July marked a historic month for the crypto market. Trading activity reached astronomical levels, pushing global crypto market capitalization above the $4 trillion mark for the first time ever.

However, the euphoric rally has also triggered waves of profit-taking, prompting a short-term pullback across several digital assets in late July. Still, large holders—often called crypto whales—show no signs of backing down. Instead, they are rotating capital into tokens they believe will record gains in August.

Cardano (ADA)

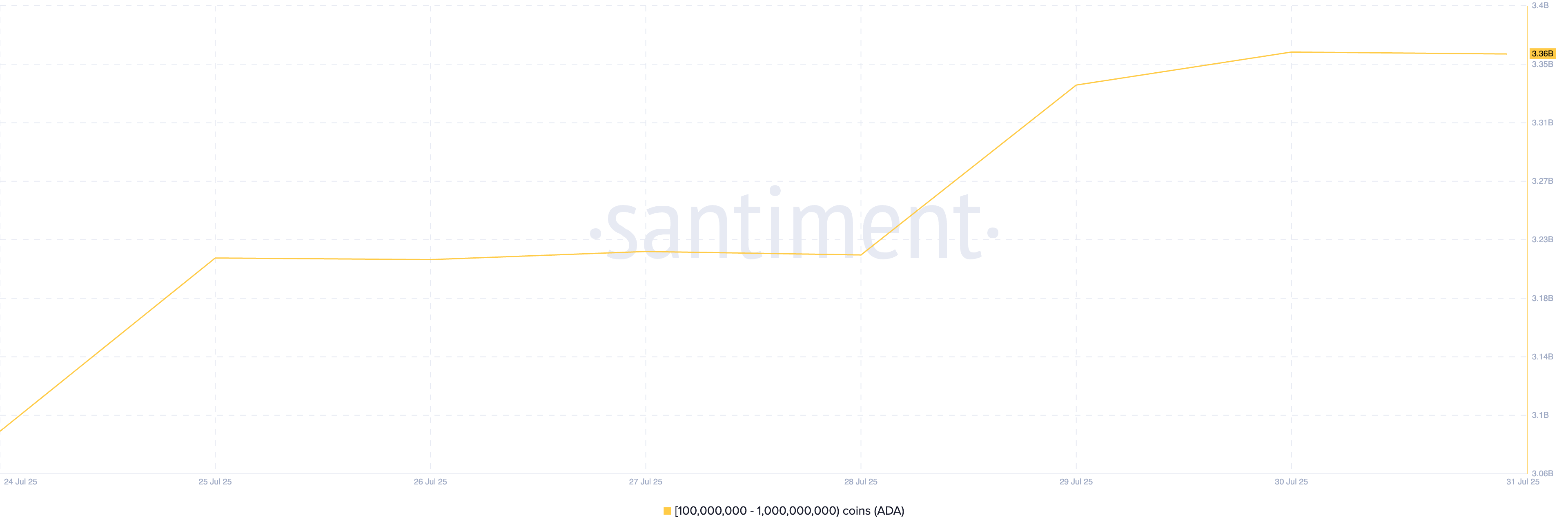

Layer-1 (L1) token Cardano (ADA) has emerged as a top pick among crypto whales eyeing gains in August. On-chain data reveals that since July 24, large holders with wallets containing between 100 million and 1 billion ADA have accumulated 270 million tokens, valued at over $210 million at current market prices.

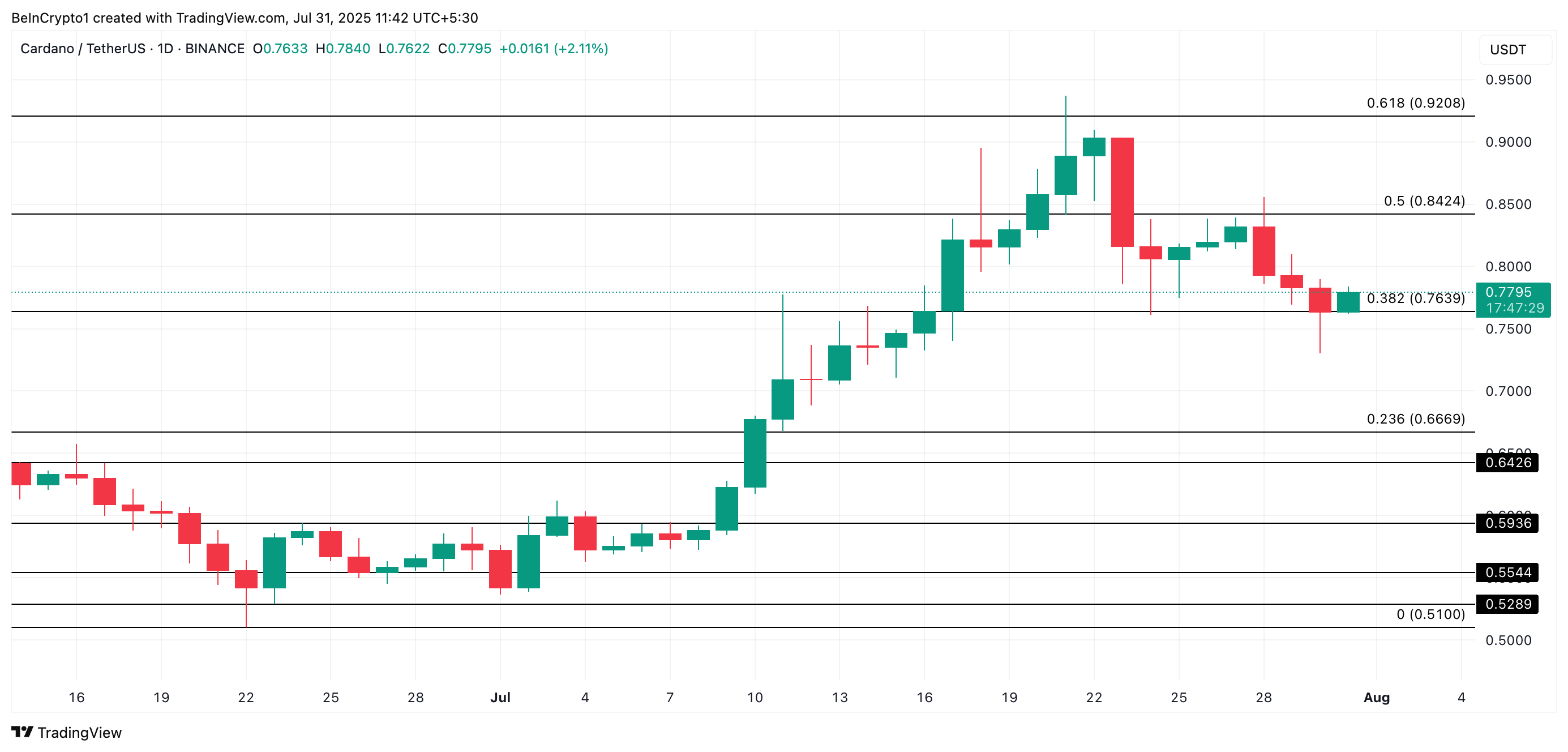

This accumulation comes amid a recent pullback in ADA’s price. The altcoin has slipped from its cycle peak of $0.93 on July 21 to trade at $0.77 at press time. Despite the correction, the sustained interest from high-net-worth investors signals continued confidence in ADA’s long-term prospects.

If their accumulation persists and counterbalances the supply rise, it could stabilize ADA’s price and stall its decline. In this scenario, the coin could initiate a bullish reversal and climb to $0.84.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On the other hand, if whale demand falls, ADA could extend its decline, break below $0.76, and fall to $0.66.

Tron (TRX)

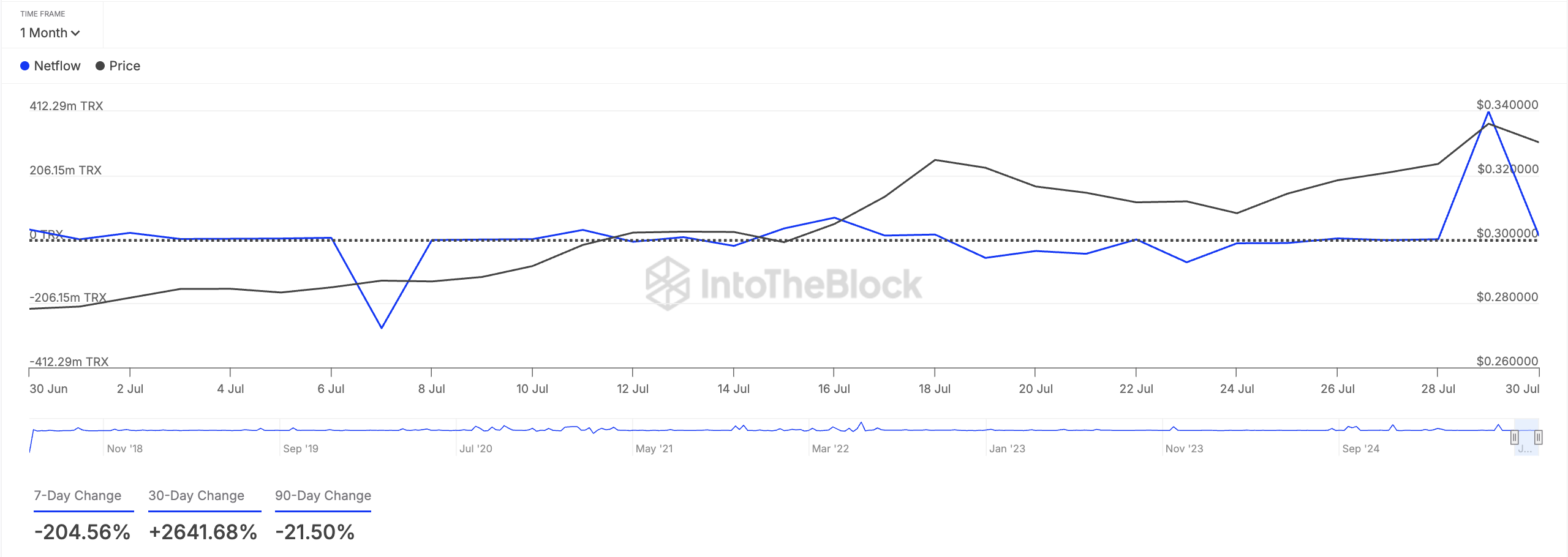

TRX has trended within an ascending parallel since June 22, noting a 24% price rise. By July 29, the altcoin had reached a six-month high of $0.35, driven by increasing whale accumulation.

This is highlighted by its large holders’ netflow, up over 2,600% in the past month, per IntoTheBlock.

The large holders’ netflow measures the difference between the amount of tokens that whales buy and sell over a specified period.

When an asset’s large holders’ netflow sees a positive spike, wallets holding more than 1% of the asset’s circulating supply are accumulating more coins. This signals growing confidence among these key holders and hints at a sustained TRX price rally if they maintain demand.

TRX could extend its rally and climb to $0.35 in this scenario.

However, a resurgence in profit-taking activity would invalidate this bullish outlook. If market demand falls, the altcoin’s price could crash below $0.30 to trade at $0.29.

Solana (SOL)

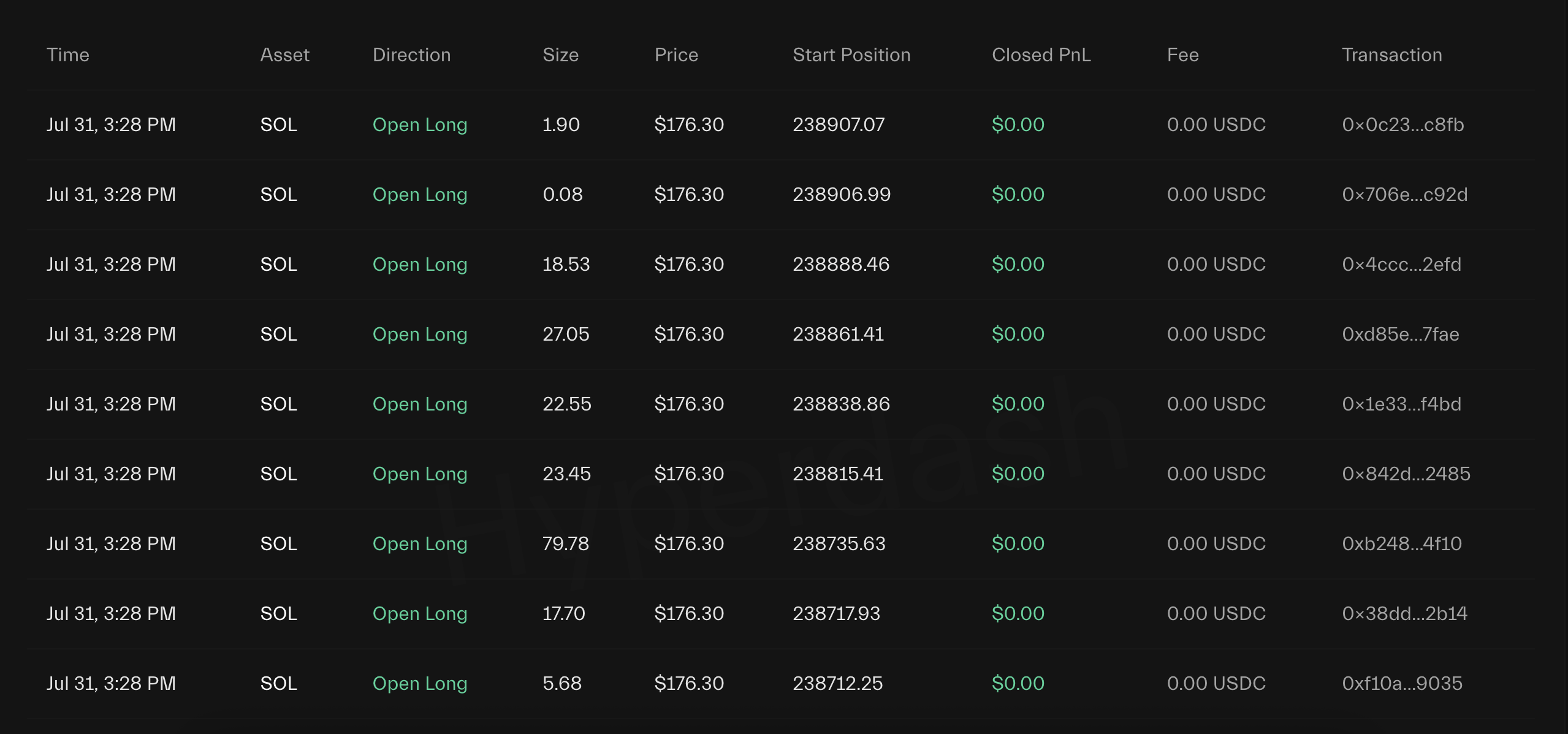

On-chain data has revealed a potentially bullish development for Solana. A high-performing whale trader initiated a massive long position today, which could influence price direction heading into August.

According to data from HyperDash, a whale holding over $2.9 million in profits opened a long position of 238,909 SOL, valued at approximately $42.3 million.

This trader has built a strong reputation in recent weeks. Over the past 20 days alone, they have executed 14 trades with an impressive 85.71% win rate, adding weight to the market’s attention on their latest move.

The timing of the position may suggest rising confidence in SOL’s upside potential for the month ahead.

If this accumulation trend continues into August, it could reignite broader bullish sentiment toward the coin. Should retail traders follow suit, SOL’s price may resume its upward trajectory and attempt to reclaim levels above $190.

Conversely, if selloffs persist, SOL’s price could slip below the $180 support to test a lower level around $176.33.