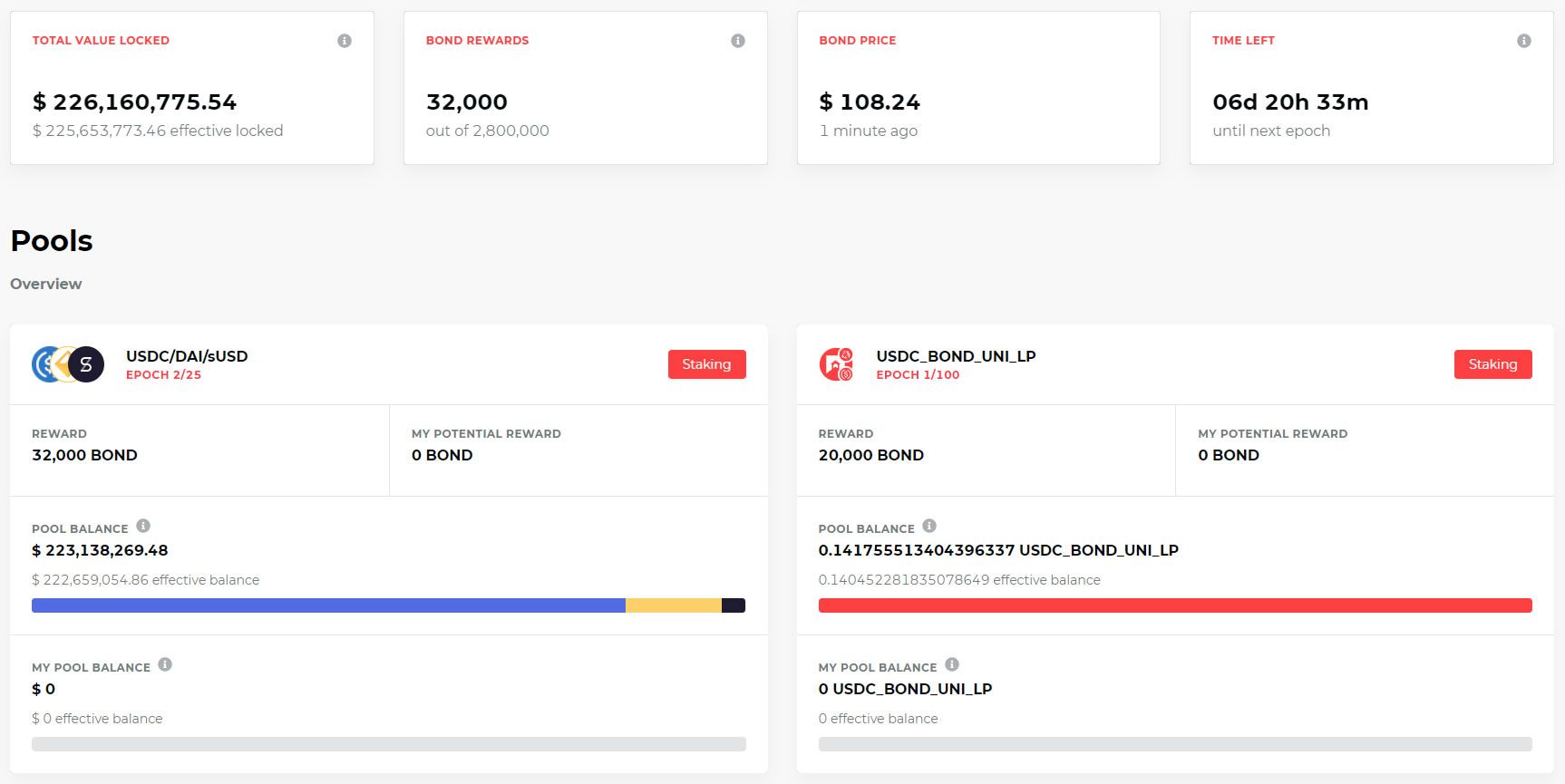

Before the official launch of liquidity mining, farmers had already contributed over $200 million into the smart contract pre-price discovery according to a tweet from the firm on Oct 25.

Within an hour of launching on Oct 26, over a million more had been accrued in the liquidity pool.

One hour in… $1,100,899 in the liquidity pool.

— BarnBridge 🌉 (@barn_bridge) October 26, 2020

Bridging the DeFi Gap

The protocol was announced in late September as a two-phased liquidity mining program. The program contains two sequential staking contracts with distinct specifications for token distribution. In essence, BarnBridge wants to bridge the gap between traditional finance (TradFi) and DeFi, building on the efficiencies of the latter in order to attract a wider range of participants;“The migration of yield and yield-based derivatives from less efficient centralized financial systems to more efficient decentralized financial systems will be one of the largest movements of wealth in human history.”It added that the DeFi sector will likely continue to create markets for TradFi firms that want to get away from the zero-interest yields that the industry has now sunk to amid a global economic meltdown. BarnBridge has created the first fluctuation derivative protocol with the aim of smoothing out the risk curve and offering layered risk management.

BOND-enomics

BOND is the platform’s governance token which is being offered to farmers who stake DAI, USDC, or sUSD stablecoins. Each epoch is one week long and 32,000 tokens will be distributed per epoch over a total period of 25 weeks. The second phase involves taking earnings from the yield farming program and harvesting them on ‘new fertile soil’ in the liquidity pool incentivization. This initiative aims to reward long-term liquidity providers with progressively more power over the protocol. There will be a 100-week duration with a total of 20% of the tokens allocated at 20,000 per week for those who use their liquidity pool tokens from the previous farming period. The ten million total BOND tokens will be distributed as follows; 60% to the community, 8% for yield farming, 12.5% to the core team, 7.5% for investors, 10% into the DAO Treasury, and the remaining 2% to advisors, according to the blog post.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored