Cardano (ADA), Algorand (ALGO) and COTI are three crypto altcoins that have bearish-looking charts and could collapse in the short term.

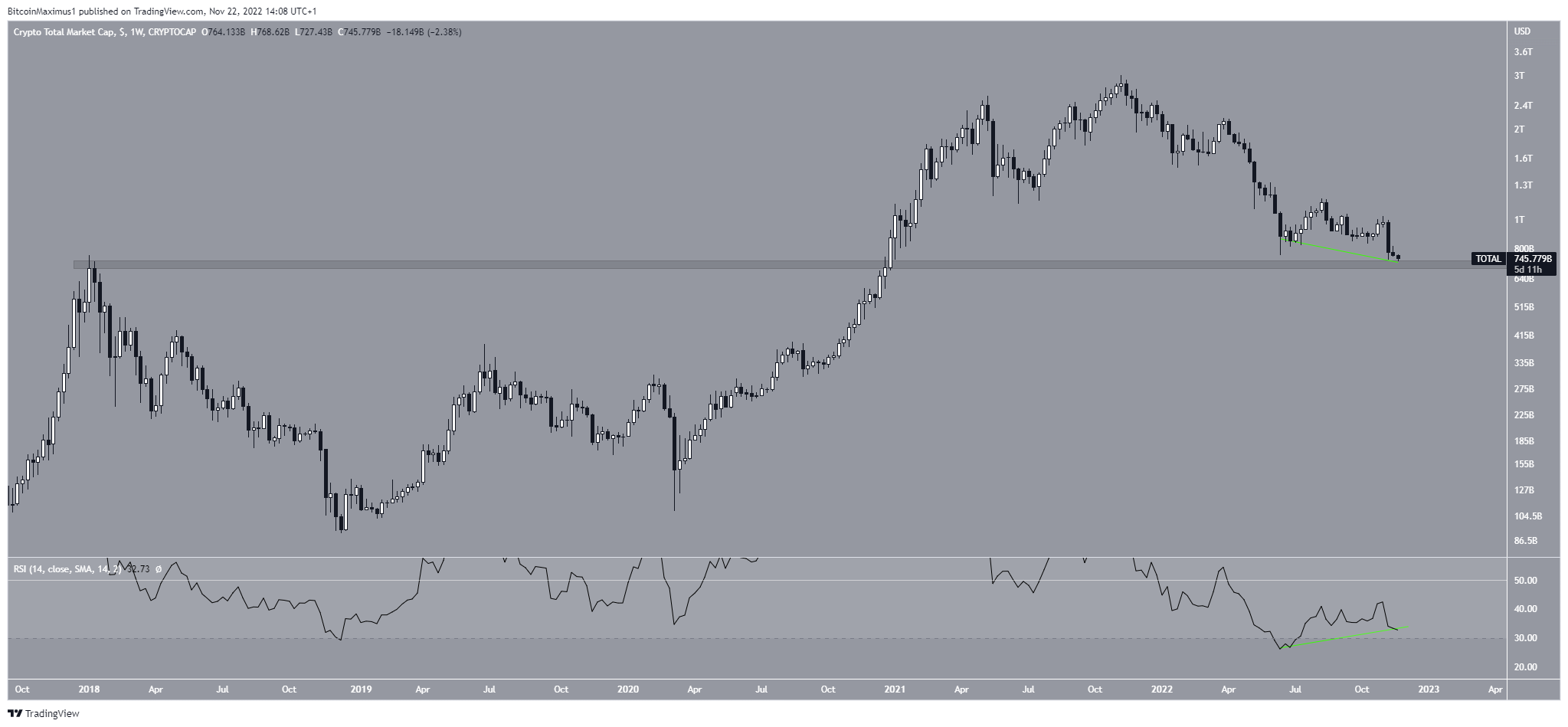

Crypto Market Cap Holds Above 2017 Highs

The Total Crypto Market Cap (TOTALCAP) has fallen since reaching an all-time high price of $3 trillion in Nov. 2021. The decrease led to a low of $727 billion in Nov. 2022.

Interestingly, the cryptocurrency market cap has stayed within the 2017 high resistance of $760 billion, even though it has created a wick below it. Nevertheless, the $760 billion horizontal support area is still intact.

Furthermore, the weekly RSI is in the process of generating bullish divergence (green line). This comes after the indicator fell to an all-time low value of 26 in June 2022.

Therefore, whether the Crypto Market cap price bounces or breaks below the $760 billion support area will determine if the crypto market prediction is bullish or bearish.

Since a bounce would also validate a bullish divergence in the weekly RSI, it would be considered a vital sign of a bottom for crypto prices.

Cardano Price Breaks Down Below $0.35

One altcoin which is showing bearish signs is ADA. The Cardano price has fallen since reaching an all-time high price of $3.10 in Aug. 2021. It reached a low of $0.29 in Nov. 2021.

The low was crucial since it caused a breakdown from the long-term $0.35 support area, which had previously been in place since Jan. 2021.

Furthermore, the breakdown caused the RSI to invalidate its bullish divergence trend line (green line). As a result, a drop toward $0.15 is the most likely scenario. This would amount to a decrease of 50% from the current price. The long-term Cardano wave count is also bearish.

Conversely, a weekly close above $0.35 would invalidate this bearish Cardano price prediction.

Algorand Falls to Yearly Low

Another altcoin that has fallen considerably is ALGO. The Algorand price has decreased since Nov. 2021, when it reached a high of $2.99.

The downward movement caused a breakdown below the $0.28 area, which has now been validated as resistance (red icon).

Unlike Cardano, the weekly RSI for ALGO has generated bullish divergence (green line), and its trend line is still intact. As a result, the potential for a bullish reversal is higher. However, a close above $0.28 is required in order to confirm this.

Conversely, the next closest support area is at $0.20.

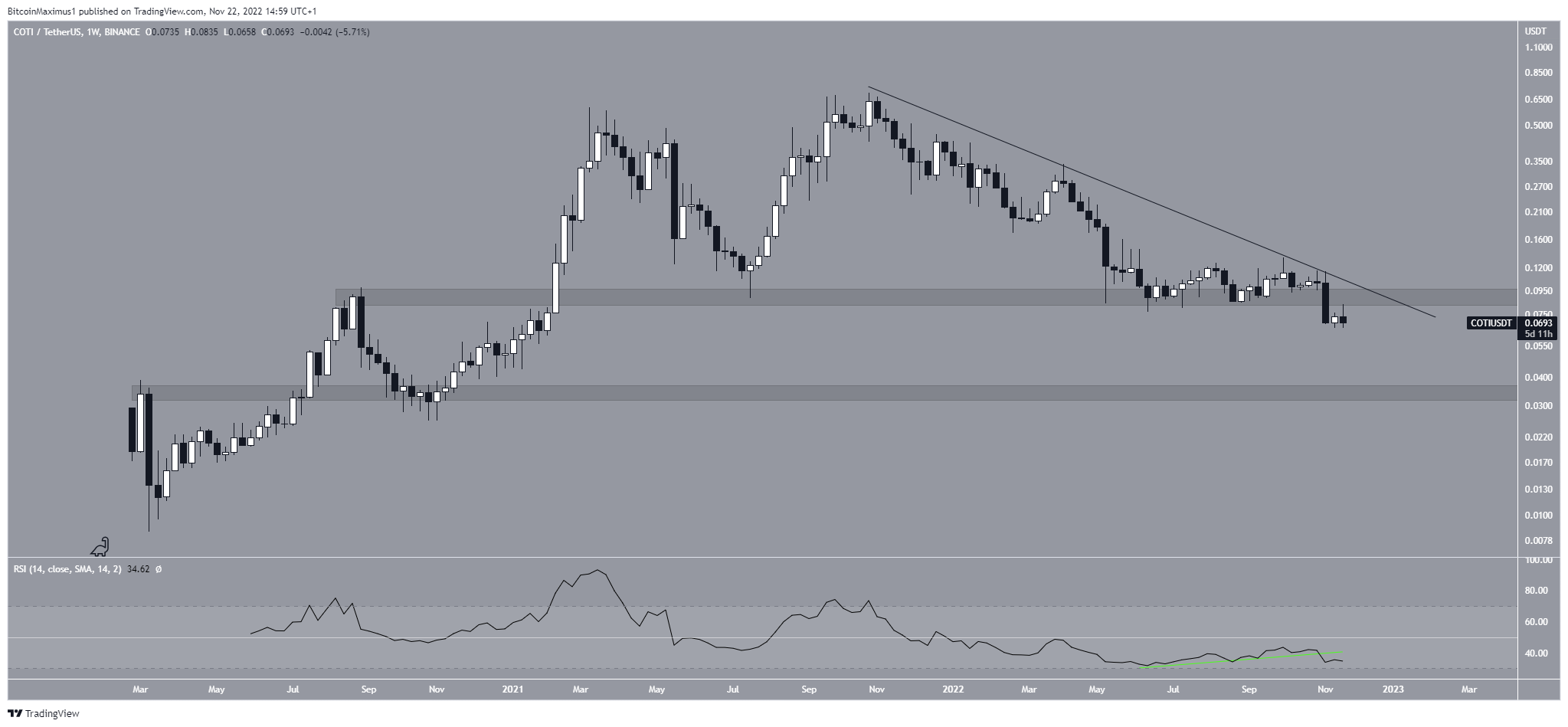

COTI Breaks Down Below $0.09

The COTI price has fallen since reaching an all-time high of $0.69 in Oct. 2021. The downward movement led to a low of $0.06 in Nov. 2022. It followed a descending resistance line, which caused a rejection on Nov. 9 (red icon).

The downward movement also caused a breakdown from the $0.09 horizontal support area. This was a crucial level since it acted as the previous all-time high resistance in July 2020.

Similarly to ADA, the weekly RSI has invalidated its bullish divergence trend line (green line).

As a result, a drop towards $0.035 is the most likely scenario. A weekly close above $0.09 would invalidate this bearish COTI price prediction.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date news and information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.