The Bitcoin mining firm Stronghold Digital has unveiled its financial and operational results for the quarter ending June 30, 2023. The update comes as the firm faces fierce legal troubles and a worrisome debt burden.

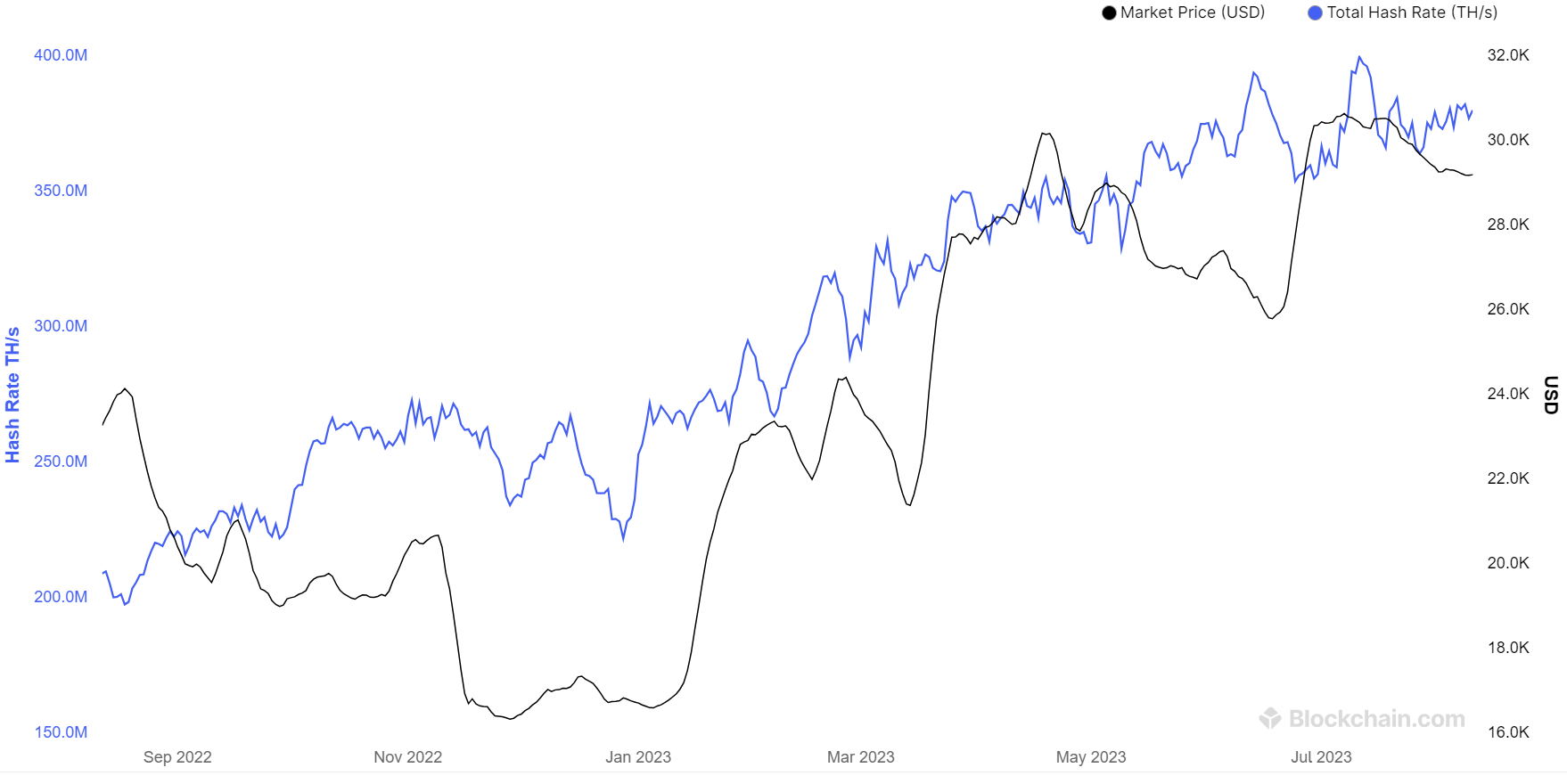

In the August 10 announcement, it also shared notable operational updates. The company now expects to achieve a hash rate of 4 EH/s by September 1, 2023. A hash rate is the computational power of a miner. An exahash (EH/s) represents one quintillion (10^18) hash calculations per second.

Stronghold’s Bitcoin Mining Becoming More Efficient

During the second quarter of 2023, Stronghold achieved a mining output of 626 bitcoins. A growth of around 43% compared to the fourth quarter of 2022.

This acceleration is a month ahead of the prior forecast and a four-month improvement from the estimate on March 29, 2023, according to a company statement. The firm also said its business model of wholly-owned power plants and data centers will provide fruitful as the Bitcoin halving—projected to take place in April 2024—approaches.

Following the news, the company’s shares closed 11% higher on Thursday. Its stock performance is up 69% YTD.

Mine your crypto from home with our simple guide: How To Build a Mining Rig: A Step-by-Step Guide

However, the Bitcoin miner is in legal trouble after allegedly lying about its hash rate during its initial public offering (IPO). In July 2021, Stronghold submitted its initial public offering (IPO) to the SEC. It debuted on the Nasdaq stock exchange three months later.

On August 10, a federal court in New York greenlit a class action lawsuit against Stronghold Digital, accusing it of lying to investors during its IPO. The lead plaintiff, Mark Winter, contends that Stronghold’s IPO documents contained significant falsehoods about its mining operations, including understating production costs.

As a result of the alleged deception, Winter alleges, he and others bought Stronghold’s stock at an inflated price and suffered financial losses.

Bitcoin Mining Hit Hard by Rising Energy Prices

Winter’s lawsuit asserts that Stronghold deliberately provided misleading information to investors about the failure of a contract with a specific supplier and the performance of its Bitcoin miners. This, the lawsuit claims, is a violation of provisions of the US Securities Act.

Rosy forecasts aside, Stronghold has not had the best year. In February, the mining firm agreed to a debt restructuring deal with Whitehawk Finance LLC. The pact will allow Stronghold to delay the principal repayments of $54.9 million of debt through to June 2024.

The company’s business model has struggled under the weight of increasing energy prices. It hopes to avoid the Chapter 11 bankruptcy fate of some of its industry rivals.