The PEPE price has risen by 6% in the last 24 hours, but sustaining this little green candlestick could be difficult.

The shift in investors’ sentiment has been remarkable in the sense that the meme coin enthusiasts have seemingly given up.

PEPE Investors Look Away

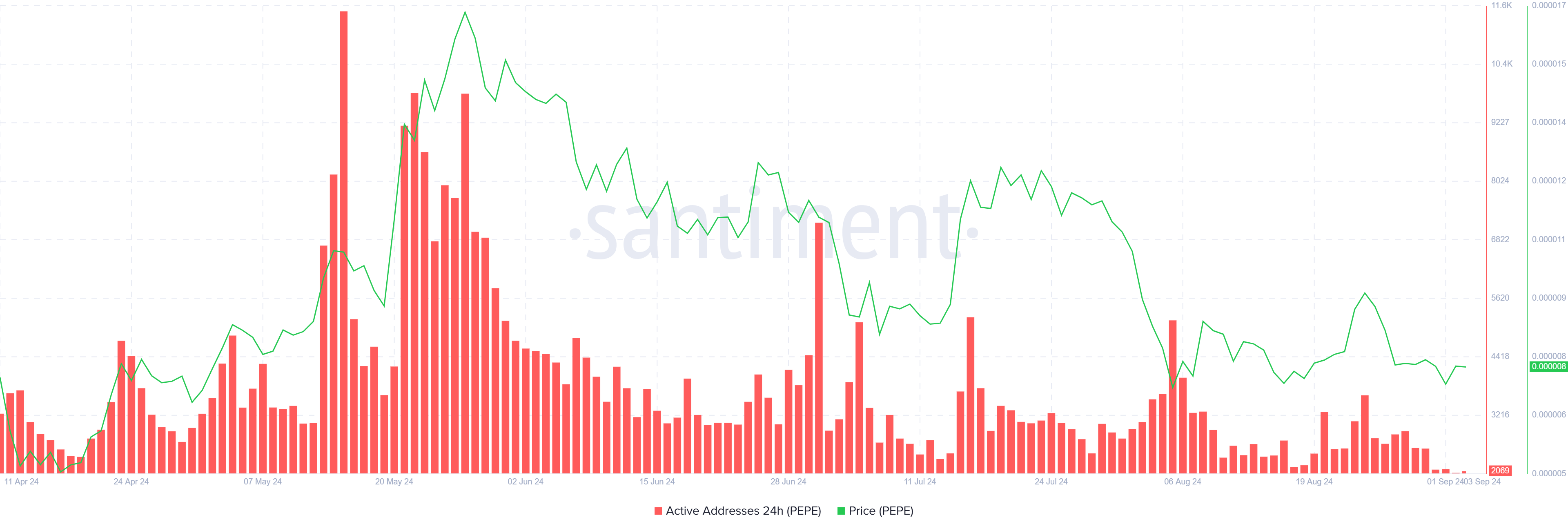

The PEPE price has noted a 24% drawdown in the last ten days, which has naturally had a considerable impact on investors. The fear of losses has pushed participation to a five-month low, as PEPE holders are refraining from conducting transactions on the network.

According to the on-chain metrics, the meme coin suffered from low participation throughout Q2. This trend could continue as Q3 comes to a close unless the broader market cues support recovery.

Read more: Pepe: A Comprehensive Guide to What It Is and How It Works

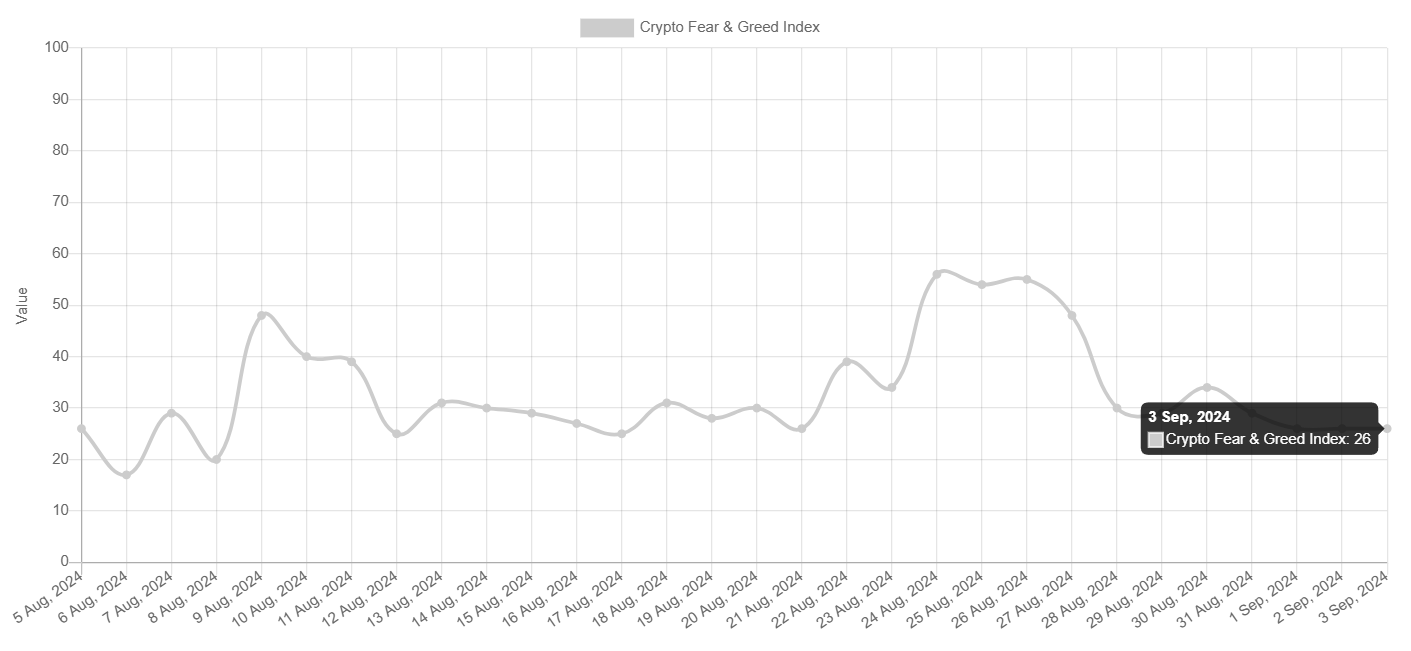

However, this turnaround would warrant a shift in the crypto market’s sentiment, which is currently in fear. The Fear and Greed Index highlights that throughout the past week, investors have been tormented by the potential of losses.

Yet, at the moment, the crypto market is exhibiting slightly bullish cues. These signals could carry the altcoins towards recovery, if not gains. PEPE’s price could also benefit from this and recover from the three-week lows.

PEPE Price Prediction: All Rise

PEPE price is the recipient of a micro-bullish outlook despite the persisting bearishness. This is because the bigger picture of the meme coin is still rather unappealing. The meme coin has been in a consolidation for the last five weeks.

This range sits within $0.00000977 and $0.00000702. Both of these levels have been tested in the past as resistance and support, respectively. PEPE failed a breach of $0.00000977 thrice in mid-July while nearly falling below $0.00000702 three times in August.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

Considering this pattern, PEPE has a potential rise ahead of it, which could push it up by 21% to hit $0.00000977. A breach of this line could imbue investors with confidence and increase buying momentum, potentially sending PEPE beyond $0.00001000 and extending the holders’ profits.