Following July’s market-wide uptick, August has brought a sharp pullback, with many digital assets either consolidating in tight ranges or sliding lower amid lackluster trading activity.

This shift in momentum has fueled uncertainty among retail investors, but on-chain data shows crypto whales are still actively positioning themselves for gains in September.

Arbitrum (ARB)

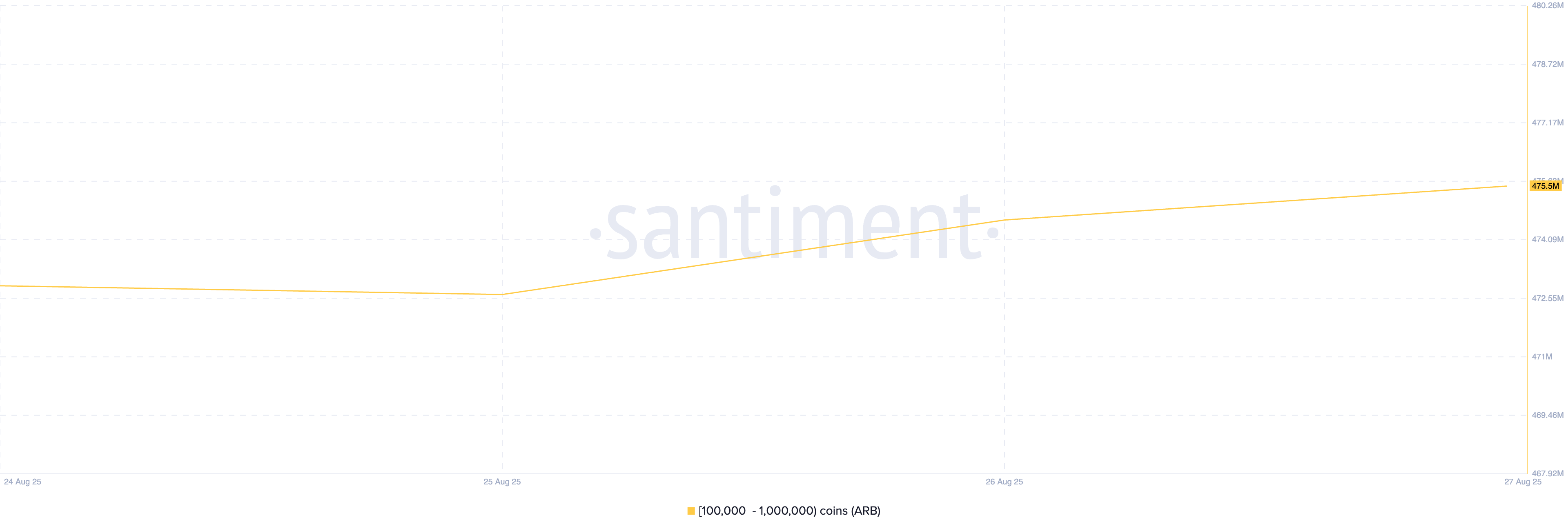

Layer-2 (L2) token ARB is one of the assets crypto whales are eyeing for gains in September. On-chain data reveals that since August 24, large holders with wallets containing between 100,000 and 1 million ARB have accumulated 2.1 million tokens.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The uptick in whale accumulation comes amid the token’s sideways movement since mid-August. Daily chart readings indicate that the token has faced strong resistance at $0.58 while finding support around $0.47, suggesting it has been consolidating within this range for several weeks.

If whale accumulation continues to grow, it could provide the buying pressure needed for the token to break above the $0.58 resistance, potentially pushing prices up to $0.62.

Conversely, a slowdown in whale activity could weaken support at $0.47, triggering a downtrend to $0.45.

Uniswap (UNI)

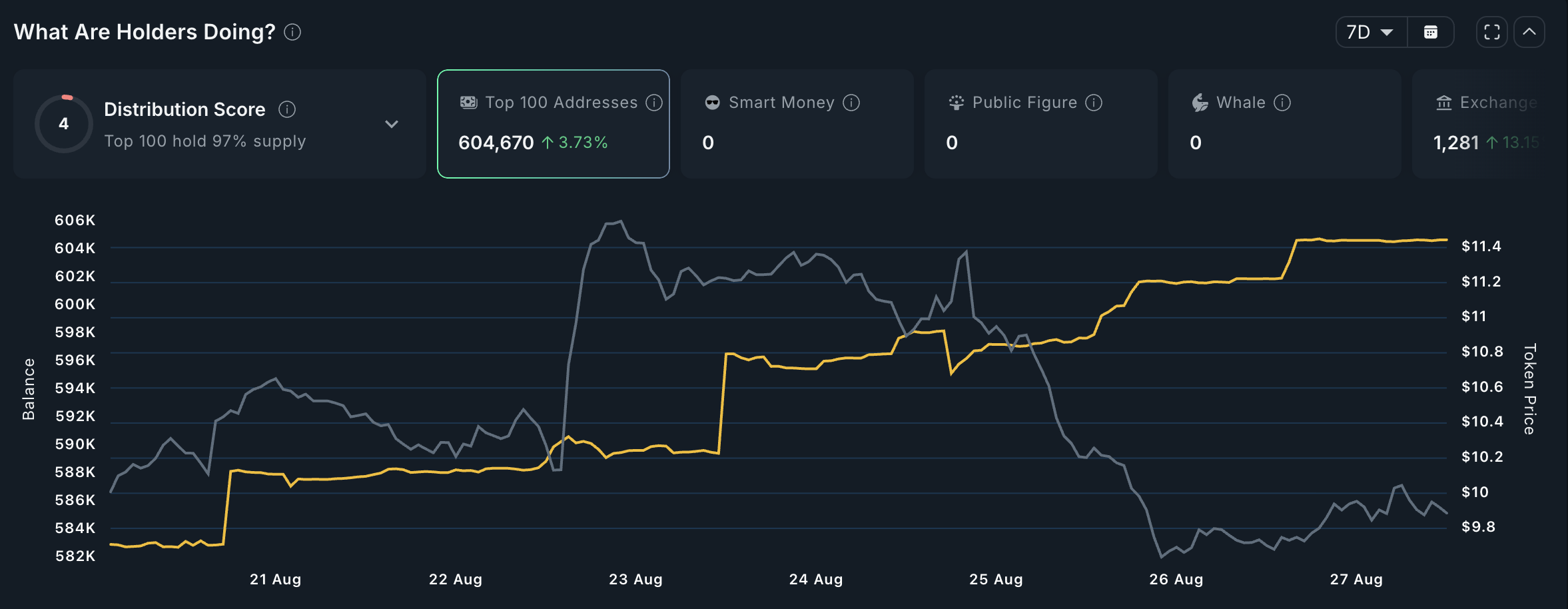

DeFi token UNI is another asset that large investors are holding for potential gains in September.

According to Nansen, the top 100 addresses holding the largest amounts of UNI on-chain have increased their holdings by 4% over the past week.

Continued accumulation by these top holders could encourage retail investors to follow suit, potentially driving a UNI price rally toward $10.25.

Conversely, the token could face a pullback to $8.67 if bearish pressure intensifies.

PEPE

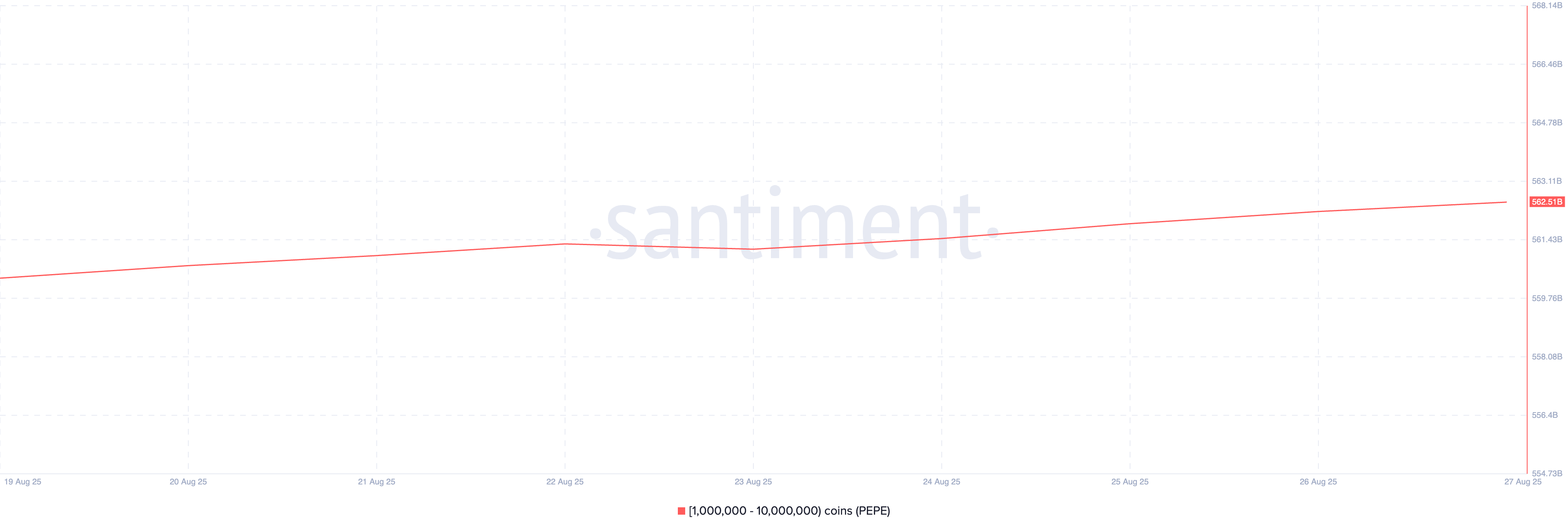

Frog-themed meme coin PEPE is drawing attention from crypto whales ahead of September. According to Santiment, holders of large wallets containing between 1 million and 10 million PEPE have accumulated 2.18 billion tokens.

This high accumulation indicates growing interest from influential investors, suggesting that whales may be positioning for a potential price surge. If this buying trend continues, PEPE could climb to $0.00001070.

On the other hand, if demand weakens and selling pressure rises, the token could fall to $0.00000830.