Leading on-chain analytics firm CryptoQuant has issued a cautionary note for investors banking on Bitcoin’s (BTC) price to sustain its recent rally past $94,000. The firm warns that the Bitcoin price top of this cycle could be close.

Their analysis highlights key indicators signaling potential exhaustion in BTC’s upward momentum. This raises the question: are these signs a genuine cause for concern, or could the rally still have room to run?

Bitcoin Could Soon Be Overvalued, CryptoQuant Says

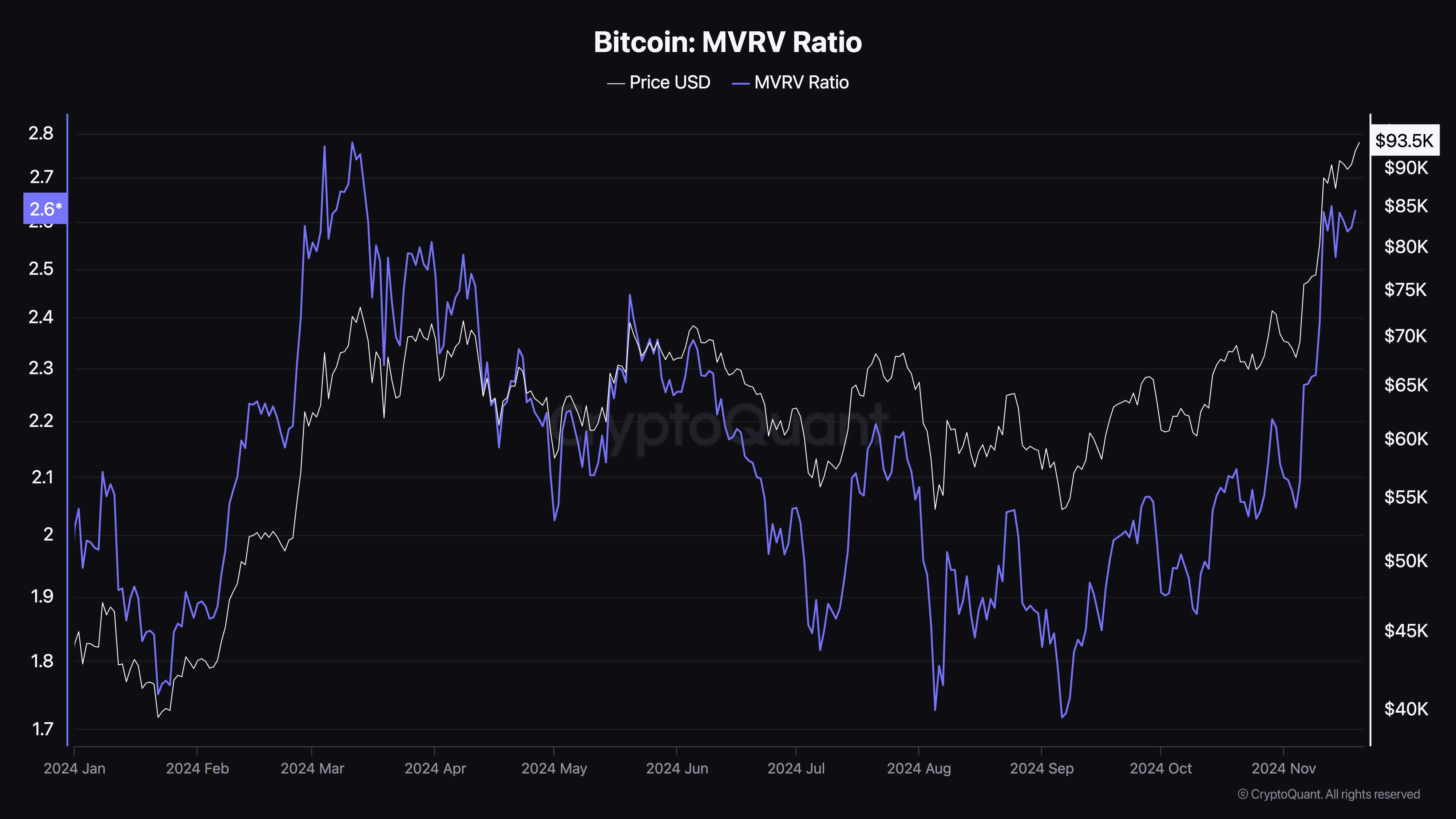

One indicator that CryptoQuant says could suggest Bitcoin’s price is at its highest is the Market Value to Realized Value (MVRV) ratio. The MVRV ratio serves as a key metric for gauging whether Bitcoin’s price is overvalued or undervalued.

Historically, values exceeding 3.7 have marked price peaks, signifying overvaluation. On the other hand, values dipping below 1 have indicated price bottoms, suggesting undervaluation. At press time, Bitcoin’s MVRV ratio sits at 2.62

This suggests that Bitcoin’s price is no longer undervalued. While it has not reached the overvaluation stage, a continued increase could send BTC toward that peak.

Additionally, the on-chain data provider highlighted that the Crypto Fear and Greed Index has entered the “extreme greed” phase, a strong indicator that Bitcoin’s price top might be approaching.

This observation aligns with BeInCrypto’s recent analysis and a cautionary statement from CryptoQuant’s CEO, Ki Young Ju, projecting potential risks as the market heads into 2025.

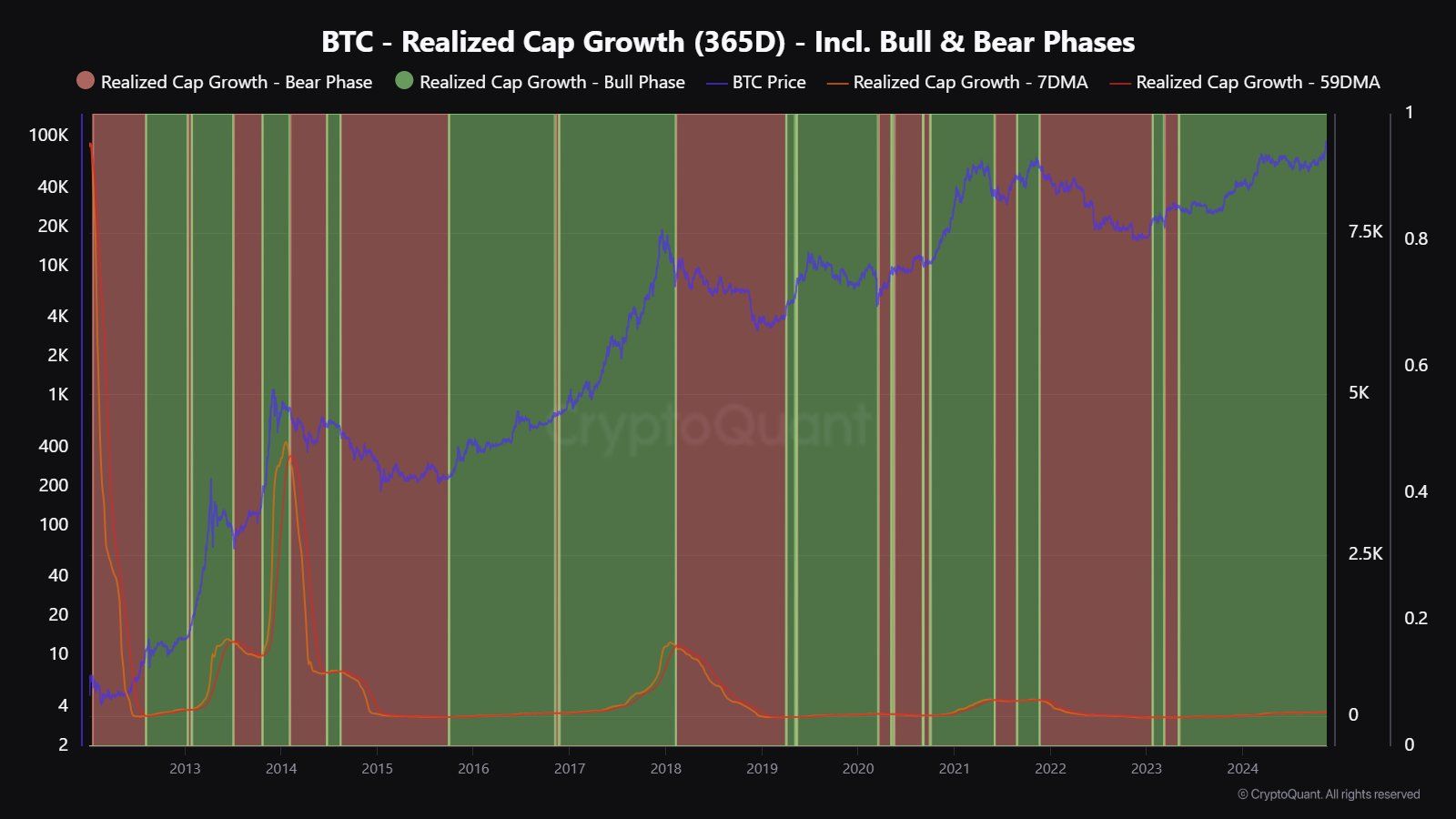

The firm also emphasized that Bitcoin is currently lacking in new capital. The 365-day Realized Cap Growt — a metric used to identify bull and bear market phases, evidenced this.

“For prices to stay strong, new money must flow into the market; without enough inflow, price pressure increases,” it stated on X.

As seen above, Bitcoin has recently seen an inflow of capital. But most of it has come from old money, suggesting retail investors are yet to exert a lot of pressure. Meanwhile, it also disclosed that the fact that long-term holders are selling could restrict BTC from going as high as investors desire.

BTC Price Prediction: Higher Highs Before Correction

At press time, Bitcoin’s price is $94,248, and it is trading within an ascending channel. The Bull Bear Power (BBP), which measures the strength of buyers versus sellers, is also in the positive region.

When the BBP increases, it means bulls are in control, and the price can increase. On the other hand, when the reading falls to the negative region, it means bears are in control. Therefore, the current reading suggests that the Bitcoin price top might not be here.

If that is the case, then BTC could rally toward the $100,000 mark. However, if the MVRV ratio climbs toward 3.7 and the cryptocurrency continues to lack new money, a correction to $80,795 could be next.