Amidst tight regulation in the US, regulators have amassed up to $19.45 billion from settlements with crypto-related firms in 2024.

With barely two months left, this year could beat 2023 in terms of lawsuit settlements as regulatory clampdown intensifies.

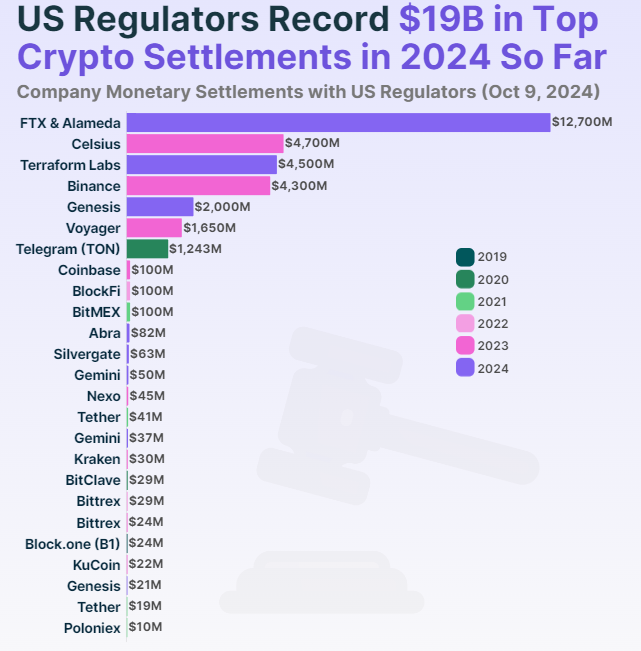

Top Company Settlements with US Regulators

As crypto enforcement actions in the US continue, a CoinGecko report indicates that regulators have accumulated $19.45 billion from eight settlements so far in the year. This represents a 78.9% increase in settlement value compared to 2023, putting 2024 higher on the leaderboard for lawsuit settlements.

The report details US regulators’ clampdown against bankrupt crypto exchange FTX and its sister firm, Alameda Research, as the top crypto enforcement action on penalty metrics. As it happened, the duo paid fines of up to $12.7 billion in August 2024, with the US Commodities Futures Trading Commission (CFTC) spearheading the crackdown.

BeInCrypto reported that the funds serve to make FTX customers and creditors whole, with claims reaching $11.20 billion. Bankrupt crypto lending firm Celsius is next in line with $4.7 billion in settlement fees, followed by Terraform Labs, the 2022 bear market instigator, which paid $4.5 billion.

Binance, the largest crypto exchange by trading volume, comes fourth after paying $4.3 billion in a settlement that saw its former CEO Changpeng Zhao step down, actions that culminated in his four-month jail term.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Sixteen out of the top 25 crypto settlements with US regulators happened between late 2022 and 2024. This came on the back of accelerated regulatory scrutiny following the implosion of Sam Bankman-Fried’s (SBF) crypto empire, FTX. Notably, the incident revealed the rot that could exist within crypto-related entities, prompting heightened regulatory scrutiny for investor protection.

US Crypto Regulation Remains Controversial

Some associate the heightened regulatory clampdown in the US, particularly from the US Securities and Exchange Commission (SEC), with Gary Gensler’s ascension to chair the agency. This is after a joint statement from the commission revealed that in the 2023 financial year, the SEC’s enforcement division took 784 actions, resulting in $4.9 billion in penalties and disgorgement.

“Since Chair Gensler took office on April 17, 2021, the SEC has increasingly gone to court to establish its policy positions —confirming what the industry has long known regarding regulation by enforcement,” Paradigm Policy Manager Brendan Malone indicated.

Malone revealed that 92% of the SEC’s actions against the crypto industry under Gensler have involved registration violations, 5% higher than the actions of preceding SEC Chairs.

On the same note, Alexander Grieve, Paradigm’s VP of Government Affairs, recently detailed what is wrong with the US SEC policies. He cited a hand that is always ready to hit the Wells Notice buzzer, forum shopping, and a barbell approach, approaches that flaw the regulator enforcement actions.

Meanwhile, the SEC, as well as other regulators advocate for enhanced regulatory scrutiny, citing investor protection. Notwithstanding, the general sentiment among industry sympathizers is that tough regulation in the US drives innovation overseas.

Read more: Who Is Gary Gensler? Everything To Know About the SEC Chairman

Accordingly, regions like Hong Kong and the Middle East are benefitting from this perspective because of their favorable stance towards cryptocurrency.