After the dramatic fall of FTX, the Binance founder Changpeng Zhao (CZ) is once again at the center of controversy, with rising speculation that he could be engineering a takedown of Hyperliquid, the decentralized exchange behind the HYPE token.

As trading volume surges on Aster, and concerns mount over HYPE’s upcoming token unlock, whispers of a potential “death spiral” are spreading fast. Could Hyperliquid be the next domino to fall, or is the FUD simply overblown?

Double Kills for HYPE

Former Binance CEO CZ has recently been pulled into a heated debate surrounding Hyperliquid (HYPE). The discussion erupted as Hyperliquid may soon face significant supply pressure.

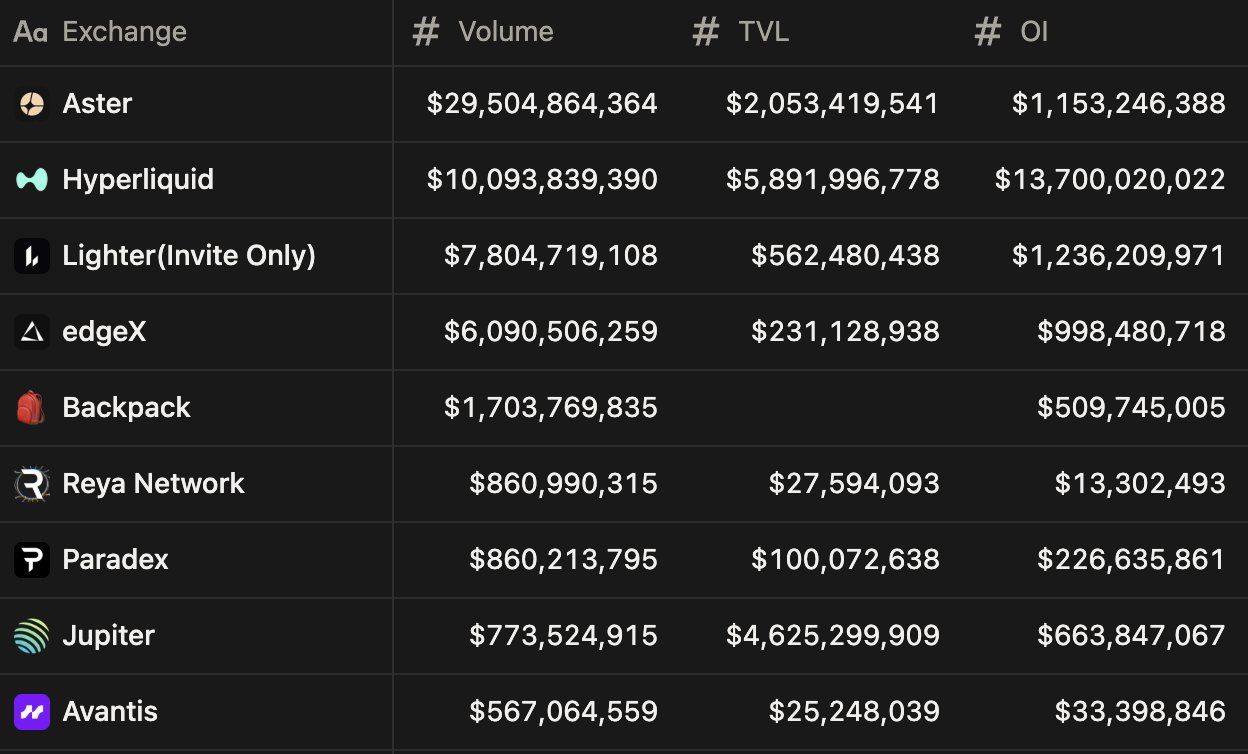

Meanwhile, the newly-emerged project Aster, rumored to have CZ’s backing, has recorded a 24-hour trading volume over three times higher than Hyperliquid. Together, these factors raise the question: Is Hyperliquid at risk of losing its position soon?

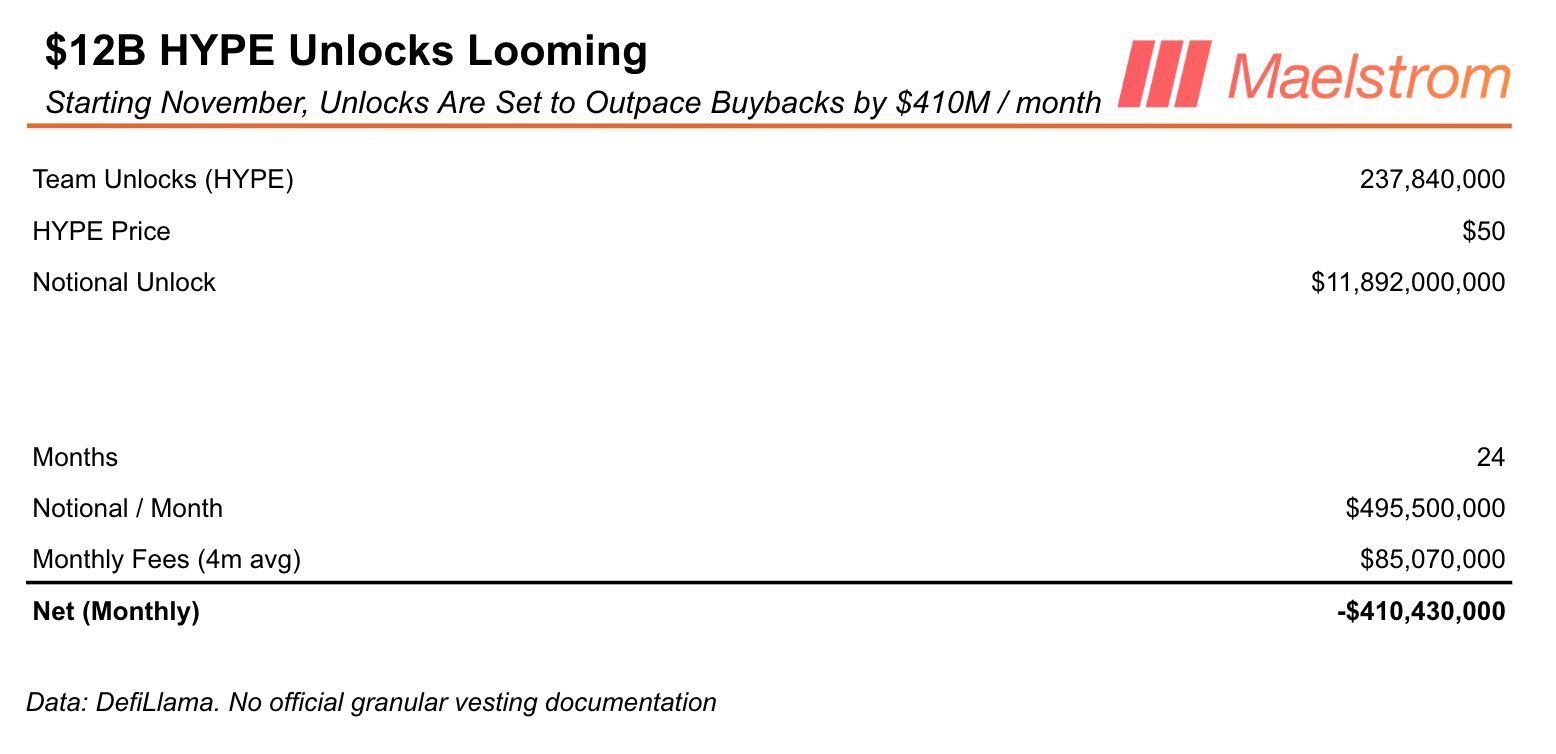

First, a recent study from Maelstrom Fund, led by the co-founder of BitMEX, highlighted serious flaws in Hyperliquid’s tokenomics.

According to the report, 237.8 million HYPE tokens will begin linear vesting over 24 months starting November 29, equivalent to around $500 million monthly. However, with buybacks estimated to absorb only about 17% (roughly $90 million), the market could face an oversupply of nearly $410 million monthly.

Maelstrom also pointed to the role of DATs (Data Availability Tokens) such as Sonnet, with $583 million in HYPE and $305 million in cash. Still, it argued that these are insufficient to offset the unlocking pressure.

Maelstrom further warned about rising competition. They specifically questioned CZ’s involvement with Aster two months before Hyperliquid’s unlock event. This has fueled community speculation that CZ may attempt to “kill” Hyperliquid to clear the path for Aster’s growth.

Can CZ Manipulate HYPE?

Some in the community accuse CZ of being “one of the largest holders from the get go”. In fact, there are claims that he holds up to 10% of HYPE, has not yet sold, and is preparing for the “death spiral final act.”

Although there is no concrete evidence, such rumors have raised significant concerns. The logic goes: if a major holder also operates a derivatives market (HYPE/USDT), they could move prices in favor of their long/short positions. On top of that, they could dump their entire holdings in a “full vamp attack” on HYPE.

“Do we really think cz isn’t capable of killing $HYPE by dumping his entire spot bag on the open market, short on hl/nance and attempt a full vamp attack on TOKEN?” one user asked on X.

On another note, trader Ignas argues the real issue is the market reflexivity mechanism. A price drop reduces the value of future airdrops/accumulation, which weakens trading incentives on Hyperliquid. This creates a loop where reduced participation further lowers buyback fees and worsens price declines.

“HYPE price goes down → future airdrop value falls → traders have less reason to trade on HL → they exit and pull capital → lower OI and volumes reduce fees used for buybacks → HYPE price drops further,” Ignas observed.

That said, not everyone agrees with the bearish narrative. Some argue that profitable investors (e.g., from Aster) are likely to reinvest in strong products like Hyperliquid, and not every fluctuation in volume signals the death of a platform.

“The talk of Hyperliquid being dead, the theories of CZ being the top holder to now dump $HYPE to 0, the annualising 1 week of revenue… Most of you saying this have no idea what you’re doing in crypto or just want engagement at this point.” another X user noted.

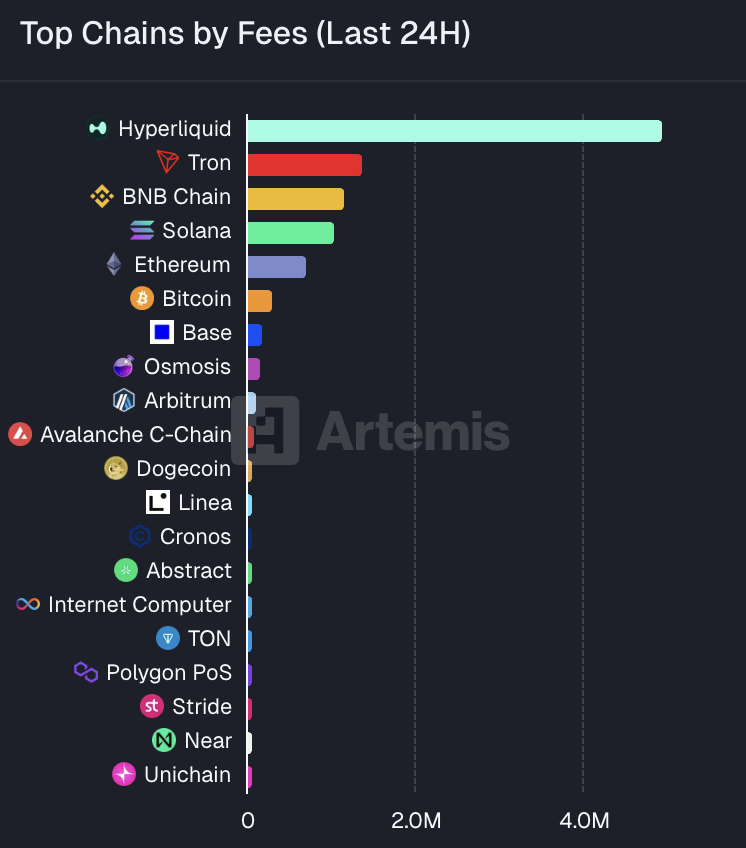

Data from Artemis shows that Hyperliquid generated more fees in the last 24 hours than Tron, Solana, BNB, Ethereum, and Bitcoin combined.