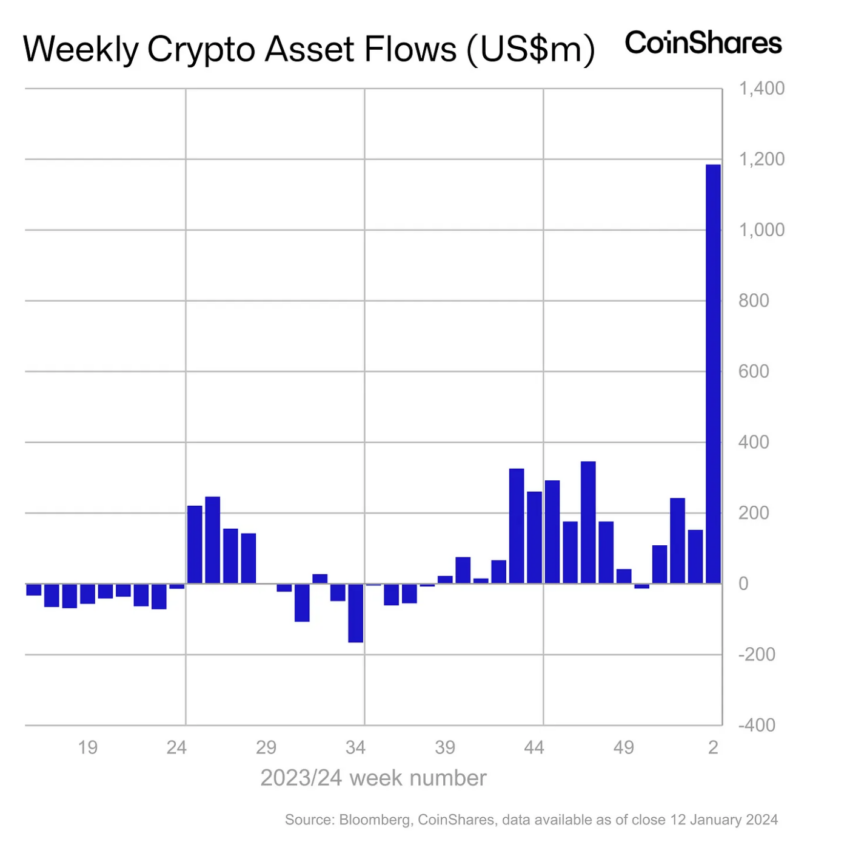

Last week marked a historic moment in the cryptocurrency market as exchange-traded products (ETPs) trading volumes surged to an unprecedented all-time high of $17.5 billion. Meanwhile, the crypto inflows for the ETPs have been the highest since October 2021.

This record-breaking figure is a staggering leap from the $2 billion weekly average of 2022. Indeed, it underscores a growing investor interest and confidence in cryptocurrency markets.

Record-Breaking Crypto Trading Volumes

According to CoinShares, digital asset investment products witnessed $1.18 billion in inflows last week. Still, this impressive number fell short of the record set by the launch of futures-based Bitcoin ETFs, which reached $1.5 billion in October 2021.

The large spike in weekly crypto asset flows is mainly due to the US Security and Exchange Commission’s (SEC’s) approval of spot Bitcoin exchange-traded funds (ETFs). Industry leaders, such as Mati Greenspan, CEO of Quantum Economics, believe that the Bitcoin ETF approval will bring significant institutional adoption.

“In the mid-term, spot Bitcoin ETFs should provide a frictionless on-ramp for institutions to add Bitcoin to their books in a way that’s both regulatory friendly and compliant with various fund structures,” Greenspan told BeInCrypto.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

The United States led the charge with inflows totaling $1.24 billion, followed by Switzerland’s $21 million. However, these inflows contrast with minor outflows in Europe and Canada. In fact, Canada, Germany, and Sweden witnessed outflows of $44 million, $27 million, and $16 million, respectively.

Bitcoin, the flagship cryptocurrency, experienced inflows of $1.16 billion last week, representing a significant 3% of its total assets under management (AuM). Even short-Bitcoin products saw minor inflows, totaling $4.1 million.

Read more: How to Short Bitcoin: A Step-by-Step Guide

Other cryptocurrencies also reported positive inflows. Ethereum garnered $26 million, XRP attracted $2.2 million, while Solana saw a modest inflow of $0.5 million. This diversified interest across various digital currencies suggests a maturing market with investors spreading their bets across different assets.

Notably, blockchain equities have also received substantial attention, with inflows totaling $98 million last week. This brings the total inflows over the last seven weeks to an impressive $608 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.