Decentraland (MANA) is approaching a crucial horizontal area that previously acted as the all-time high resistance region. If it gets there, it’s likely that this area will help boost the price.

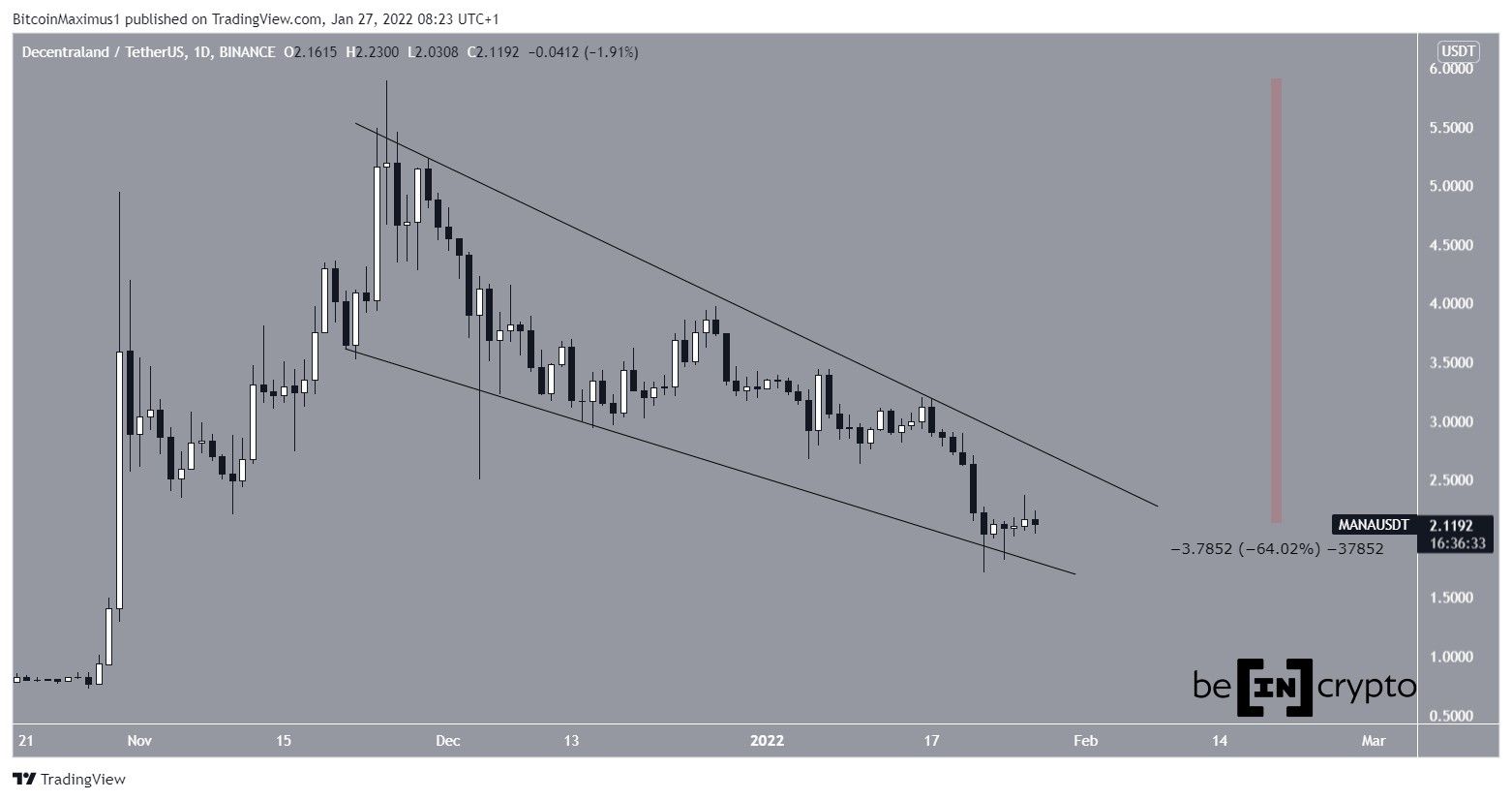

MANA has been falling since Nov 25 after reaching an all-time high price of $5.90. The downward move led to a local low of $1.70 on Jan 22 equating to a loss of 64%.

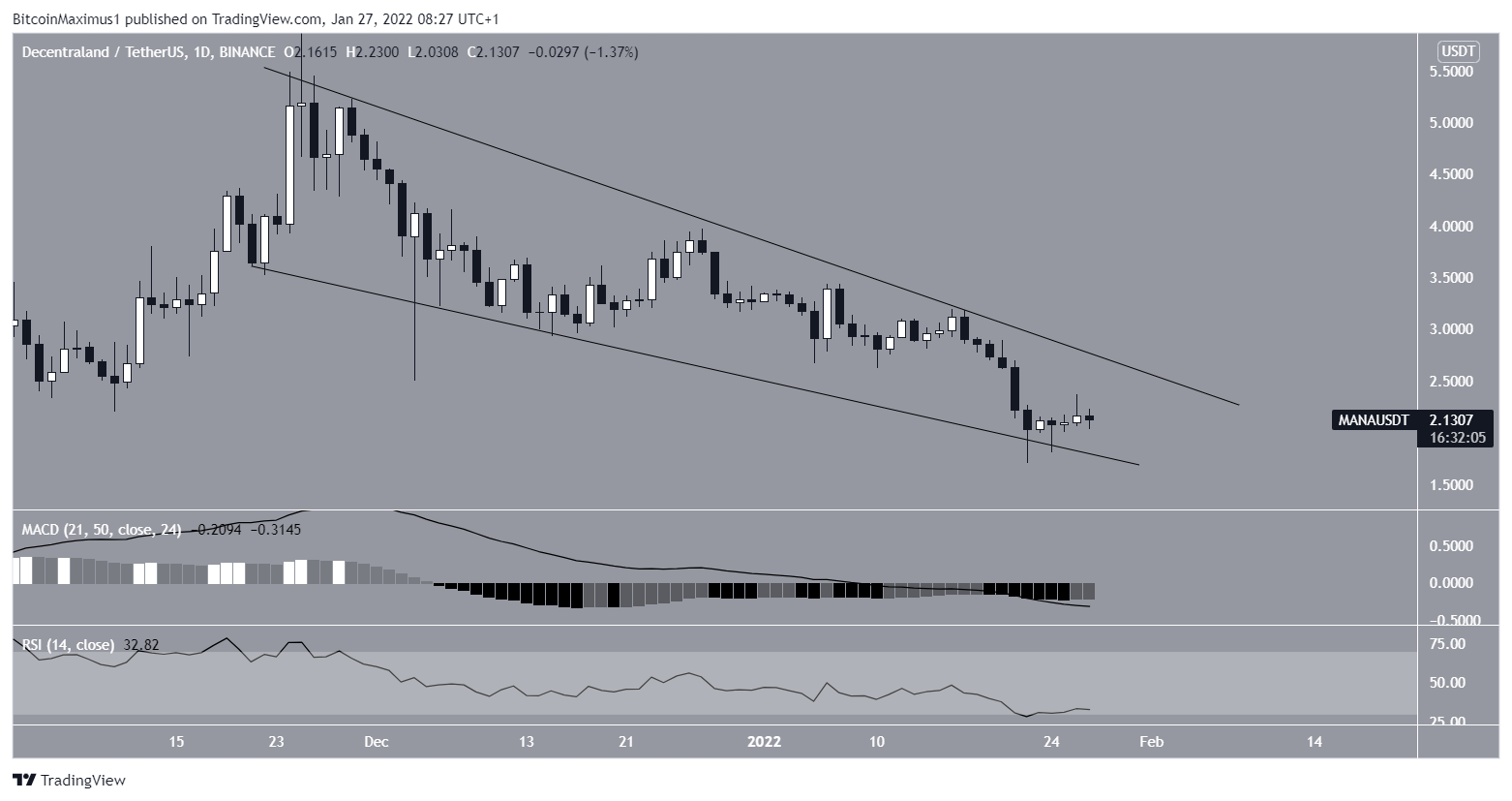

While the pattern is not completely clear due to the presence of numerous wicks, it’s possible that MANA is trading inside a descending wedge. The wedge is considered a bullish pattern, so an eventual breakout above it would be likely.

Future MANA movement

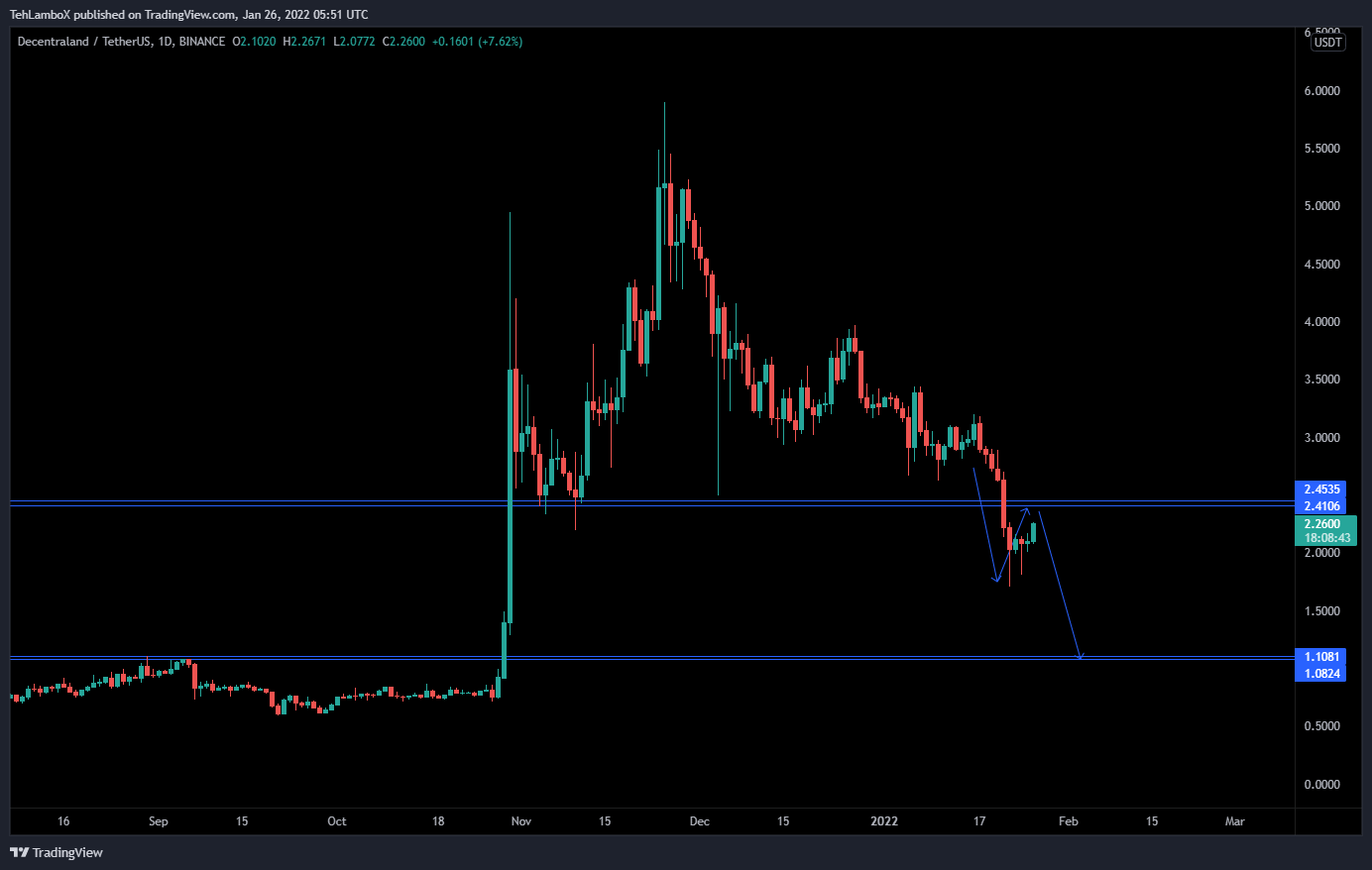

Cryptocurrency trader @TehLamboX tweeted a MANA chart, stating that it could fall all the way back to $1.

Technical indicators in the daily time frame do not yet show any bullish signs, since both the RSI and MACD are falling.

The RSI, which is a momentum indicator is at the 30-line. RSI readings below 50 are normally considered bearish.

Similarly, the MACD, which is created by short and long-term moving averages (MA) is negative, also a reading associated with bearish trends.

Therefore, despite trading inside a bullish pattern, there are no bullish signs in either the RSI or the MACD.

When zooming out, there is a very strong horizontal support area found at $1.55. The area previously acted as the all-time high resistance in May 2021, therefore it’s possible that it will now turn to support.

In addition to this, the level coincides with the resistance line of an ascending parallel channel from which MANA previously broke out. This further increases its significance.

Therefore, if MANA gets there, a sizeable rebound would be likely.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here!