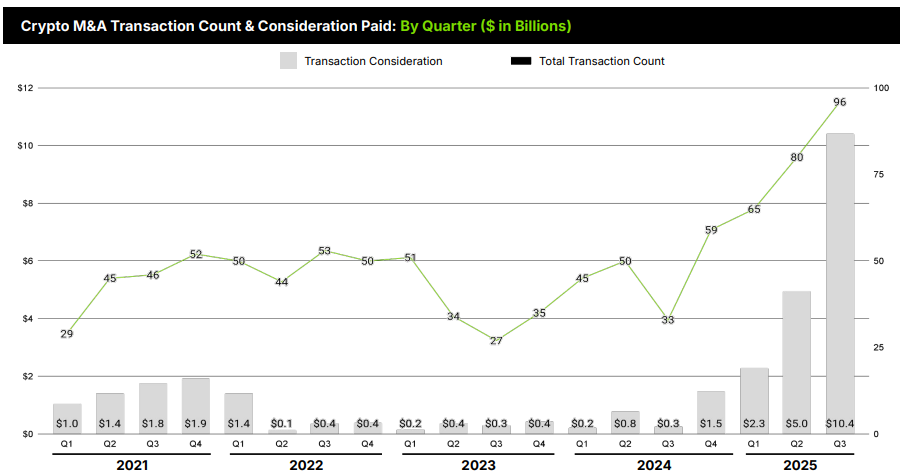

A new report from Architect Partners has revealed that crypto-related mergers and acquisitions (M&A) topped $10 billion in value during the third quarter of this year. This is the largest total ever recorded for the sector.

That figure doubles the previous record of $5 billion set earlier this year and represents a thirtyfold jump compared with the same period in 2024.

Why Crypto M&A Deals Are Thriving

To put the number in perspective, this single quarter nearly equals the total M&A deal value from Q1 2022 through mid-2025, which amounted to about $11 billion.

Considering this, Architect Partners said the surge signals a clear break from the prolonged downturn that followed the last market cycle. It also showed how the current pro-crypto environment fuels the industry’s growth.

“Weʼve firmly broken out of the ‘Crypto Winter,’ and are reaching a more disciplined, mature state where founders that can clear diligence are raising meaningful checks,” the firm stated.

Architect Partners outlined five key forces fueling the current wave of crypto mergers and acquisitions during the period.

According to the report, firms involved in M&A deals are focused on bridging traditional finance with digital-asset services and scaling their operations efficiently. They are also working to meet stricter compliance and licensing standards, expand crypto payment infrastructure, and improve treasury management strategies to handle liquidity and volatility better.

So, it is unsurprising that digital asset treasury reverse mergers accounted for roughly $6.2 billion, or around 37% of the total disclosed value in the reporting period.

This shows that institutional investors increasingly use these deals to gain crypto exposure while maintaining listings on traditional stock exchanges.

Momentum Continues Into Q4

That momentum shows no sign of fading as several new deals have already emerged this quarter.

For context, FalconX, a crypto prime broker, is reportedly finalizing a deal to acquire asset manager 21Shares. Coinbase, the largest US exchange, is also through its purchase of Echo, while Kraken recently completed its acquisition of Small Exchange, a derivatives platform.

To industry observers, these developments point to a deeper structural shift. Raphael Bloch, co-founder of The Big Whale, said the current wave marks the start of a new competitive order.

“We’re entering a new phase for the crypto industry – a wave of consolidation. The strongest players have the cash, the licenses, and the vision to scale. Others, exhausted by the bear market, are becoming attractive acquisition targets,” he noted.

Bloch also noted that traditional financial institutions like banks are accelerating their entry into the emerging industry by investing in crypto infrastructure firms.

According to him, this shows a clear acknowledgment that tokenization, custody, and digital trading are becoming indispensable to modern portfolios.

“This isn’t just a few deals – it’s the start of a structural shift. Over the next year, expect dozens of acquisitions, partnerships, and mergers reshaping how crypto connects with traditional finance,” he added.