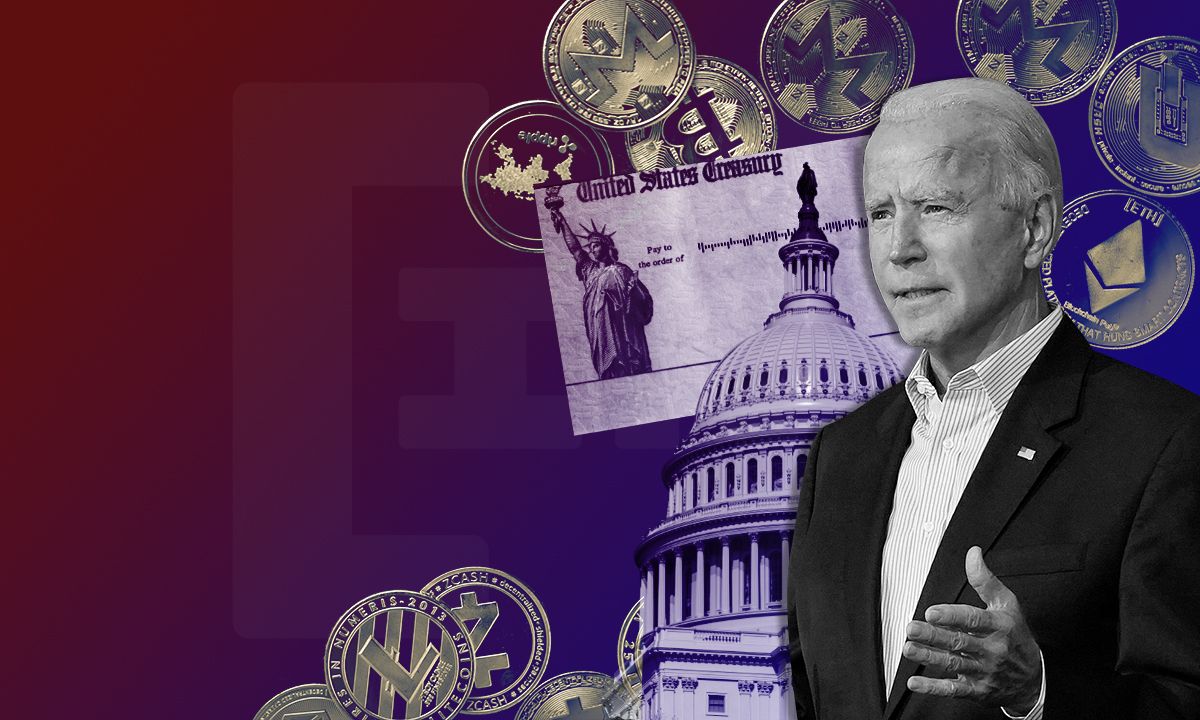

President Biden has unveiled a new infrastructure bill aimed at boosting the economy, saying that some of the cost will be paid by tax enforcement on crypto.

The Biden administration has published a new infrastructure bill, one that will raise billions through crypto taxation. The White House published a statement, called the “Historic Bipartisan Infrastructure Deal,” on July 28, calling it a “once-in-a-generation” investment.

The infrastructure deal’s primary intention is to bolster the country’s economy by job creation and is expected to add 2 million jobs per year over the next decade. Specifically, it will focus on growing the economy and enhancing the country’s competitiveness and sustainability.

Toward the end of the statement, the administration notes that the costs will be offset by strengthening tax enforcement on cryptocurrencies, among other things. This could herald a soon-to-be-published set of regulations, which have shown all the signs of arriving in recent months.

The change comes as the country grapples with China’s growing influence in many fields, including blockchain technology, AI, and IoT. It is also motivated by the broader concerns of climate change and the creation of good-paying union jobs.

The industries and initiatives that the bill will affect are wide-ranging and signals the intent to keep its position as the world’s strongest economy. Roads and bridges, public transport, electric vehicles, water and power infrastructure, and high-speed internet are all on the cards.

Could crypto regulation be incoming?

While more taxation on crypto — though no details have been specified yet — will no doubt rile some investors, most will likely be pleased with the long-term benefits of clear regulation. This lack of clarity is precisely what has been stopping more investors, both retail and institutional, from entering the market.

Proponents of bitcoin ETFs have also been clamoring for the approval of these funds, but regulatory authorities have been hesitant because of concerns surrounding investor protection and market manipulation. The SEC currently has over a dozen ETFs under consideration, and it will want to move as quickly as possible.

The Biden administration had previously been rumored to be working on a broad regulatory framework for the crypto market, but it has not offered any updates since those initial reports. This, in combination with remarks by SEC Chairman Gary Gensler and Treasury Secretary Janet Yellen, suggest that authorities soon declare guidelines.

If clear regulation does ease some of those aforementioned concerns, then it could result in a big boost for the market. Certainly, the U.S. does not seem to be going in the direction of some other countries, if the move to tax crypto robustly is anything to go by.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.