In an era where digital currencies are becoming increasingly mainstream, regulatory bodies worldwide are updating their policies to reflect the evolving sector. The European Union, Singapore, and Thailand have recently made significant amendments in their approach to crypto regulation, showcasing a global shift towards more structured governance.

Firstly, the European Union has taken a groundbreaking step with the provisional agreement on parts of the anti-money laundering (AML) package.

EU Targets Crypto Asset Providers With Updated AML Regulations

This comprehensive strategy is designed to fortify the EU against money laundering and terrorist financing. Belgian Finance Minister Vincent Van Peteghem emphasized,

“This agreement is part and parcel of the EU’s new anti-money laundering system. It will improve the way national systems against money laundering and terrorist financing are organised and work together.”

Consequently, this move marks a decisive effort to clamp down on the illegitimate use of the financial system by criminals and terrorist networks.

An intriguing aspect of the EU’s strategy is the expanded list of obliged entities, which now includes most of the crypto sector. Crypto-asset service providers (CASPs) will be required to conduct thorough due diligence on their customers for transactions exceeding €1000.

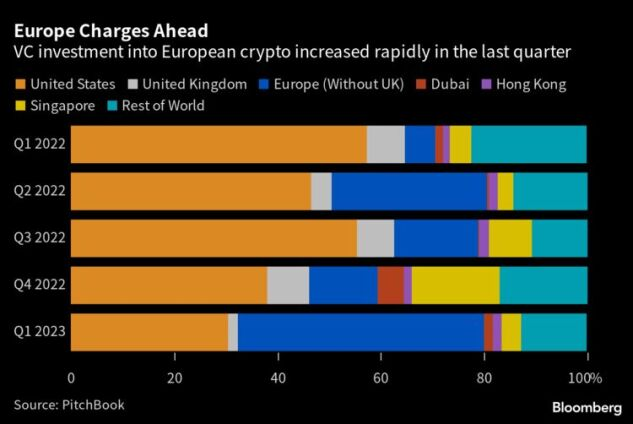

This extension to digital currencies indicates a significant shift in the EU’s approach to the crypto market as investors continue to pour in.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

ICOs and ETFs in the East

Meanwhile, Singapore has taken a more conservative stance. The Monetary Authority of Singapore (MAS) has blocked the listing of Bitcoin ETFs. The regulatory body cited the inherent volatility and speculative nature of crypto transactions.

An MAS spokesperson highlighted the risks associated with such investments, stating,

“Encrypted currency transactions are inherently highly volatile and speculative, and are not suitable for casual investors.”

This decision reflects Singapore’s cautious approach to the unpredictable crypto market, aiming to shield casual investors from potential financial pitfalls.

In contrast, Thailand’s SEC is embracing the digital asset sector by updating its regulatory framework for crypto businesses. The SEC has notably lifted the investment limit for retail investors in real estate-backed and infrastructure-backed initial coin offerings (ICOs).

However, Thailand also recently blocked investors from accessing US-based Bitcoin ETFs as it ‘monitors developments.’

Overall, these updates from the EU, Singapore, and Thailand highlight diverse crypto regulation approaches. Each region uniquely balances digital currency opportunities with investor protection and financial stability.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.