American crypto investors account for more than 40 million users globally. However, many could face repercussions or even jail if they fail to file taxes.

Cryptocurrencies have grown in popularity in recent years, with many investors looking to profit from the high volatility and potential returns. However, one issue arising from the increased use of cryptocurrencies is the need for clarity around reporting gains or losses on investments made using them. Only a minor share of crypto investors globally paid tax on their crypto. Thus, causing significant concern for government revenue collection.

Complications of Crypto Tax payments

One of the reasons many investors may have yet to pay taxes on their crypto investments is the complex nature of cryptocurrencies. The technology can be challenging to understand. Hence many investors still need to be aware of their investments’ tax implications. This lack of knowledge could lead to unintentional tax avoidance, resulting in a lower level of tax revenue for governments.

Additionally, the decentralized nature of cryptocurrencies makes it challenging for governments to regulate and enforce tax laws. Since cryptocurrencies operate independently of any central authority or institution, it can be hard for governments to track transactions. Ergo, enforce taxation. This lack of regulation and enforcement could be a significant reason many investors have not reported their crypto gains or losses.

Another factor behind the low number of taxpayers reporting crypto gains is the relative newness of cryptocurrencies. Cryptocurrencies have existed only for a bit over a decade. Further, many investors may need to learn how to report their gains and losses properly. This lack of knowledge and understanding could lead to underreporting or non-reporting crypto transactions.

Low Tax Payments Reported Last Year

The low number of taxpayers reporting their crypto gains is a concern for governments globally. The complex nature of cryptocurrencies, the decentralized nature of transactions, the relative newness of cryptocurrencies, and the lack of clarity around tax regulations all contribute to this issue.

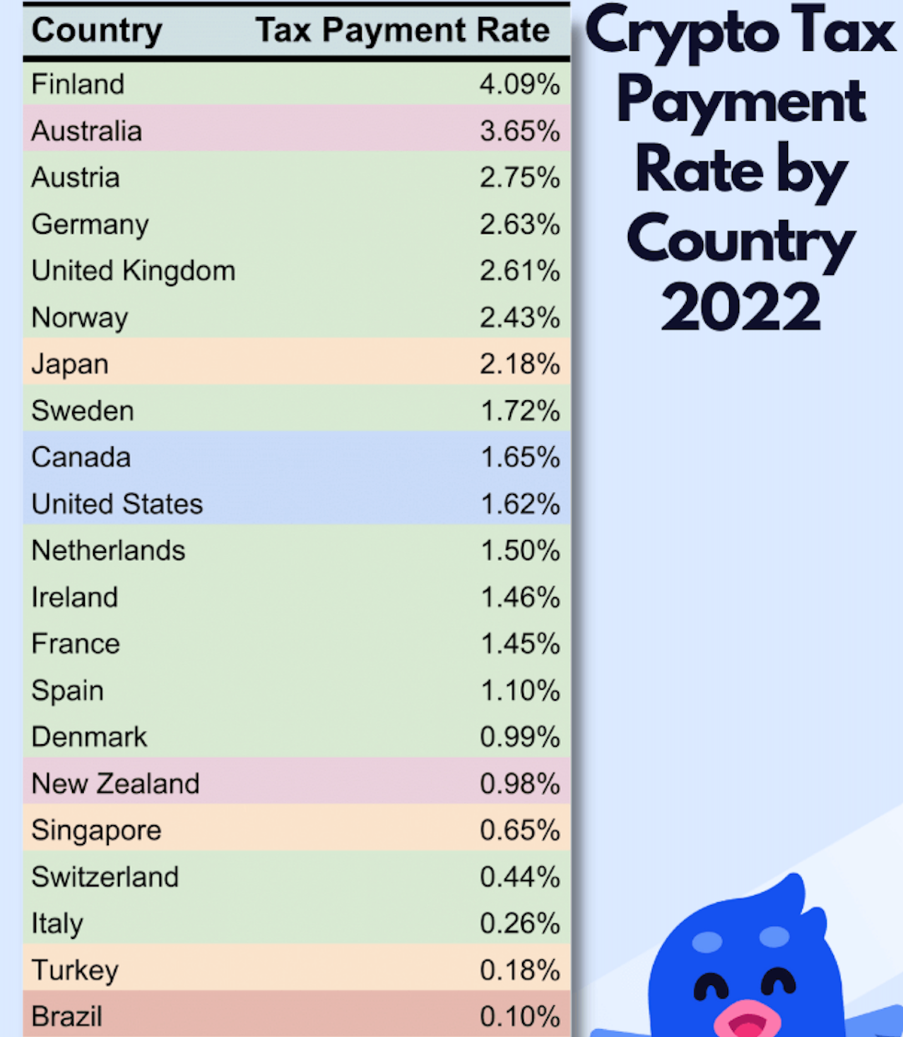

According to a report by Swedish crypto tax firm Divly, only 0.53% of crypto investors globally paid tax on their crypto in 2022. The approach for determining the tax payment rate for cryptocurrencies across 24 different countries utilized a multi-step process. The method comprised analysis of official government statistics, search volume data, and accessible cryptocurrency ownership data.

The report estimates that Finland has the highest proportion of crypto investors. That is, those who paid the required taxes on crypto in 2022, at 4.09%, with Australia following closely with 3.65%. Surprisingly, the United States ranked 10th on the list with only a 1.62% tax payment rate.

The difference in tax payment rates across countries was attributed to differences in awareness, overall tax compliance, and government policies. The report analyzed countries with the highest number of crypto taxpayers, with the United States topping the list, followed by Japan, Germany, the United Kingdom, and Australia.

Despite ranking lowest in the top ten countries for tax payment rate at 1.62%, the United States has a high adoption rate of cryptocurrencies and a large population, resulting in almost twice the number of tax declarations involving cryptocurrencies compared to the country with the second-highest number of declarations.

American Crypto Users May Face Jail

One authority on the matter is Danny Talwar, Global Head of Tax at crypto tax software Koinly. In discussion with BeInCrypto, Talwar shared recent research conducted by Koinly. Per their external findings, nearly 20% of crypto investors don’t realize the asset class is taxable. This statistic highlights the need for more awareness and education on tax compliance in the cryptocurrency industry. As per internal findings shared by Koinly, 20% of global users fail to declare their taxes on time. This statistic highlights the need for more awareness and education on tax compliance in the cryptocurrency industry.

According to global statistics, there are about 45 million crypto users in the United States, meaning some nine million Americans could be at risk of legal consequences for tax evasion. As the US tax year is ending in a week (April 18), those involved in cryptocurrency must take the opportunity to submit their taxes on time and ensure compliance with the law. Failure to do so can result in serious fines and legal penalties, including the risk of imprisonment.

The specific penalties and consequences will depend on various factors, such as the type and amount of taxes owed, how long the taxes have gone unpaid, and whether the failure to pay was intentional or unintentional. Individuals who fail to file their tax returns or pay their taxes on time may be subject to penalties, interest charges, and even legal action. The Internal Revenue Service (IRS) can impose penalties for late filing, late payment, and failure to pay estimated taxes. The penalties can be substantial, including monetary fines and even imprisonment in some cases.

Above all, governments need to establish clear tax laws for cryptocurrencies and educate investors about the tax implications of their investments to ensure that taxpayers report their crypto gains accurately.