In the modern era of digital transformation, companies are pressured to innovate constantly to remain competitive against tech-enabled startups and fast-moving unicorns. This has led to the rapid decrease in the lifespan of companies at the pinnacle of success, leaving room for new technologies like Decentralized Finance (DeFi).

While in 1958, organizations listed in the S&P 500 had an average stay of 61 years, this figure plunged to a only 18 years presently. The speed of disruption is hastening, and it is projected that by 2027, 75% of the companies currently listed on the S&P 500 will vanish.

DeFi to Take Over the Finanacial System

In the aftermath of the 2008 Global Financial Crisis, the financial system has been grappling with numerous challenges including inclusion and digitization. Traditional Finance (TradFi) has shown resilience but at the expense of financial inclusion.

According to the World Bank, 1.4 billion people worldwide do not have access to a bank account. This is barring “more commonly women, poorer, less educated, and living in rural areas” from essential financial services and perpetuating the cycle of poverty.

“To reach them, governments and the private sector will need to work hand-in-hand to forge the policies and practices needed to build trust in financial service providers, confidence in using financial products, new tailored product designs, as well as a strong and enforceable consumer protection framework,” Leora Klapper, Lead Economist in Development Economics Vice Presidency of the Global Findex report, said.

DeFi is a blockchain-based form of finance that does not rely on central financial intermediaries. These include brokerages, exchanges, or banks to offer traditional financial instruments.

Instead, DeFi offers a plethora of financial services. From lending to borrowing, and trading within a blockchain, DeFI ensures transactions are publicly available, transparent, and immutable.

Read more: TradFi vs. DeFi: Everything You Need To Know

DeFi is poised to rewrite the rule book of global financial systems, as it presents numerous benefits over TradFi. It enables real-time value movement, reduces barriers to entry, and ensures users retain control over their assets, to name a few.

“Lengthy onboarding processes, as well as the amount of time involved in trade execution and post-trading activities, make TradFi much more expensive than it needs to be. The sector could reduce up to 80% of what it currently spends on post-trading settlement expenses by leveraging blockchain technology to its fullest… Overall, it’s estimated that ‘moving securities on blockchains could save $17 billion to $24 billion per year in global trade processing costs,'” Concordium’s DeFi-TradFi Report read.

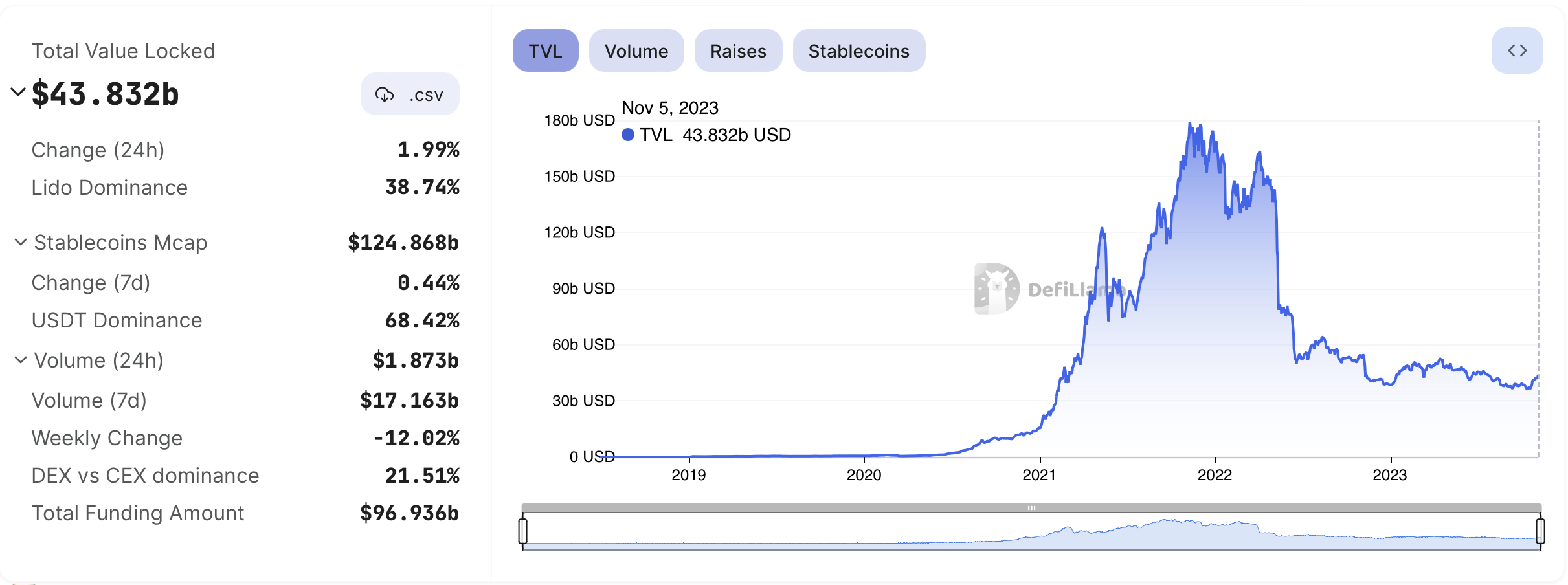

The potential of DeFi in the next bull run has caught the attention of the traditional banking sector. Daily transaction volume in this sector at its peak exceeded $10 billion, and locked-up assets growing from less than $1 billion to over $100 billion in a short span of two years.

The decentralized structure of DeFi fuels its rapid growth. It eliminates the need for intermediaries, significantly reducing overhead and processing costs.

This is a game-changer for the unbanked population in emerging economies. Now they can access financial services without the need for a traditional bank account.

“By removing the need for intermediary management of assets, blockchain enables the maximally efficient allocation of resources, thus ensuring that every member of society can enjoy unbiased access to credit services. Blockchain is a powerful tool for righting the catalog of inefficiencies within the traditional finance sector by streamlining processes and facilitating more inclusivity and higher grades of global accessibility,” Lars Seier Christensen, Chairman & Founder of Concordium, stated.

Regulatory Framerworks to Foster Adoption

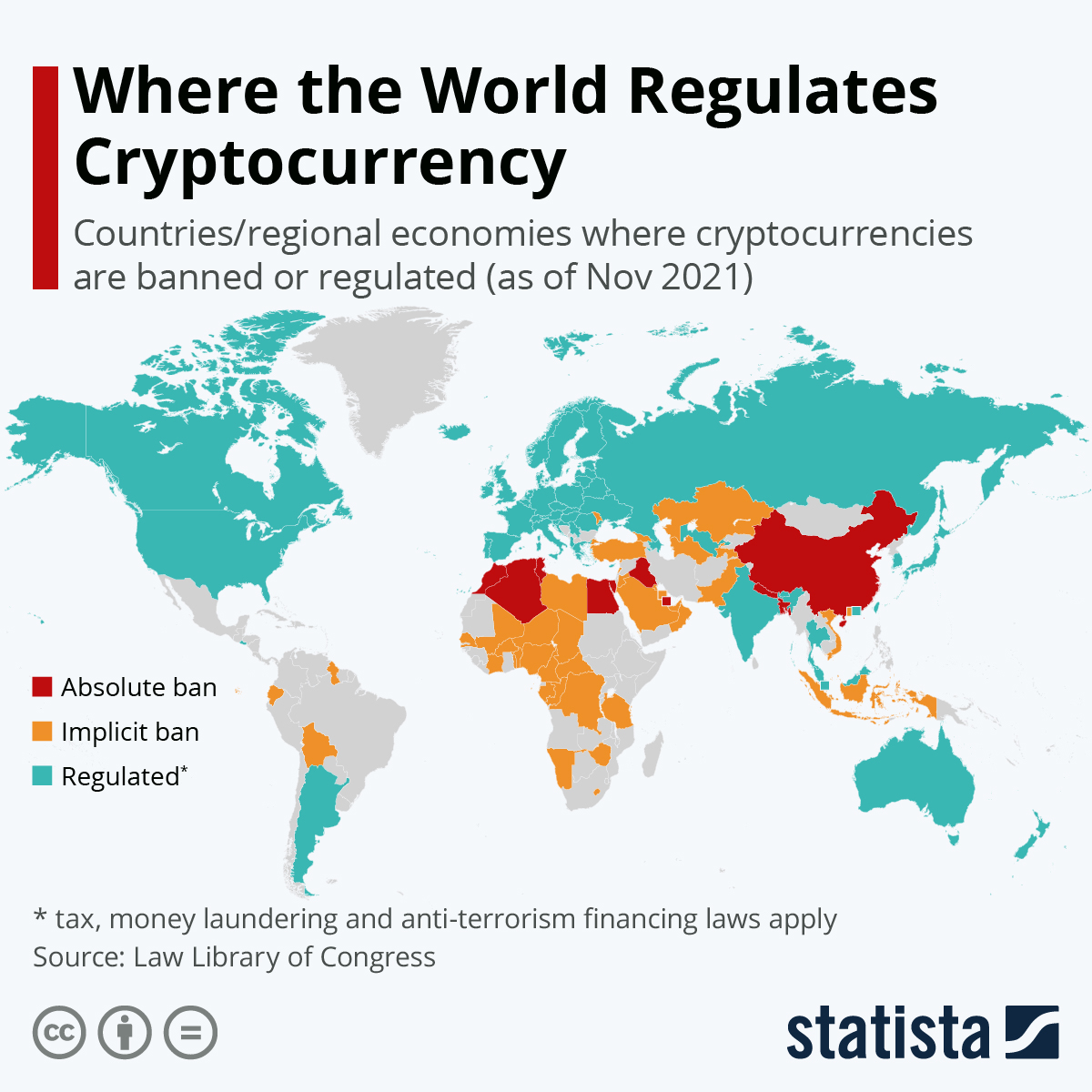

However, for DeFi to fully harness the potential of blockchain technology and drive mainstream adoption, a regulatory framework is crucial. Legal clarity will not only protect users but also prevent market manipulation, promoting financial stability in DeFi.

Additionally, a regulatory framework will foster wider acceptance, adoption, and trust. Therefore paving the way for DeFi exponential growth in the next bull run.

“If they are to attain mainstream adoption, DeFi and crypto must integrate some of the regulatory and self-regulatory practices that have brought functional stability to TradFi. But there’s also an urgent need for the stewards of the global economy to explore DeFi and crypto solutions to its many problems,” Michael Casey, Economics Researcher, said.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

The integration of a self-sovereign ID framework at the protocol level can address the Know Your Customer (KYC) compliance. Hence, reducing the risk of identity theft or fraud while ensuring privacy and security. This regulatory-ready framework significantly lowers entry barriers for businesses, propelling DeFi to become a mainstream financial solution.

As DeFi continues to evolve and integrate regulatory and self-regulatory practices, it stands as a beacon of financial innovation. JPMorgan Chase and Bank of America are already exploring blockchain technology, indicating a promising transition towards a DeFi-dominated financial ecosystem.

“DeFi applications require development to produce a differentiated product and positive user experience, which drives adoption and usage. Increasing adoption and usage result in increasing revenues and native token appreciation if properly designed, both of which can be reinvested in development. [Althought DeFi applications are immature,] we remain in the early stages of a major change in applications that may take place over the next 30 years,” Bank of America reported.

With its potential to foster financial inclusion, reduce costs, and promote innovation, DeFi could be the biggest gainer in the forthcoming bull run, reshaping the global financial landscape.