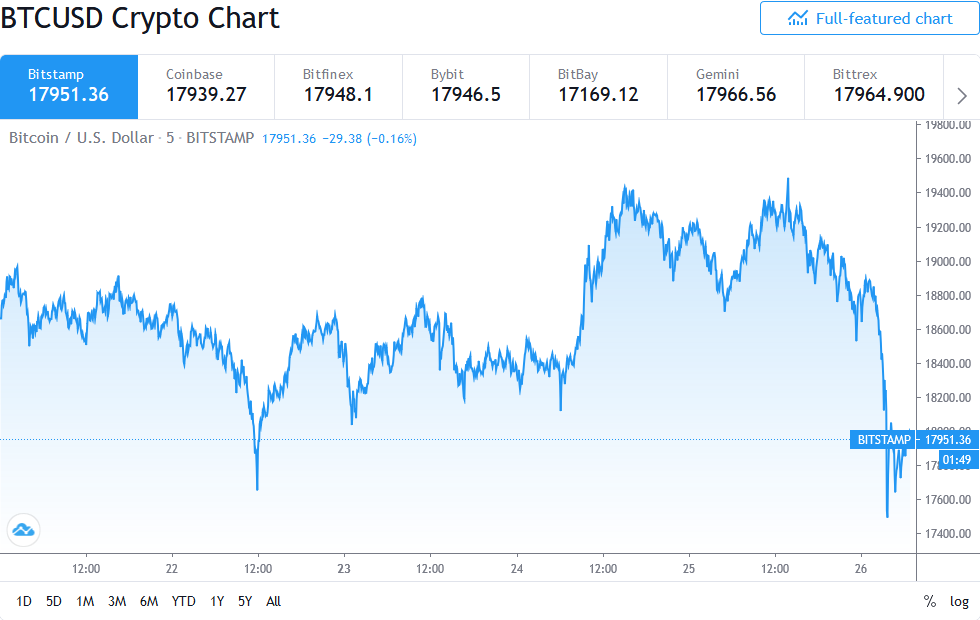

After stopping short of reaching its all-time high (ATH), the Bitcoin price saw a sudden $1,000 drop.

The price action coincides with major crypto exchange OKEx resuming withdrawals after a one-month imbroglio. Reports also show significant BTC inflows to exchanges which might signal an imminent price correction.

The Bitcoin price is currently hovering below $17,900 following a dramatic 11% slide that saw BTC lose over $1,000 in a little under three hours. Before the dip, BTC was attempting to surmount its ATH by possibly climbing above the $20,000 for the first time.

Several factors appear to have contributed to the Nov. 26 dip with data from on-chain analytics provider CryptoQuant showing a significant BTC inflow to exchanges. Such a scenario often points to traders positioning their coins for sale to cash-in on local tops amid Bitcoin’s bullish rise.

Thursday’s dip might also signify temporary bull fatigue after successive rejections above the $19,500 price level. Commenting on the sudden drop, Vinny Lingham, CEO of crypto wallet provider CivicKey tweeted:

This sell-off was expected. Shouldn’t drop below $16,000 and so you can expect some healthy sideways trading for the coming weeks. $20k requires a lot of consolidation to get enough momentum to maintain a break above.

Meanwhile, OKEx is set to resume crypto withdrawals by 8 AM (UTC). The crypto exchange reportedly holds about $3.48 billion worth of Bitcoin that has been stuck on the platform since mid-October.

The $1,000 Bitcoin price slide also caught out some unaware futures traders. According to data from crypto derivatives aggregator Datamish, the drop triggered a liquidation of over $81 million in BTC longs on BitMEX.

Despite the drop, BTC proponents say the bull case is still strong. Indeed, the 2017 bullish advance did see a few 30% corrections as the Bitcoin price almost crossed the $20,000 price mark. BTC is still up 147% since the start of 2020.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.