Yesterday saw heavy downturns in the prices of several cryptocurrencies. BeInCrypto looks back on some of the major events amid the collapse.

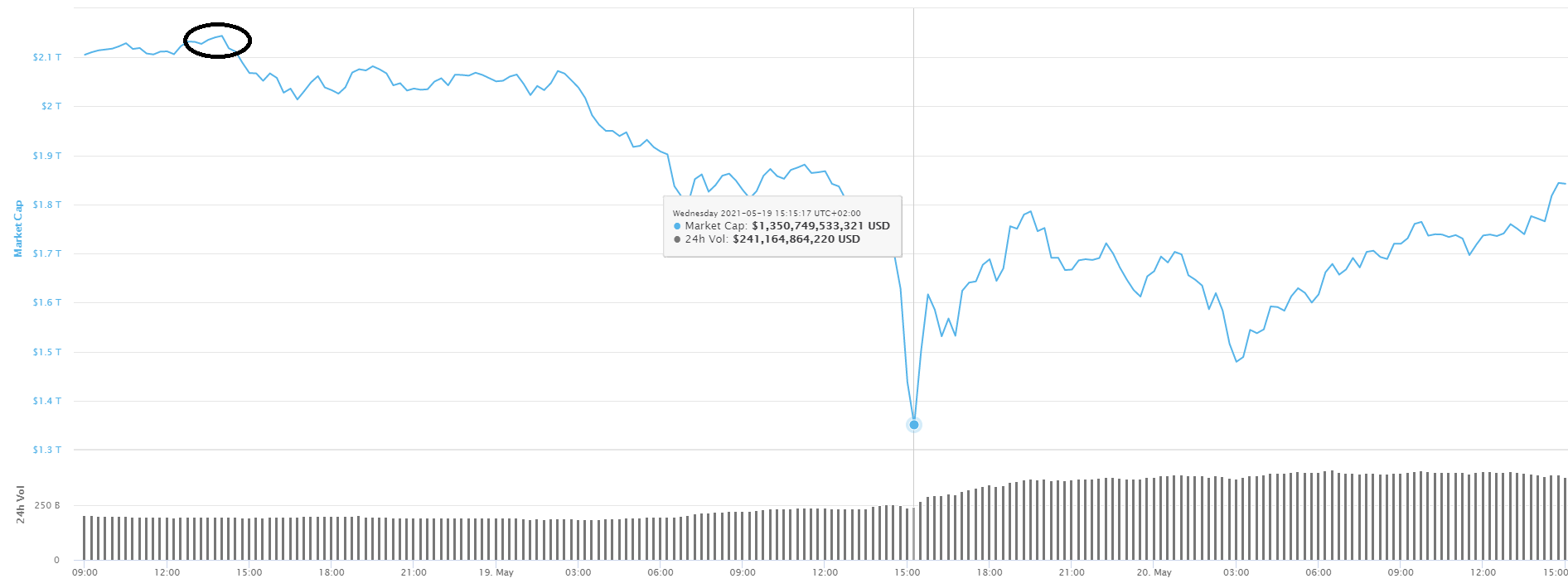

The crypto market suffered astronomically at the hands of May 19’s price crash, with reports indicating that at one point as much as $750 billion was lost.

Potential root causes

It’s the cumulative effect of a variety of factors and events, including Elon Musk’s recent comments about bitcoin (BTC) on Twitter, and the ban extended in China, to name a couple.

BTC’s price has been on a consistent decline ever since Tesla CEO Elon Musk Tweeted that he would be suspending vehicle purchases made in the cryptocurrency, citing the environmental impact as the reason. These comments alone were believed to be the cause of BTC’s price falling below the $50,000 threshold last week.

The crypto community at large has reacted in a variety of ways to Tesla dropping bitcoin payments. MicroStrategy CEO Michael Saylor called the move “ironic because no incremental energy is used in a bitcoin transaction.” Sardonically, Binance CEO Changpeng Zhao said, “Elon probably did not research how much energy is required to run other (non crypto) currencies that Tesla accepts.”

Others saw the market dip that followed as a good buying opportunity. “This may be the selloff that sets Bitcoin up for new all-time highs,” said David Grider of Fundstrat Global Advisors.

Meanwhile, the Chinese central bank pivoted on its standpoint on cryptocurrency transactions, banning banks and online payment channels from offering any crypto-related services to their clients. This represents a deviation from last month’s announcement by the People’s Bank of China that bitcoin was an “investment alternative.” With the joint statement reading:

“Recently, cryptocurrency prices have skyrocketed and plummeted, and speculative trading of cryptocurrency has rebounded, seriously infringing on the safety of people’s property and disrupting the normal economic and financial order.”

Specific casualties and recoveries

BTC continued to plummet from an already-low point of $43,000, all the way down to $30,000 in the space of around 14 hours, its lowest price point since January. However, a considerable recovery followed, reclaiming its $43,000 position by May 20.

According to Glassnode, exchanges registered a single-day net inflow of 30,749.89 bitcoin, on May 17. This is the fastest inflow of bitcoin exchanges have experienced since “Black Thursday” on May 12, 2020. Bitcoin’s price dropped 40% that day.

An influx of bitcoin occurs when investors liquidate their positions en masse, or convert their holdings into other crypto. Either way this indicates that people are practically tripping over each other to sell their bitcoin.

According to data on CoinGecko, BTC has been hovering around the $39,000 to 40,000 line ever since. Reports state that one moment BTC dropped to a pre-Tesla acceptance price.

Altcoins also suffered in the price collapse. Data indicates that ether (ETH) slid to a low of $2,050, while XRP dipped below the $1 dollar mark. XRP spiked again to $1.35 hours later, only to decline steadily again and land on a low of $0.93 in the small hours of May 20. At the time of writing, it has regained ground again at the $1.15 mark.

Over 800,000 liquidations

The ensuing 24 hour period saw over 800,000 liquidations made. According to Bybt, these accounted for $8 billion worth of positions affected. The BTC futures market made up 50% of all total liquidations. Reports indicate that the world’s largest cryptocurrency lost value for the fifth day in a row.

Meanwhile, huge sell-offs brought operations to a halt, as several crypto exchanges suffered outages and downtime. Coinbase, for one, went down on the morning on May 19 amid the price tumble. They, along with Binance, blamed network congestion for the outages, which other exchanges such as Gemini also suffered.

Still, not all have been put off by this price collapse. Saylor revealed that he would not be selling his BTC. His company holds over 92,000 BTC, though this is a large chunk of the 111,000 BTC he holds overall.

However, there are some key finance players who were more critical, even unsurprised by the collapse. European Central Bank’s vice president Luis de Guinados, already a critic of cryptocurrency, emphasized his doubts about their viability as an asset. Dubbing cryptocurrency as “not a real investment”, he referred to the assets as having “very weak fundamentals.”

Mike Novogratz, on the other hand, blamed the crash on “a supply response that overwhelms demand.” On Twitter, the Galaxy Investment Partners CEO compared the price collapse to a similar event in 2017.

“The proliferation of cryptos is a supply response that overwhelms demand. Same happened in 2017,” he wrote.

Yassine Elmandjra, blockchain and crypto-asset analyst at Ark Invest, agreed that the recent pullback could be triggered by a news-driven event.

“So the broader question is, is news like this powerful enough to completely invalidate the current bull market and I think not. I think that we are still consistent with previous market cycles. In hindsight, it will likely be a healthy correction, that’s kind of my assessment of it,” she said.

Meanwhile, Matt Hougan, chief investment officer at Bitwise Asset Management, thinks that “what we’re seeing today is primarily a forced deleveraging of retail investors who jumped into the market over the past few months chasing an asset that is up hundreds of percent this year. Volatility is an important part of the crypto market; we’ve had these kinds of pullbacks before and we will have them again.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.