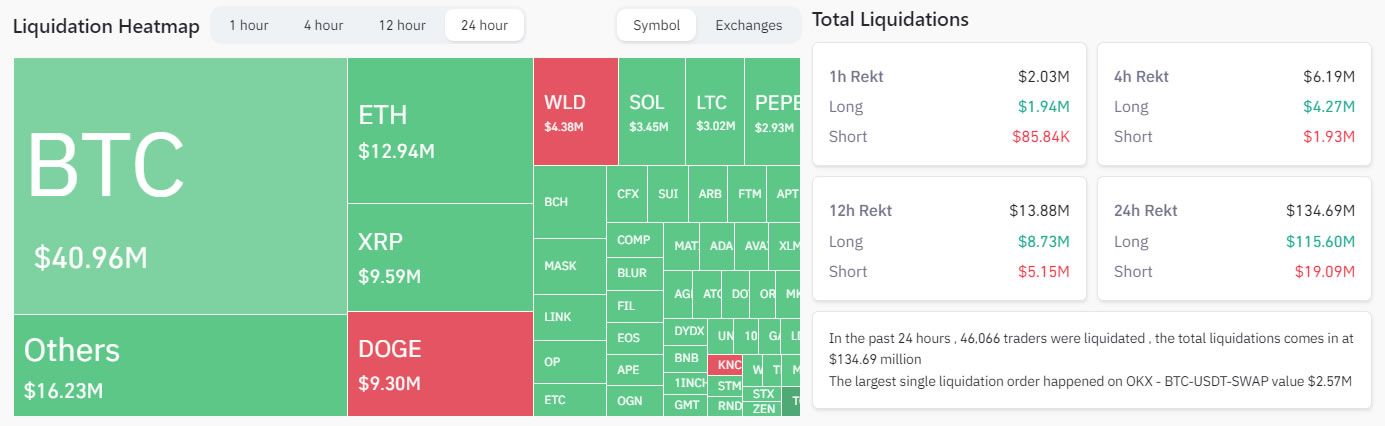

Crypto liquidations have spiked over the past day as markets retreat and sentiment wanes. Furthermore, the vast majority of those rekt were long positions in various crypto assets, according to Coinglass.

The total amount in crypto liquidations over the past 24 hours has reached $135 million. July 24 was the highest day for liquidations for the past ten days as markets fell back again.

Crypto Liquidations Spike

Analytics platform CoinGlass data shows a 225% increase in liquidations on July 24 from the previous day. Furthermore, 85% of them were long positions in BTC, ETH, and XRP, it noted.

In the past 24 hours, 46,066 traders were liquidated, it reported.

Bitcoin’s 2.2% fall on the day to touch $29,000 has wiped out a lot of long positions from those who expected it to top $30,000 again.

Ripple’s XRP has also caused traders much pain as it dips below $0.70 for the first time since the SEC victory news.

The last four hours paint a different picture with short positions in DOGE getting liquidated as the token surges. Around $1.8 million in liquidations occurred on Dogecoin alone as DOGE makes 8% on the day.

Read more:Dogecoin vs. Bitcoin: An Ultimate Comparison

Speculators on the newly launched Worldcoin WLD have also been liquidated as the token dumped more than 40% less than a day after it launched.

Crypto spot markets have lost $23 billion over the past 24 hours. Moreover, this has sent total capitalization back to $1.21 trillion, its lowest level for a month.

Volatility Index Shrinks

Nevertheless, markets remain within a range-bound channel that has continued for the past four months.

Derivatives analytics platform Greeks Live reported that the volatility index for BTC and ETH has fallen to its lowest level since the metric was measured two years ago.

This means that implied volatility (IV), which is measured from expiring contracts, is also at an all-time low. Derivatives traders are expecting more sideways movements with diminished volumes and liquidity.

“Continued low liquidity has severely depressed IV levels, and today’s rapid decline to a new short-term low of $29,000 failed to pull IV up, with almost all term IVs not moving up, and the market remaining dead.”

Reflecting this lull in volatility and sentiment, the Bitcoin fear and greed index remains neutral, smack in the middle at 50.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.