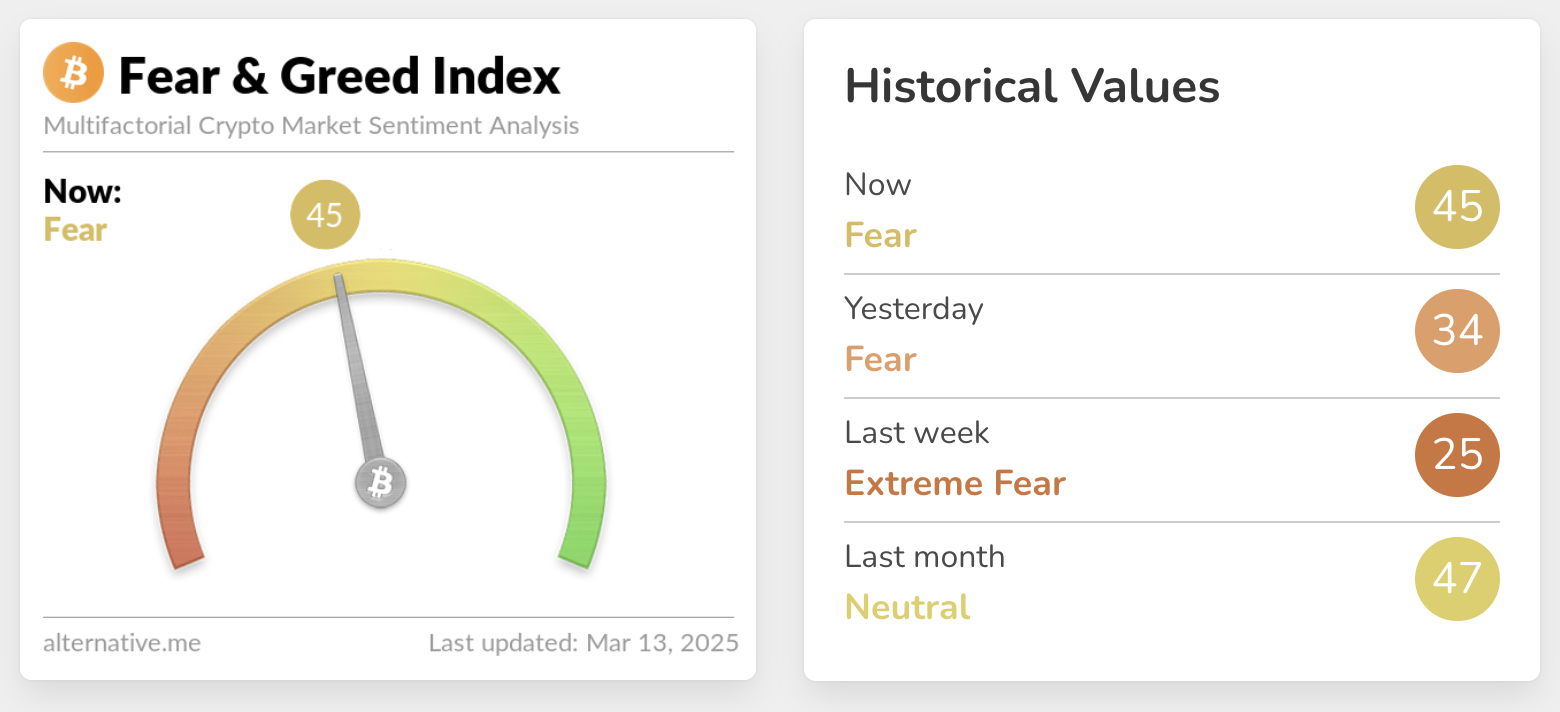

The Crypto Fear and Greed Index rebounded from its recent lows, showing diminished concerns of a bear market. However, several crypto stocks have posted huge losses, and gold is surging towards an all-time high.

The constant market volatility has helped exhaust short-term and speculative traders, rebuilding a little stability. The latest US CPI report was better than expected, and it may help create interest rate cuts for a more long-term solution.

Have We Avoided a Crypto Bear Market?

Over the past few weeks, rumors of a bear market have circulated through the crypto space. Two weeks ago, the Crypto Fear and Greed Index reached its lowest level since the FTX collapse, and recession fears have kept markets reeling.

However, the Index now reports a significant rebound, and crypto traders are evidently regaining some confidence.

The pertinent question, then, is why has this happened. By all accounts, crypto investors have a lot of reasons to fear a bear market.

Several private firms that maintain significant Bitcoin holdings, like Metaplanet, MicroStrategy, and Marathon, all recorded double-digit percentage drops in their stock value this week.

Meanwhile, traditional assets like gold are spiking.

Gold is a risk-off asset, and cryptoassets are generally considered risk-on. If fears of an imminent recession define the TradFi market, this will have a negative impact on investments in the crypto space.

However, a few points could diminish fears of a crypto bear market. For one, the US CPI report for February was less bad than expected, which may help fuel future cuts to US interest rates.

Since the report dropped, Bitcoin and other cryptoassets recovered a little, and some corporate BTC holders like Tesla also posted a slight rebound. This optimism may or may not prove fragile, but it’s helped keep the market upright.

More importantly, the constant volatility in this market might be causing some benefits. As President Trump repeatedly flip-flopped on tariffs, crypto sentiment has yo-yoed between bear market fears and resurgent optimism.

This has exhausted most of the short-term and speculative traders in this market, at least for the time being.

In short, all capital markets are in chaos right now. Parts of the crypto market are showing cautious optimism, but all the ingredients of a bear market are still in play.

The industry has been agitating for interest rate cuts, but it may face serious hurdles. Ultimately, we’ll need a major bullish development to dispel these lingering market fears.