With the bitcoin price currently hovering near $10,000, it seems the entire crypto community has been in the doldrums of late. Even Decentralized Finance (DeFi), the controversial and once red-hot segment of the market, has fallen from its high horse.

Research company Messari assessed the damage, tweeting an image with the details from the past week’s bloodbath in DeFi.

As it turns out, half-a-dozen DeFi assets joined a club they’d probably not want to be a part of — the one that has shed more than 50% of its value in the last seven days.

Rough week in DeFi land with 6 assets dipping more than 50% + over the last 7 days

Where are we going next? pic.twitter.com/3vJiqb4xhr

— Messari (@MessariCrypto) September 8, 2020

Grading on a Curve

Curve (CRV), an exchange liquidity pool built on Ethereum for stablecoin trading, saw the worst of it. CRV suffered nearly 60% declines, giving the skeptics fodder for an argument that DeFi is just another 2017 altcoin bubble waiting to pop.

CRV is one of the DeFi tokens that cryptocurrency exchange Binance listed, which has come back to bite the trading platform. In addition, Binance also listed SUSHI days after the project launched.

The move placed a target on the back of the giant exchange, considering that SushiSwap investors got swindled by the project’s founder.

The SushiCoin debacle, which took place during 5 – 6 Sept., saw the founder sell their SUSHI stake and hand over the project to someone else. Nevertheless, the coin actually managed to eke out gains of around 33% in the last seven days.

Another high-flying wonder project, yearn.finance (YFI), shed about one-third of its value, erasing gains from investors during the same period.

WeChat Users Search for DeFi

Sophisticated investors are largely waiting on the sidelines until there’s more clarity on DeFi’s network mechanics. Nevertheless, the uncertainty is not scaring away WeChat users.

Cole Kennelly, the organizer of DeFi NYC, tweeted some stats about WeChat trends as it relates to the industry. He noted that searches hover at all-time high levels with nearly 1 million unique searches in early September.

The number of WeChat searches for #DeFi is at record levels.

Almost 1 million unique searches on September 2. 👀 pic.twitter.com/3cndAmmGa8

— Cole Kennelly (@ColeGotTweets) September 7, 2020

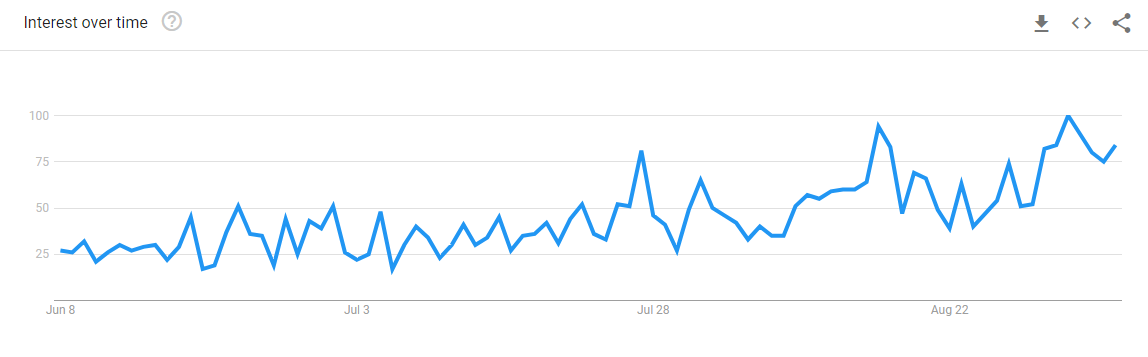

Google Trends show similar interest, with DeFi searches since mid-July on a jagged but upward trajectory.

DeFi remains uncharted territory, even for crypto. One thing that the highly levered DeFi space can seemingly promise is price volatility.