Things are going from bad to worse for Digital Currency Group (DCG). According to reports, it may be forced to sell its crypto publication CoinDesk.

On Jan. 18, CNBC reported that CoinDesk had engaged investment bank Lazard. The Digital Currency Group-owned outlet is considering a full or partial sale of the business.

In an emailed statement, CEO Kevin Worth said, “over the last few months, we have received numerous inbound indications of interest in CoinDesk.”

The outlet was started in 2013 and broke the first story regarding the problems with FTX and its dubious balance sheet. Furthermore, DCG acquired the media company in 2016 for $500,000, according to the WSJ.

The eventual collapse of the Sam Bankman-Fried crypto empire has caused no end of problems for Barry Silbert’s Digital Currency Group. The firm is also the parent company of digital asset manager Grayscale.

Clouds Darkening for DCG

Financial advisory and asset management firm Lazard will assist the media company in exploring “various options to attract growth capital to the CoinDesk business, which may include a partial or full sale.”

DCG’s problems mounted after the failure of FTX. Its crypto lending company Genesis is on the verge of bankruptcy as it reels from exposure to toxic loans. This has impacted crypto exchange Gemini which had $900 million in customer funds locked with its yield partner Genesis.

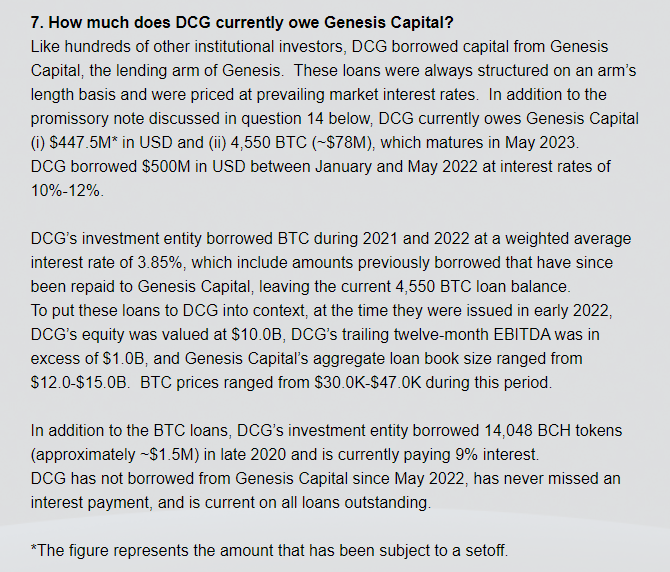

In a letter to shareholders earlier this month, CEO Barry Silbert said DCG owed Genesis Capital $447.5 million and 4,550 BTC. The loan matures in May 2023.

DCG also has shares in Grayscale’s Bitcoin Trust (GBTC). The firm has reportedly purchased $722 million worth of GBTC since March 2021. The trust is currently selling at a discount of -40% to the net asset value.

On Jan. 18, DCG sent a letter to shareholders stating that it was halting quarterly dividends to conserve funds. Furthermore, the group shuttered its wealth management business earlier this month and slashed staff.

Crypto Market Declines

Crypto markets are in decline today, with a 3.9% fall in total market capitalization. This has caused the figure to fall back below $1 trillion again.

As a result, all of the majors are in the red at the time of writing. Bitcoin dropped 2.5% on the day in a fall to $20,710. Meanwhile, Ethereum is down 3.8% over the past 24 hours, trading at $1,519 at the time of writing.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.