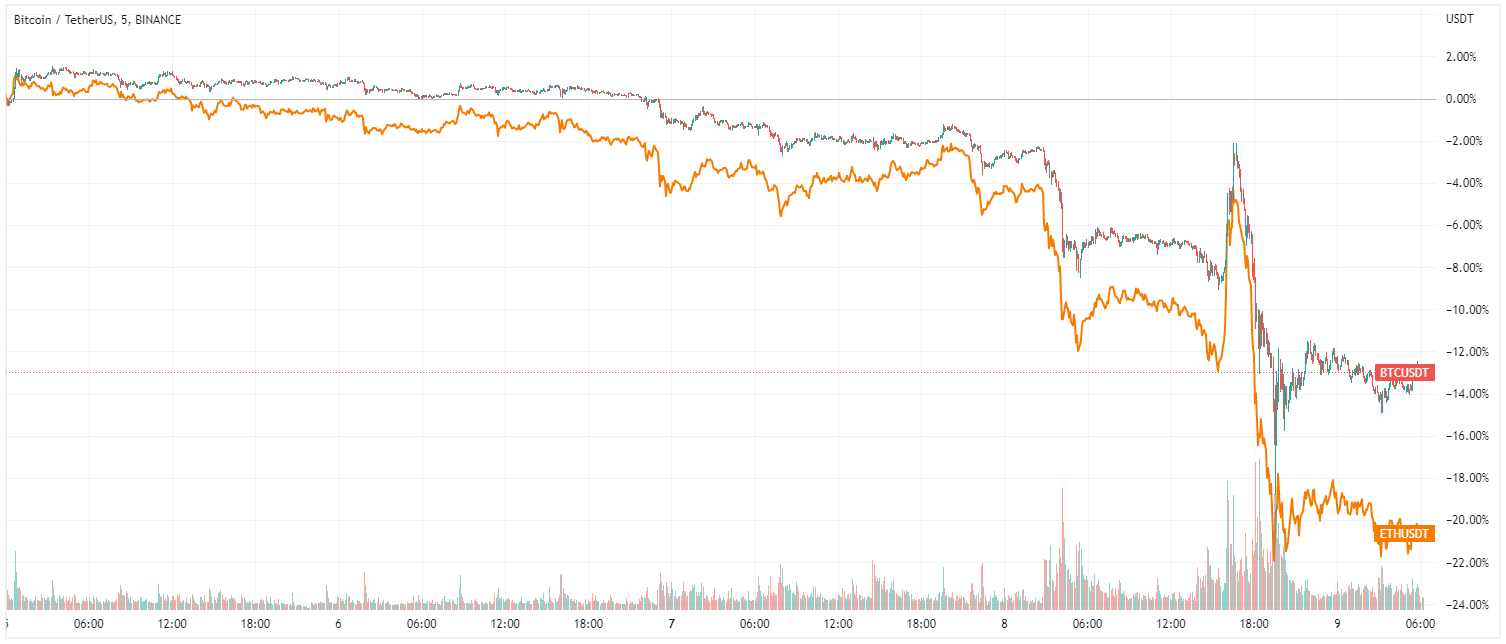

Over 380,000 crypto market traders have been liquidated in the past 24 hours, resulting in over $875 million in positions closed. Both Bitcoin and Ethereum experienced double-digit drops.

The crypto market has taken suffered massive bleeding in the past 24 hours. The global market cap tanked by 6.8% to $950 billion. Over $875 million has been liquidated in the past 24 hours, as bitcoin drops by 11% to around $18,400.

Bitcoin suffered the most in terms of liquidations, with traders losing roughly $233 million in BTC. Ether followed with $175 million in liquidations. The Solana and FTX tokens, both of which have been in the news lately, followed with $41.5 million and $28.4 million in liquidations.

The single largest liquidation took place on Binance, with the BTC/USDT value amounting to $6.7 million. Overall, over 380,000 traders saw their positions liquidated. Most of these liquidations took place on Binance, with accounted for $243 million.

Traders who have been hoping for an improvement in the market have been hit hard by the turnaround. Bitcoin and others had been looking good as the market heads into the end of 2022, but there may be drama yet.

Crypto Liquidations Pile On, Bull Market Canceled?

Analysts are pondering what might have triggered the drop in prices, given that the market showed signs of improvement in the past few weeks. It is true that a lot of concerning developments have occurred in the past few days, though it’s unclear to what extent these have impacted prices.

The biggest of these developments is the fact that Binance will acquire FTX, which was rumored to have liquidity issues. After having denied it before, FTX CEO Sam Bankman-Fried said that the exchange was in facing a liquidity crunch. He said that Binance’s acquisition would resolve the matter and protect customers.

The FTT token has crashed considerably since the news. Bankman-Fried thanked Binance CEO Changpeng Zhao and said that FTX was in the “best of hands.”

BTC and ETH both fell past support levels

The FTX token is down by over 70% and may be one of the market’s biggest victims — but bitcoin and ether are not unscathed either. Both of these have taken deep dives. Bitcoin fell past its support level of $20,000 to briefly reach a new long-term low of $17,100. Ethereum is also now significantly below its support level of $1,500 and is trading at $1,300.

For a while, both BTC and ETH were looking good to break past their respective resistance levels — of $22,500 and $1,550. Investors will now have to wait a little longer before that happens while the market focuses on stabilizing itself.